Leverage Ratios to Evaluate businesses

Investors in the oil and gas industry should observe the balance sheet’s debt levels. In such a capital-intensive industry, high debt levels can strain a company’s credit

Investors in the oil and gas industry should observe the balance sheet’s debt levels. In such a capital-intensive industry, high debt levels can strain a company’s credit

What is Nikkei 225 Stock Average? Nikkei 225 is Japan’s primary stock index and a gauge of the Japanese economy. It is a price-weighted index, operating in

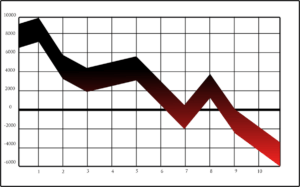

While selecting security for investment, traders always look at its historical volatility in order to calculate the relative risk of a potential trade. Various metrics measure volatility

Stock charts can appear to be a tad intimidating to those with little experience in investing. However, understanding them is crucial to understanding stocks. Therefore, in this

When it comes to options, binary options are a variety that is concerned with the subject of payout. The buyer will receive a fixed payout or nothing

We had a discussion on the US Federal Reserve, or the Fed, last time. We discussed how they could control the inflation rates in the US by

Have The Best Of Trade Market News Delivered Directly To Your

Mailbox. Subscribe To Receive The Latest Market News.

Disclaimer:

TradeMarketNews.com provides information and news solely for reference purposes. The accuracy, relevance, and completeness of any information and news may vary and cannot always be guaranteed. Readers are responsible for their use of such data (as stated in the ToS) and its appropriateness for the user.

Email: [email protected]

Connect with: trademarketnews