CITY INDEX REVIEW

Home > Broker Reviews > City Index Review

GENERAL INFORMATION

Broker Name:

City Index

Broker Type:

Forex

Country

UK

Operating since year:

1983

Regulation:

FCA, ASIC, MAS

Address:

Park House, 16 Finsbury Circus, London

Broker status:

Regulated

CUSTOMER SERVICE

Phone:

Local: 0845 355 0801 (local rate) / International: +44 203 194 1801

Email:

Languages:

English, Spanish, Czech, Chinese, German, French, Italian, Polish, Portuguese, Romanian, Slovenian,Hindi, Hebrew, Arabic, Russian

Availability:

24/5

TRADING

Trading platforms:

MT4

Trading platform Time zone:

EET (GMT +2)

Demo account:

YES

Mobile trading:

YES

Web-based trading:

YES

Bonuses:

NO

Other trading instruments:

YES

ACCOUNT

Minimum deposit ($):

$100

Maximal leverage:

1:200

Spread:

YES

Scalping allowed:

YES

GENERAL INFORMATION: City Index

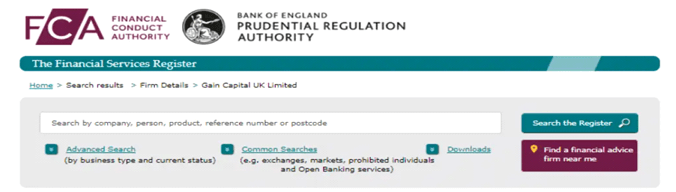

City Index was founded in 1983 and is part of publicly-traded company Gain Capital Holdings Inc (NYSE: GCAP). City Index possesses the UK Financial Conduct Authority regulation and authorization, offering a high level of security and safety.

The broker is from the United Kingdom. Their address is Park House, 16 Finsbury Circus, London.

City Index offers retail, professional, and premium trading accounts to trade on more than 12,000 instruments, including Shares, Indices, Cryptocurrencies, Commodities, and Forex via CFD, Spread Betting, and Options. Spreads are fixed or viable, and Spread Betting accounts offer commission-free trading, and also, CFD accounts provide commission-free trading on all assets except Shares.

The broker offers a feature-rich trading platform and mobile apps for iOS and Android users. Traders can download MetaTrader 4 and an AT Pro desktop platform. City Index offers additional trading tools in the form of technical and fundamental analysis and trading signals at the AT Pro platform.

FUNDS TRADING AND SECURITY

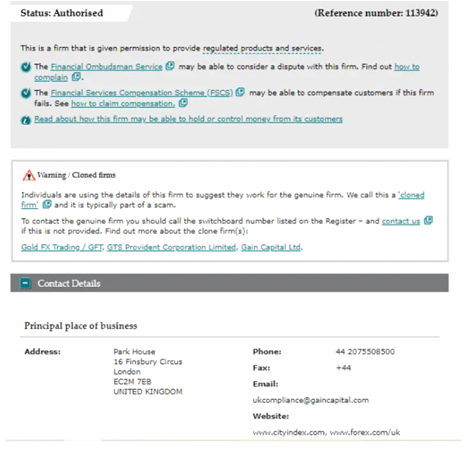

City Index is authorized and regulated under Gain Capital UK Limited, publicly traded on the New York Stock Exchange. The broker offers segregated funds, negative balance protection for retail clients, and is a member of the Financial Services Compensation Scheme (FSCS).

The research we did on City Index review, shows that the broker also keeps investors protected by holding client’s funds in segregated accounts and being part of the Financial Services Compensation Scheme (FSCS).

TRADING ACCOUNTS

We’ve already mentioned that City Index has a demo account option. It offers unlimited access to their trading platforms for 12 weeks, and a £ 10,000 in virtual cash for try out. And however convenient that sound, what matters are broker’s live accounts.

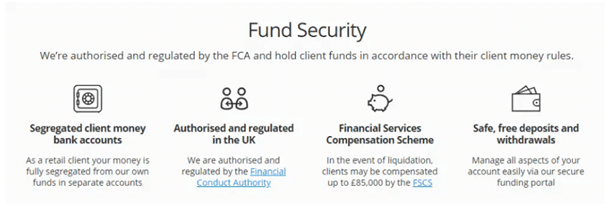

City Index offers three trading accounts for CFD trading and spread betting called Trader, Premium Trader, and Professional Trader.

So, let’s get a little bit in-depth about each account:

TRADER

- Ideal for both new and experienced traders

- Competitive pricing

- 24hr trading support

- Never lose more than you deposit

- Education, news, and analysis

- Trade on award-winning platforms

PREMIUM TRADER

- Invitation only, for brokers private retail client account priority service

- Competitive pricing

- Priority service

- Relationship manager

- Invitations to premium events

- Dedicated broker-assisted dealing

PROFESSIONAL TRADER

- Margin rates from 0.25%

- Credit facility available

- Dedicated broker-assisted dealing

- Relationship manager

- Rewards and premium events

- Advanced trading platforms

As you start collecting some trading experience, your account type is also improving. In any case, you won’t have a feeling you will miss something unless you upgrade since the more premium accounts don’t invalidate the basic ones.

TRADING CONDITIONS

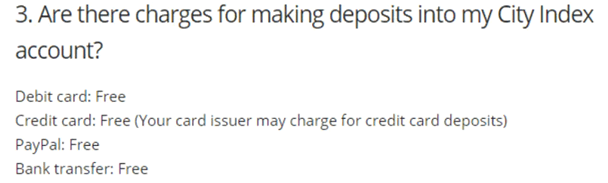

The broker offers users to deposit funds fee-free via credit and debit card, PayPal, or bank wire transfer.

The same thing applies to withdrawals, which are also fee-free. However, there is a technical minimum withdrawal amount, 50 GBP, or all available funds in the account. Withdrawals usually take between 3-5 working days, but they could be processed in one day if the client’s bank uses the faster payment service.

City Index spread betting accounts offer commission-free trading. Also, there is commission-free trading on CFD accounts, except for Shares.

Margin rates and spreads may vary depending on the account type and a trading instrument. This information can be found on the broker’s website, with a few of the markets available to trade on with the City Index.

According to regulatory restrictions, City Index does not offer any promotions or bonuses.

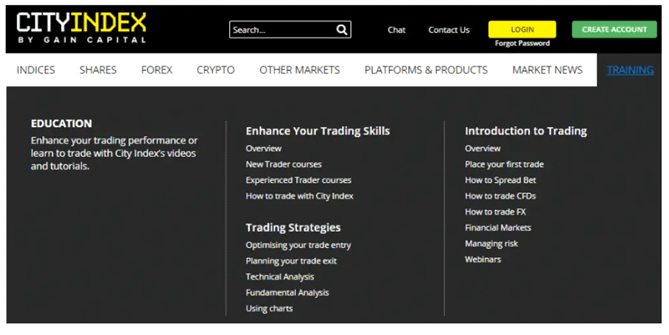

The broker provides a wide variety of trading education tools, such as videos, e-books, webinars, and Trading Academy.

Users get access to a broad base of articles, courses, and videos, which are there to improve the client’s trading skills.

We hope that you have found this City Index review helpful! Make sure to find additional information on the broker. Have fun and good luck with trading!

COMMENTS

Recommended for You

Cryptocurrency Market Update: March 3

Recommended for You

Recommended for You

Recommended for You

Recommended for You

Recommended for You

City Index Review

-

Support

(4.5)

-

Platform

(2)

-

Spread

(2.5)

-

Trading Instrument

(2)