ETFINANCE REVIEW

Home > Broker Reviews > ETFinance Review

GENERAL INFORMATION

Broker Name:

ETFinance

Broker Type:

Forex

Country

Сyprus

Operating since year:

2016

Regulation:

CySEC

Address:

Office 1, 2nd Floor, KPMG Center, 1 Agias Fylaxeos Street, Limassol, Cyprus, 3025

Broker status:

Active

CUSTOMER SERVICE

Phone:

+8006 003 7004

Email:

Languages:

English

Availability:

24/5

TRADING

Trading platforms:

MT4

Trading platform Time zone:

+8006 003 7004

Demo account:

YES

Mobile trading:

YES

Web-based trading:

YES

Bonuses:

N/A

Other trading instruments:

N/A

ACCOUNT

Minimum deposit ($):

$250

Maximal leverage:

1:500

Spread:

Variable

Scalping allowed:

Yes

General Information

ETFinance is an experienced broker that started operating nearly five years ago, in 2016. It provides a multi-asset trading experience that’s simple to get into because of how the broker is set up. The broker operates from Cyprus, which is a favorite location for online brokerages. Since it’s there, it works under CySEC’s watch. The exact address of its offices is Office 1, 2nd Floor, KPMG Center, 1 Agias Fylaxeos Street, Limassol, Cyprus, 3025.

The first impression you get about a broker is often from how well its website handles. Sites don’t make or break an experience, as once you switch to a trading terminal, they’re inconsequential. However, a clunky website demonstrates that the broker is sloppy in their work and makes getting info on them more challenging. Luckily, ETFinance left a fantastic initial impression as far as its website is concerned.

It handles well, and there’s no lag when changing webpages. That makes it vastly less frustrating than some other brokers’ sites, allowing you to get informed quickly. And on that end, it also does well in presenting the information in a comprehensive, transparent way. The broker doesn’t hide anything or divide details into small parts so you have to switch pages a ton. As such, the usually tedious research process ends up not consuming a ton of time or mental energy.

The website’s pretty easy on the eyes, creating a professional atmosphere. Admittedly, visual design is way down on the list of essential qualities for a broker, but we give credit where credit is due. So with that brief overview, it’s time to move forward and inspect the broker in more detail. For starters, here are some of ETFinance’s best qualities:

• Real Madrid Basketball Club Sponsorship

You might wonder why we place so much importance on a broker’s sponsorship deal with another institution. Well, as broker-sports club agreements become more common, they also become an excellent way to tell a brokerage’s intentions. World-renowned clubs wouldn’t risk pairing with faulty firms without a detailed inspection of their background and future plans. Doing such a thing would harm its reputation and bring more harm than good in the end. That’s why the sponsorship speaks both about ETFinance’s trustworthiness and its quality.

• Thorough Education

Educational features have become commonplace in the brokerage world, simplifying the trading process for beginners. However, most brokers only have educational features because they feel like they need to, without investing particular effort in them. In ETFinance’s case, the teaching experience is quite expansive and of a higher quality than most competitors. On top of that, there are multiple mediums you can use to learn, including text, video, and audio materials.

• No Fees

Many brokers use fees to fund the service they provide to traders. Some less customer-oriented firms go a step beyond that and use commissions as an earning-booster. The most malicious companies even try and obscure these charges, hoping the customer won’t notice for some time. While the first situation is the only one that’s somewhat excusable, it still acts negatively towards trading. That’s why traders often go with firms such as ETFinance that provide a fully transparent and fair funding structure.

Funds Trading and Security

Security and trading conditions must always come together for brokers that wish to push into the top market spots. Earning money, just for all of it to be stolen, feels horrid and is, of course, unadvisable. Likewise, being entirely sure all your money is safe in your account is useless if you can’t earn a dime. At that point, you’re better off using a bank account for storage. Luckily, ETFinance does well in both areas, but let’s look at its security first.

As we stated earlier in our ETFinance review, the broker works under the Cypriot watchdog, CySEC. The regulator is undoubtedly one of the most stringent ones out there, ensuring the broker’s proper functioning. Even in the case of a misstep, CySEC has a reimbursement program, promising customers their money back. Naturally, that would come with fines for the broker.

