DERIV REVIEW

Home > Broker Reviews > Deriv Review

GENERAL INFORMATION

Broker Name:

Deriv

Broker Type:

Crypto

Country

Malta

Operating since year:

2020

Regulation:

MFSA, BVI FSC

Address:

W Business Centre, Level 3, Triq Dun Karm, Birkirkara, BKR 9033, Malta

Broker status:

Regulated

CUSTOMER SERVICE

Phone:

+44 1942 316229

Email:

Languages:

English

Availability:

Monday – Friday: 24h, Saturday – Sunday: 8 a.m. – 5 p.m. GMT +8

TRADING

Trading platforms:

Proprietary

Trading platform Time zone:

N/A

Demo account:

YES

Mobile trading:

YES

Web-based trading:

YES

Bonuses:

NO

Other trading instruments:

YES

ACCOUNT

Minimum deposit ($):

$10

Maximal leverage:

1:1000

Spread:

Floating

Scalping allowed:

YES

GENERAL INFORMATION

While Deriv is a new broker, starting their operations earlier this year, the company roots go over two decades into the past. Namely, the broker has been established by Regents Market Group, the same organization in charge of Binary and BetonMarkets. The two brokerages are quite prominent, and the older has been founded in 1999.

Deriv has multiple offices worldwide, but its main one seems to be located in Malta. The exact address is W Business Centre, Level 3, Triq Dun Karm, Birkirkara, BKR 9033.

When rebranding or creating new brokerages, many companies tend to just slap a new coat of paint over their old formula and call it a day. That’s why you can bump into a lot of firms that claim to be founded in the last two or three years that look and feel like they came out of the ’90s. For Deriv, the new coat of paint is definitely there, as the website looks sleek and modern, but it was followed by a functional upgrade.

Let’s dig into this Deriv review.

The research we did on Deriv review, showed us some of the features that might make you think about using the broker’s service:

• MULTIPLE LICENSES

Getting one license from a respected regulator is usually enough to leave an impression of a trustworthy broker. Deriv, however, went beyond that and secured numerous licenses with a range of regulative bodies. And while certificates don’t guarantee safety, it’s certainly difficult to ignore the number of them at Deriv.

• 24/7 TRADING

Trading around the clock is a feature that many traders seem to enjoy but few brokers seem to provide. Deriv is one of the few that do, and even though the assets you’ll be able to trade on might be limited during off-hours, it’s great that you can make at least a bit of progress.

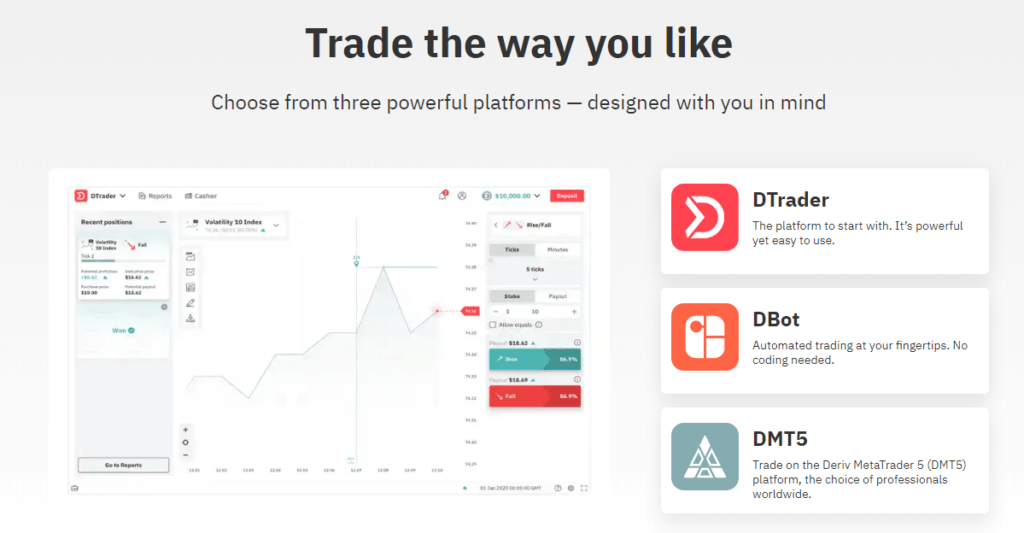

• VARIOUS PLATFORMS

Variety is nearly always a good thing when it comes to online brokers. More choices mean that you can customize a more significant part of your experience and have a more enjoyable time trading. At Deriv, that variety comes in the form of four platforms you can use, including both standard and proprietary options.

FUNDS, TRADING, AND SECURITY

As we’ve mentioned earlier in our Deriv review, the security the broker provides is quite high-level. Namely, the company has secured three licenses from MFSA, BVI, and FSC. And sometimes, brokers can slip by a regulator and pull off some questionable stuff, but it’s hard to avoid three.

To determine the likelihood of a broker trying to trick you despite a license, we usually go by what their customers think. Now, since Deriv was only founded earlier this year, their reputation hasn’t solidified yet, as not enough people have shared their experiences. That doesn’t mean we’re in the dark entirely, however, as we can take a look at Deriv’s parent and sister companies.

The organization in charge of the broker has over two decades of experience in handling online brokerages. The two trading service providers they run both enjoy quite a positive reputation and are prominent names in the trading world. Now that doesn’t guarantee that Deriv will follow the same path, but it’s quite a strong indication.

