Building wealth and reducing tax liability are two crucial goals that many people seek to achieve. While there are multiple financial instruments that can help you accomplish those goals, it can be challenging to invest in them. That’s where the equity-linked savings scheme (ELSS) comes into play.

ELSS Explained

As the name suggests, ELSS is a mutual fund scheme that mainly invests in the stock market or equities. ELSS funds are diversified equity funds that aim to maximize capital appreciation over the long term.

They invest in stocks in specific amounts based on the fund’s objective, and the stocks are selected across large-, mid-, and small-cap companies. Fund managers usually choose the stocks to amplify the returns in investors’ portfolios.

ELSS funds invest a huge portion of their corpus, precisely 80%, in equity or equity-related instruments. Since they are loaded with stocks, they have the ability to deliver long-term returns that can outperform inflation.

ELSS Three-year Lock-in Period Explained

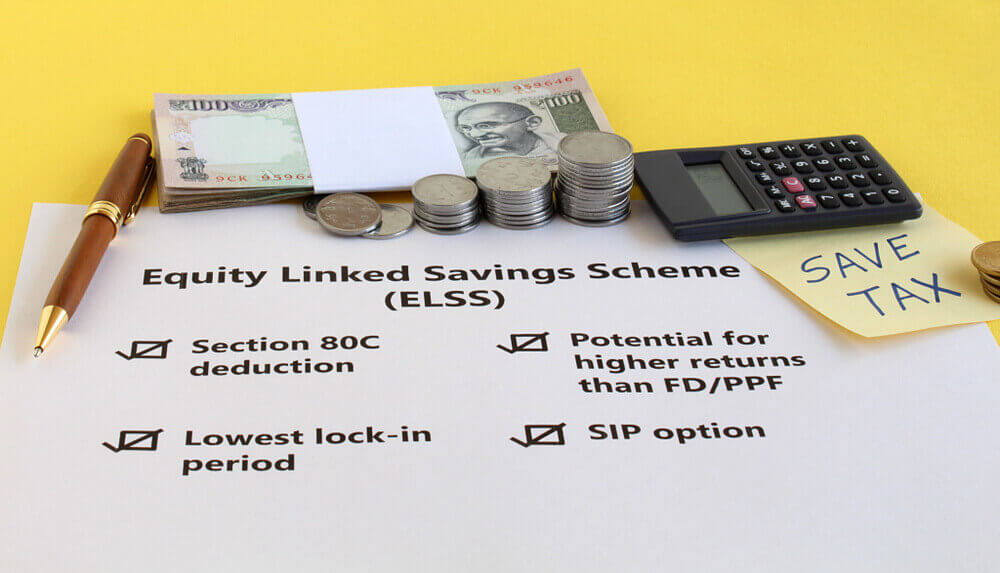

Investments in ELSS come in with a lock-in period of three years, meaning if you want to take out the funds and be exempted from taxes applicable on returns, you need to wait three years. The lock-in period of the ELSS is the shortest out of all tax-saving plans.

While many investors feel uneasy about it, the lock-in feature provides your money more time to increase. It is recommended not to withdraw your money unless the need calls for it or even after the lock-in period expires, as compounding can keep going as long as you remain invested.

Moreover, the quantum of volatility is reduced when you stay invested in ELSS over the long term.

Individuals Who Can Invest in ELSS Funds

Beginner Investors

ELSS is an ideal option for first-time investors, as you can experience investing in equities and mutual funds.

While equities have a high-risk exposure over the short term, their risk exposure is lower over the long term. Like other stock investments, one good way is to start investing in monthly systematic investment plans (SIPs) throughout the year.

SIPs in ELSS funds allow you to collect more units during a weakened market and create excellent returns during a surging market.

Salaried Employees

A specific amount goes towards your Employee Provident Fund (EPF) when you are a salaried individual. Therefore, if you want to strike a balance between the risk and reward in your investment portfolio, ELSS is one way to do it.

In addition to the potential of turning a big profit, investments in ELSS are qualified for a tax reduction under section 80C. A unit-linked insurance plan (ULIP) works the same way can offer the same benefits, but its lock-in period tends to be longer, and the returns can be lower than an ELSS fund.

ULIPs come in with a lock-in period of five years, while ELSS have a lock-in period of only three years, which is the shortest one.

Individuals with Long-term Investment Outlook

ELSS can be an excellent option if you’re willing to take a high level of risk and looking to invest in equities for the long term. You can minimize volatility and risk in ELSS by staying invested for an extended period, which is at least eight to ten years.

Benefits to Investing in ELSS

Tax-saving

Investments in ELSS are eligible for tax deduction under section 80C. The dividend or long-term capital gain you earn is exempted from income tax. Simply put, your returns from the ELSS fund are tax-free. This tax-saving feature is one of the main reasons why investing in ELSS is worth considering.

Lock-in Period

The ELSS’s lock-in period of three years is the shortest when compared to other options. Tax-saving options, such as fixed deposits, come in with a five-year lock-in, while a public provident fund (PPF) has a maturity period of 15 years. Overall, ELSS offers more liquidity over the medium term.

Compounding

It is advisable to invest in equity funds for at least five to ten years. ELSS offers a disciplined, long-term investment due to its lock-in feature. As a result, investors are able to take advantage of the power of compounding in the long run.

Factors to Consider Before Investing in ELSS

Fund Returns

Compared to fixed-income instruments like PPF and bank fixed deposits, the returns from ELSS are not guaranteed since it is a market-linked fund.

The performance of an ELSS fund is determined by several factors impacting the markets. Therefore, if the markets take a dip, the returns generated can disappear immediately.

Lock-in Period

While it embeds an excellent habit to remain invested for a long period, the three-year lock-in period of an ELSS can be a disadvantage when you need urgent money. Regardless of whether you invested through a considerable amount or SIP, you can only take out your money after three years.

Before you decide to invest in ELSS, you need to be a hundred percent certain that you would not require the money invested in the fund for three years.

Portfolio Performance

Make sure you have chosen a qualified and experienced fund manager to manage the underlying portfolio. Fund managers play a vital role in managing the primary portfolio. A poor performance from the portfolio can impact potential returns.

The risk of poor performance could materialize if the fund manager made a wrong move. Such a mistake can weigh down the gains, and you may have to be the one to carry the consequences of the poor decision taken by the fund manager.

Risks

Keep in mind that ELSS mainly invests in equities, which are volatile assets. You should be fine investing in this type of fund when you have a high-risk tolerance and are capable of dealing with volatility.

However, if you are a more conservative investor who finds even the tiniest sign of volatility concerning, you may want to avoid ELSS.

The Bottom Line

Choosing the right ELSS fund to invest in can positively impact your wealth-building and keep you in a good financial position. Not only can you lower your tax liability, but you can also maximize the potential of equities to grow your money further.