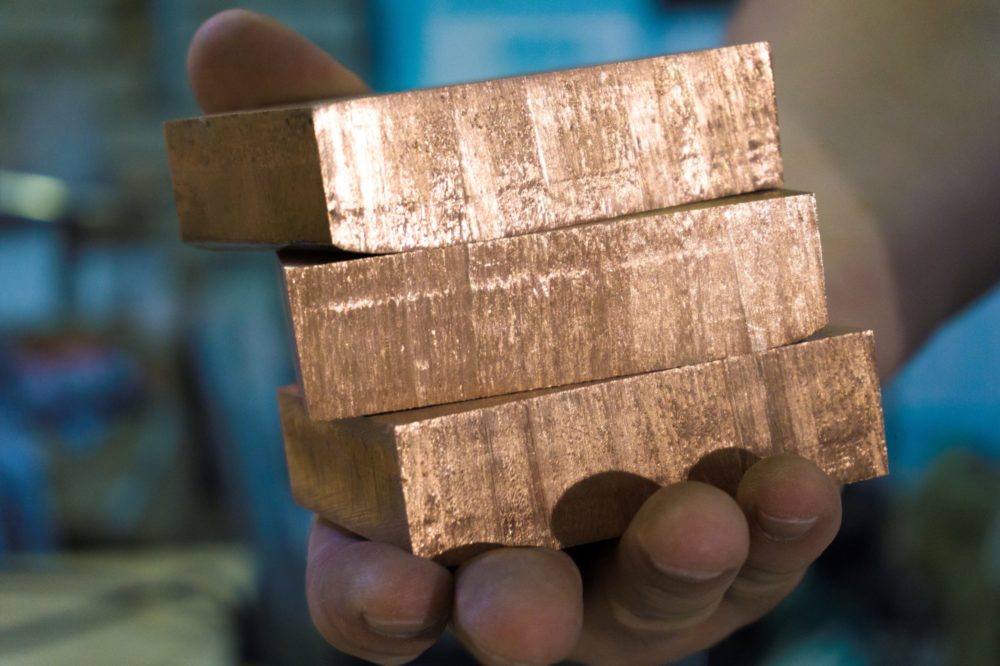

Copper surpassed $8,000 a ton for the first time in over seven years. The market is seeing the sharpest rally in over a decade. Significantly, China’s appetite for commodities and supply snags early on in the coronavirus pandemic boosting Copper around 80% from its March lows. Additionally, expectations for a deficit and the weaker greenback have also fueled gains.

On the London Metal Exchange, Copper increased by 1.4% and settled at $8,028 a ton for the first time since 2013. Additionally, other metals also witnessed gains. For example, Nickel increased by 0.4%. Singapore iron futures boosted over $160 a ton and reached their highest level since 2013.

Copper is likely to hit new all-time highs in the upswing of the cycle

Evy Hambro, Blackrock’s global head, announced that Copper is likely to hit new all-time highs in the upswing of the cycle. Notably, China’s relative success in containing the pandemic and hopes about global economic recovery lifts industrial commodities.

Remarkably, it’s been a turnaround for Copper. It dropped over 50% from a record high in 2011. Additionally, it traded below $5,000 a ton during a fall in 2015-16 and again earlier this year.

Another essential thing to mention is that Copper also benefits from more specific factors that make it attractive to long-term investors. Some analysts think oil prices are likely to rebound in the short term as the world begins returning to normal. There is more uncertainty about its long-term outlook as the energy transition gathers pace. On the other hand, analysts say that Copper might benefit from the shift because of its electrical wiring use.

In the near term, copper is getting help from tight supplies and strong demand. Top consumer China churned out a record volume last month, pointing to resilient consumption as the country recovers from the pandemic. Moreover, stockpiles tracked by top exchanges, including the LME, have fallen to a six-year low.