TRADING ACCOUNTS

Deriv offers the basic split into the demo and the live accounts. The demo account is easy to set up and requires only the simple process of typing in your email and verifying it. From there, you’ll be able to experience three of the four platforms they offer without the need to download anything. The fourth (MT5), sadly requires you to sign up for one of their live account variations.

And as far as their live accounts go, Deriv went on a slightly different path than most brokers. Instead of setting up the types so that they scale and become better the more funds you invest, the broker split their accounts by specialization. The Financial or Standard account is the all-rounder, the Financial STP is more currency-focused, and the Synthetic account is the one that lets you trade around the clock.

Distributing accounts in the way Deriv did has its advantages and disadvantages. The most significant upside is that everyone gets an even playing field, and you don’t need to invest large amounts to earn a decent service. Perhaps the greatest downside is the opposite side of the coin, where those willing to invest large sums might not get the benefits they would from other brokers. On top of that, it feels like all the accounts could’ve been bundled into one type, but they were possibly split to adhere to regulation in different areas.

Overall the account typing isn’t bad, but we would say it needs some work. However, we’ll give you a preview of what account gets you, and you can judge them for yourself.

FINANCIAL

- Leverage: Up to 1:1000

- Margin Call: 150%

- Assets: 50+

- Stop Out Level: 75%

FINANCIAL STP

- Leverage: Up to 1:1000

- Margin Call: 150%

- Assets: 50+

- Stop Out Level: 75%

SYNTHETIC

- Leverage: Up to 1:1000

- Margin Call: 100%

- Assets: 10+

- Stop Out Level: 50%

TRADING CONDITIONS

If you disregard the strange way the accounts are divided at Deriv, as well as their somewhat limited asset selection, you’ll find that the rest of the conditions are quite a bit above average. Namely, their leverage doubles the usual 1:500, and the spreads, although they fluctuate, are tight. To add to that, there’s quite a lot of deposit and withdrawal options, most of which process quickly and have insanely low requirements of $10 and $5, respectively.

The security also significantly boosts the overall conditions, as it’s undeniably one of the crucial factors to quality service. As icing on the cake, there are multiple platforms, which slightly make up for the lack of account typing as far as experience personalization goes.

While Deriv, like any broker, has a few weak spots, they offer more than enough to make up for those. Overall, it certainly seems like the broker offers more than it lacks.

TRADING PLATFORM

As we’ve already mentioned multiple times, there are four platforms you can use to trade at Deriv. The three that are apparent as soon as you open up their landing page are DTrader, a proprietary app, DBot, a platform for automated trading, and DMT5, which is MetaTrader 5 with a D for Deriv in front of it. The fourth, which you can only access once you sign up for at least a demo account, is a platform praised for its UI intuitiveness, SmartTrader.

Whether it’s intentional or not, the four available platforms supplement each other perfectly. There’s a proprietary app for those looking for something fresh, but on the other hand, there’s always the reliable MT5 you can fall back on. You’ve got something for both novices, intermediate traders, and experts, so nobody gets left behind. Also, the rare option to automate your trades with DBot is more than welcome.

Lastly, both web and mobile trading are available. That allows anyone to trade anywhere as long as they have a mobile device or desktop with them. Both features have become more or less necessary recently, so it’s no wonder Deriv included them.

DERIV'S TRADING PRODUCTS

As far as the trading products at Deriv go, they cover all the bases. However, the lack of an underwhelming number of instruments you can trade is probably the broker’s weakness. While there are a few assets in each section, the entire selection clocks in at just under a 100, which, while not horrible, is quite a bit below modern standards.

The assets you can trade:

- Stock indices

- Forex

- Commodities

- Cryptocurrency

- Synthetic Indices

DERIV REVIEW: CUSTOMER SERVICE

The support at Deriv is exactly what you’ve come to expect from a broker. The three usual options are present in an email address, a phone line, and live chat support. Their phone even works from 8 AM to 5 PM on the weekends, so you can get help even outside the workweek.

Phone number: +44 1942 316229

Email: [email protected]

DERIV REVIEW: CONCLUSION

Deriv is an example of what a fresh broker trying to attract customers in current times should look like. They’ve got an eye-catching website design, one that’s functional and easy to navigate, and beyond that, their service is stellar. Now, it’s apparent that having a team with 20 years of experience behind the broker helped shape it quite a bit, and we don’t expect everyone to reach the level of polish Deriv has right away, but they should strive towards that.

If we were to play devil’s advocate, we would note that the account typing and asset variety at Deriv is below industry standards. And while that statement is certainly true, there’s no denying they aren’t horrible, and both just need a bit of work to reach a decent level.

We’re eager to see where Deriv goes from there and hopeful of the company plugging up the small holes in their service. Even as it stands right now, we’d say Deriv is a great broker to try out, no matter if you’re a newbie or an experienced trader.

In the end, we hope this Deriv review was helpful, and we wish you good luck trading!

COMMENTS

Recommended for You

Cryptocurrency Market Update: March 3

Recommended for You

Recommended for You

Recommended for You

Recommended for You

Recommended for You

Deriv Review

-

Support

(4.5)

-

Platform

(2)

-

Spread

(2.5)

-

Trading Instrument

(2)

3 Comments

The broker is an unpolished gem. Unfortunately I don’t think it’s worth using right now, but if they got their assets in order my rating would improve drastically.

Did you find this review helpful? Yes No

Average

They provide an average service which isn’t worth using over other in my opinion. The broker is new, so it might improve in the future though.

Did you find this review helpful? Yes No

Not enough assets to diversify without picking some sub-par instruments.

Did you find this review helpful? Yes (1) No