Benjamin Franklin once described the ability of compound interest as, ‘Money makes money. And the money that money makes, makes more money.’

Compound interest is the interest you earn that is reinvested into the balance in your investment or savings account, allowing you to generate additional interest. Through compounding, your investments and savings gain more momentum for growth in the long run.

However, compounding can also work against you, particularly when you have some loans to pay. That’s because it can also increase the debt you owe over time.

Let’s explore further what compound interest is all about.

Compound Interest Explained

Compound interest refers to the interest earned on a prior interest from a bank account, loan, or investment. Adding earned interest back to your original balance gives you more interest, thereby compounding your returns.

Simply put, compound interest allows you to earn more than just one interest on your initial balance. With compound interest, your interest also makes interest.

As a result, the money you keep in a savings account can grow more quickly over time as you generate interest on a gradually increasing balance.

Typically, interest can be compounded more than once a year. In many cases, interest is added back to the principal balance continuously, daily, monthly, or annually. The more often interest is compounded, the faster your initial balance can grow.

A Further Look Into Compound Interest

There are a few important factors that you need to consider to determine compound interest. Every single aspect is different and serves different purposes for the result. And some of them can have a significant effect on your returns.

To understand compound interest, you need to grasp these five key factors:

- Interest refers to the rate that you earn or is charged to you. The higher the interest rate, the more money you can make or the more you need to pay.

- Initial principal, as the name suggests, is the starter money or the original amount you deposited or borrowed. Compounding interest adds up over the long term, but it will be based on your initial principal.

- Frequency schedule represents the number of compounding periods per day, month, or year. It is a variable that helps you see how fast your balance builds up. So when you open a savings account or take out a loan, you need to know how frequently the interest will compound.

- Duration indicates the time you expect to keep holding an account or paying off a loan. The longer you keep your money in a savings account or the longer you have a debt to pay, the longer it needs to compound and the more money you can generate or owe.

- Deposits and withdrawals are also essential factors to consider in calculating compound interest. The pace at which you grow your original balance or settle your loan payments can make a significant difference over the long term.