So on a technical level, it’s apparent that ETFinance is in the clear, but when examining security, that’s not enough. You need to look at some slightly more subjective factors, such as user impressions. However, that doesn’t change the broker’s image one bit, except perhaps improving it even further. Users seem quite content with the service the broker provides, bar a few spam reviews.

There’s also the additional factor of the Real Madrid sponsorship we went over earlier in our ETFinance review. Everything we’ve seen lines up perfectly and creates the image of ETFinance being one of the few truly secure brokers. At the very least, it earned our stamp of approval, as it vastly surpasses most competitors.

The Trading Accounts

ETFinance’s account setup makes it so each trader can decide what’s best for their needs. Additionally, it also creates room for the broker to follow the MiFID II regulation meant to protect customers. As such, it empowers the already strong security rating we gave it. We should also note that there’s a demo account option that allows users to access ETFinance’s service without paying. Novices can also use the feature to practice and sharpen their trading skills without losing money.

Moving on to the live accounts, the broker takes a tiered approach, with Silver, Gold, and Platinum variations. The accounts improve via higher investment and volumes, meaning they don’t actually cost anything. As you don’t pay for the accounts themselves, you get the full value of each penny you invest. However, to get started with the Silver version, you need to deposit at least $250.

The broker also creates a split between retail investors and professionals in adherence with MiFID II. Retail accounts are the default, and they come with limited leverage, as well as other risk-reducing qualities. If you wish to obtain a professional account, you’ll need to submit additional documentation. If the documents prove that you’re a financially stable, capable trader, the pro account takes off the training wheels. It allows for a riskier but potentially more lucrative trading experience.

Choosing an account with ETFinance is a matter of personal preference. To aid you in that choice, we’d like to present some of its account qualities:

• Silver

- 750 Assets

- 0.07 Minimum Spreads

- 1:30 Maximum Leverage

- Full 10-hour support from 10am – 8pm GMT

- Islamic account

• Gold

- 0.05 Minimum Spreads

- 1:30 maximum leverage (Retail)

- 1:400/1:500 maximum leverage (Pro)

- Dedicated account manager

- Webinars & videos

- Hedging

- Swap discount 25%

- Islamic account

• Platinum

- 0.03 minimum spreads

- 1:30 maximum leverage (Retail)

- 1:400 / 1:500 maximum leverage (Pro)

- Dedicated account manager

- Webinars & videos

- Swap discount 50%

- News alerts

- Free VPS

- Islamic account

Trading Conditions

ETFinance’s trading conditions pair with its security in making it a top-tier broker. You may have picked up on some from the previous section of our ETFinance review, but here we’ll go over them together. Starting off, the spreads are quite tight, minimizing any sort of trading cost beyond the trade itself. The leverage is high, ensuring the tactics that employ it remains viable. The platform, asset variety, and account structure are all excellent as well.

The secondary factors that back up trading also perform well. The funding, for example, is top-notch. There aren’t any fees on trades, meaning everyone gets the full worth of their money. Security is also excellent, ensuring customers won’t lose their funds to foul play from the broker or the outside.

Trading Platform

In the previous section of our ETFinance review, we mentioned its excellent platform. You probably already assumed we were talking about MetaTrader 4, and you’d be correct. The software has been the top dog in the trading terminal business for quite a while now and is the favorite tool of many traders. It provides unrivaled analytical features while remaining simple in its UI, serving both veterans and novices simultaneously. It also has web and mobile forms, increasing the ease of access and convenience of trading.

