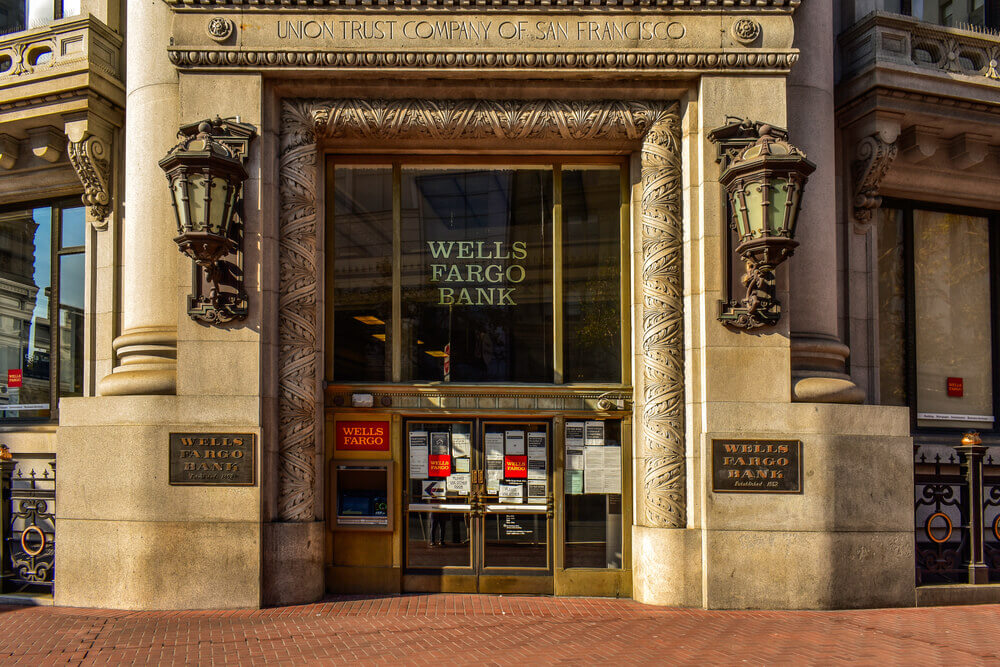

Updates from JPMorgan, Citigroup, Wells Fargo, and PNC Financial (NYSE:PNC) start the earnings season. The week saw a sharp improvement in their profit outlook due to a sell-off in U.S. Treasury bonds.

The difference between short-term rates and long-term rates is what determines a bank’s lending margins. Short-term rates should stay anchored near zero for the next two years.

The sharp rebound in cyclical stocks will stamp the banks’ Q4 results. This followed vaccine authorizations at the end of 2020.

Moreover, investors will also watch for updates on bad loan provisions, which fell sharply in Q3. This came after an initial surge in the previous three months.

Biden’s Stimulus Plans Received a Muted Response

Global stock markets shrugged at Biden’s stimulus plans, getting a muted response. It appeared to have discounted most of the $1.9 trillion in measures from his announcement on Thursday.

The Euro Stoxx 50, Nikkei, and the Shanghai Shenzhen CSI 300 were all down. Both the Euro Stoxx 50 and Nikkei lost 0.6%.

Biden’s stimulus included a top-up of $1,400 in direct payments to households. It also included aid for state and local governments. Additionally, other elements were all fiercely opposed by Republicans in the last session of Congress.

Chinese Tech Giants Removed from Blacklist

Biden’s announcement contained little to justify fresh buying. The markets’ anticipation of the event had already driven all three indices to record highs earlier in the week.

Dow Jones futures fell 141 points, or 0.5% by 6:30 AM ET (1130 GMT). S&P 500 futures also fell 0.5% and NASDAQ Futures lost 0.4%.

To be in focus later will include Alibaba (NYSE:BABA), Baidu (NASDAQ:BIDU), and Tencent Holdings (OTC:TCEHY). Tencent’s ADRs have left off the latest update to the U.S. blacklist on investment in Chinese firms.

However, the Hong Kong-listed mobile phone maker Xiaomi (OTC:XIACF) fell by over 10%. This was after they were surprisingly added to the list.

U.S. Retail Sales

Meanwhile, in other economic news, U.S. retail sales are likely to have fallen in December. This was under the impact of spreading lockdown measures. Lockdowns now appear to be flattening the U.S. COVID-19 infection curve.

At 8:30 AM ET, data due for release are likely to show a 0.2% drop, according to consensus forecasts. This would represent a second straight monthly drop.

Industrial production and producer price inflation data for December will also be out later. Recent data have shown that industry and manufacturing have held up better than consumer spending. That was during the latest surge in the coronavirus.

Read also: CFDAdvanced review | Is it safe to trade with this broker?