The Difference Between Simple Interest and Compound Interest

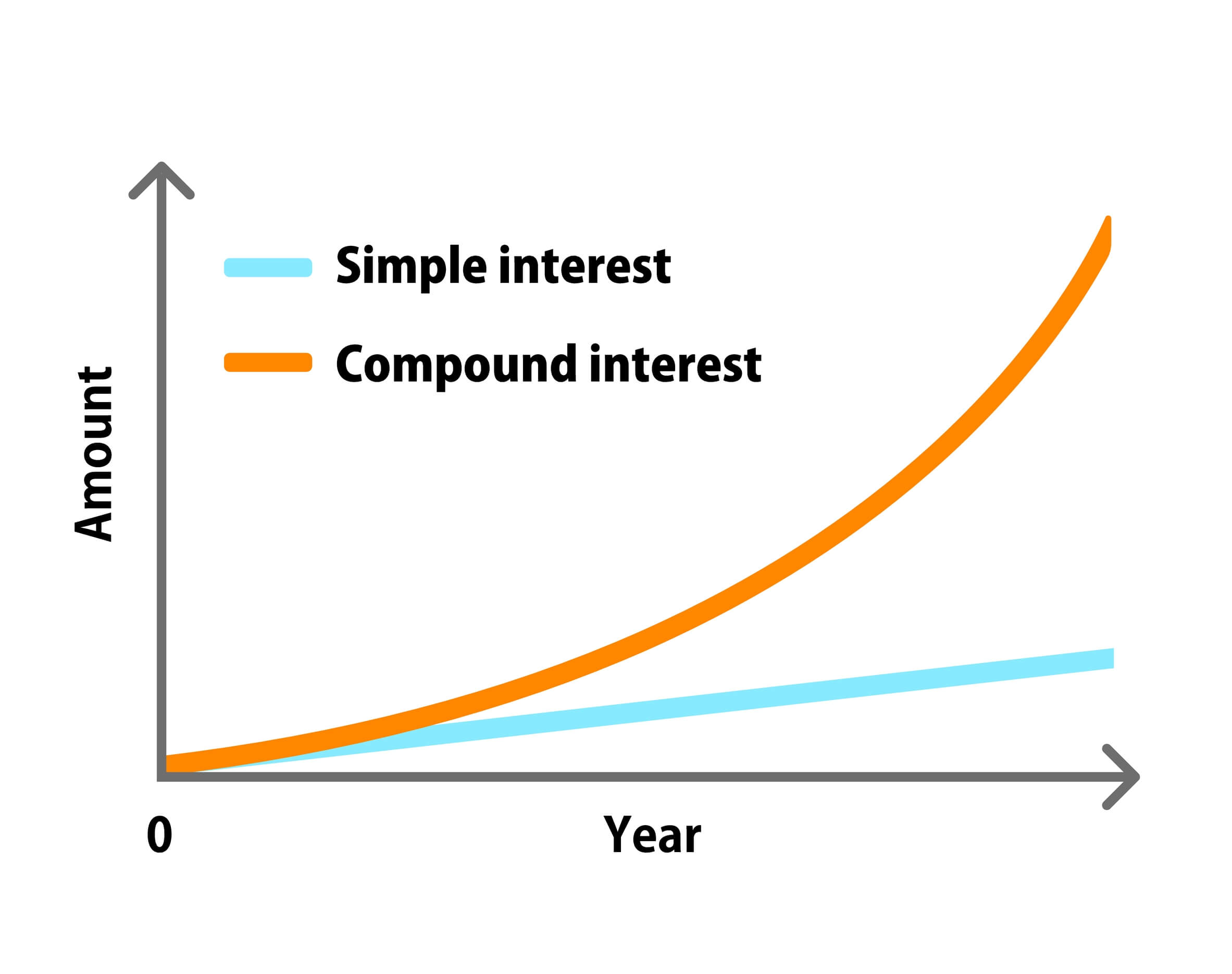

Interest can be simple or compounded. Simple interest is determined based solely on the principal balance. When calculating simple interest, earned interest has neither been compounded nor added back into the principal balance.

Simple interest usually helps calculate the interest involved on short-term loans, such as car loans.

On the other hand, the interest on a credit card is compounded, typically on a daily basis. That means your issuer charges interest in your account each day, which is why your credit card debt can grow significantly at a fast rate.

Simple interest can be beneficial when you take out a loan, while compound interest best works when you invest. Ideally, you would want to determine your savings and investments with compound interest and your debts with simple interest.

Accounts with Compound Interest

Savings, Checking Accounts, Certificates of Deposit (CDs)

Bank accounts, like savings accounts, earn interest and build up your balance in the long run. As you deposit money into the account, the interest will go into your account and be included in your balance.

Investment Accounts and 401(k)

The money you make through investments and 401(k) can also compound over the long term.

The percentage that stocks gain each day is determined based on their performance during the previous day’s trading session. In other words, they compound every business day.

While cashing out your dividends is an option, you can consider reinvesting them and being consistent with your deposits. That way, you can accelerate the growth of your balance.

Credit Cards

Interest is charged to your credit card balance every month. That balance can remain unchanged if you don’t charge anything else to the card and pay the accumulated interest monthly.

However, your credit card balance will increase if you cannot meet the required interest payment. And by the next month, that higher amount will be used to calculate the interest, which would eventually leave you with a large balance.

Using Compound Interest to Your Advantage

- Be Consistent With Debt Payments

Compound interest is not ideal when it’s related to the money you borrowed, whether it’s a credit card or a loan. The quicker you settle your debts, the less you’ll owe over the long term.

- Allot Enough Time

Time is essential to compound interest because the more time you give the investment to compound, the more your potential return can be.

That is also why compound interest is important for young investors. The earlier an investor starts saving, the greater the return they will have by the time they retire. Moreover, most of an investor’s retirement funds can be magnified with compounding.

- Check the Annual Percentage Yield (APY)

Comparing APYs can help you better understand what you can earn or be charged in interest than the annual percentage rate (APR). That’s because the APY represents compounding, while the APR accounts for the simple interest.

- Review the Compounding Rate

The more often the account compounds interest, the larger the amount you can earn or owe. In an ideal world, your savings should compound as often as possible, and your debts should only compound from time to time.