ETFinance's Trading Products

Another fantastic part of ETFinance’s service is the volume and quality of its trading instruments. As an all-around broker, it needed to cover all the major trading categories asset-wise. It achieved that and then some, with 750 assets logically placed across a multitude of classes. Naturally, some trading product types have more individual assets than others, but there’s a respectable selection of each kind. Here are the categories you can see at ETFinance:

- Assets

- Forex

- Metals

- Indices

- Stocks

- Commodities

- CFDs

- Cryptocurrencies

- ETFs

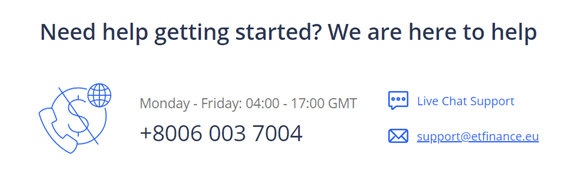

Customer Service

You can use three methods to reach ETFinance’s support: the phone line, live chat, and email. If you wish to call, you’ll need to be slightly careful about the time, as the phone operates Monday – Friday: 04:00 – 17:00 GMT. On the other hand, the live chat and email are functional 24/5, allowing for quick and efficient responses.

Phone: +8006 003 7004

Email: [email protected]

ETFINANCE REVIEW: Conclusion

ETFinance is what most modern brokers should strive to become. It’s apparent that, in its five years of operating, it’s continuously improved and updated. The result of its efforts is a world-class brokerage that does excellent on both vital fronts, trading, and security. The account typing and asset count allow for a truly personalized and skill-expressive experience. Meanwhile, the airtight trading conditions ensure that no matter how you choose to trade, you get the best possible odds. The security seals the deal, guaranteeing that your experience doesn’t get ruined by shady occurrences.

The brokerage is a good gateway into trading for beginners. It provides a comprehensive trading course and a simple-to-grasp platform, allowing novices to ease themselves into the process. On the other hand, it’s also a good fit for veterans, with powerful trading conditions and massive asset variety. Concluding our ETFinance review, we’d say the broker is a great fit for anyone looking for a new trading hub.

COMMENTS

Recommended for You

Recommended for You

Recommended for You

Recommended for You

Recommended for You

Recommended for You

ETFinance Review

-

Support

-

Platform

-

Spread

-

Trading Instrument

298 Comments

Good brokers

Based on my trading results, I can say that these are good brokers. I can see their efforts and dedication to help me attain successful trades. I gained profit and was able to withdraw swiftly.

Did you find this review helpful? Yes No

Good broker

This is my broker for quite some time and I am very glad I chose to trade with them. I get profitable signals and a fast withdrawal process.

Did you find this review helpful? Yes No

Dedicated forex broker

They are dedicted in doing thorough market research. I always get good trading advise from them.

Did you find this review helpful? Yes No

Favorable trading results

Trading results has always been favorable for the past six months. Good broker.

Did you find this review helpful? Yes No

Good broker

Fast withdrawal process. Good trading signals and services as well.

Did you find this review helpful? Yes No

Smooth withdrawals

I am done with my first withdrawal. It is smooth and fast. Hope services will be consistently good.

Did you find this review helpful? Yes No

Good broker

This is my favorite broker company. Services are all efficient and so are the tools. They are always available to help as well.

Did you find this review helpful? Yes No

Skilled broker

Skilled brokers with really dedicated customer service. They are always quick in answering phone calls and messages.

Did you find this review helpful? Yes No

Reliable brokers

Reliable and professional brokers. They’ve been consistently providing excellent services to me since day 1 up until now.

Did you find this review helpful? Yes No

Excellent trading advise

Excellent trading advice and good customer service are the things I like about this broker. I highly recommend them.

Did you find this review helpful? Yes No

Good forex company

My trusted forex company. SIgnals are good as well as the services.

Did you find this review helpful? Yes No

Passive source of income

A good passive source of income. I wouldn’t have to spend more time on this, I just have to place trades and wait for results.

Did you find this review helpful? Yes No

Good broker

I can consider them as a good broker. They are professional and skilled in the forex market.

Did you find this review helpful? Yes No

Amazing brokers

Their customer service is truly amazing. They are helpful and attentive most of the time.

Did you find this review helpful? Yes No

Reliable brokers

They’re transparent in all transactions. I can trust this broker with my portfolio they are reliable.

Did you find this review helpful? Yes No

Good tradong trainers

They have trained me do trading properly. Had given me free educational materials, too.

Did you find this review helpful? Yes No

Good broker

Good broker to trade forex. They are experienced in the forex market. Signals are good are services are reliable.

Did you find this review helpful? Yes No

Good trading broker

This broker performs good. I have been trading for a few months now. I get good profit and services, too.

Did you find this review helpful? Yes No

Accomodating customer service

They have accomodating customer service. Everytime I send message about any concerns, they imediately call me and address my needs.

Did you find this review helpful? Yes No

Reliable broker

I had a good trading experience with this broker. Trading advice are reliable. I am happy with my profit.

Did you find this review helpful? Yes No

Quick withdrawals

Quick and easy withdrawal process. I gain good profit, too.

Did you find this review helpful? Yes No

Smooth withdrawals

Easier and faster withdrawals. I never had any problem withdrawing my money.

Did you find this review helpful? Yes No

Great trading opportunities

I am impressed with the trading opportunities given to me by this broker. I have tried a few and they’re really profitable.

Did you find this review helpful? Yes No

One of the best

I am impressed with the services and the overall performance of this forex broker. They are one of the best in forex trading.

Did you find this review helpful? Yes No

No regrets joining

No regrets joining the team. Trading terms are fair, good leverage and tight spreads, too.

Did you find this review helpful? Yes No

Reliable signals

Reiable trading signals and accurate market analysis. I can fully trust them, they’re good in helping me gain good profit.

Did you find this review helpful? Yes No

Great trading experience

Great trading experience. Happy to recommend.

Did you find this review helpful? Yes No

Best brokers

It is probably one of the best brokers for trading Forex. They have low trading costs, support pleasant, fast and personalized and a wide range of products to exchange.

Did you find this review helpful? Yes No

Good broker

All services offered here are excellent. They’ve always been a my good broker for forex trading, I am fully satisfied with the services.

Did you find this review helpful? Yes No

Skilled brokers

Responsible and skilled brokers. They are transparent on all transactions. I gain good profit from the deals and satisfied with the services.

Did you find this review helpful? Yes No

The best forex company

The best company for online trading. I really had a blast.

Did you find this review helpful? Yes No

Accomodating customer service

They have accomodating customer service. Every time I send a message about any concerns, they immediately call me and address my needs.

Did you find this review helpful? Yes No

Trusted broker company

It is a broker company I can trust. I feel confident trading with them because I know that I can depend on the signals and the services.

Did you find this review helpful? Yes No

Skilled brokers

Skilled trading brokers. They always amazed me with good signals and accurate market analysis.

Did you find this review helpful? Yes No

Good trading tool

Reliable trading software. It is a bit difficult to use when I started but overall, it is a good trading tool.

Did you find this review helpful? Yes No

Great trading experience

I have joined this broker a couple of months ago and I had a great trading experience. I gain good profit and got no problem with withdrawals.

Did you find this review helpful? Yes No

Great forex tools

Great forex tools and signals. They provide not only profitable signals but also updated market news and forex educational materials.

Did you find this review helpful? Yes No

Good services

There are so many good reasons to keep the services. One of which is getting a really profitable trading signal.

Did you find this review helpful? Yes No

Happy with the services

Happy with the service. They have provided a dedicated account manager whose responsible and always available to help me with my trading needs.

Did you find this review helpful? Yes No

Good broker

Fun trading environment. I have no complaints with all of the services.

Did you find this review helpful? Yes No

Reliable broker

Genuinely reliable. I have been using this broker service for quite some time and I never had any single issues encountered as I trade along.

Did you find this review helpful? Yes No

Good to deal with

Good to deal with. They never give me any problem on withdrawals or whatsoever. I have skilled mentors as well.

Did you find this review helpful? Yes No

Interesting

Interesting forex brokers. They are well-versed about the forex industry.

Did you find this review helpful? Yes No

Good broker

Good broker to trade forex. They are experienced in the forex market. Signals are good are services are reliable.

Did you find this review helpful? Yes No

Coomendable services

Commendable trading services. Fast and easy withdrawals.

Did you find this review helpful? Yes No

Accurate signals

Good broker to deal with. They have strong market analysis and accurate signals.

Did you find this review helpful? Yes No

Profitable trading assets

There is a wide array of trading assets to choose from. Most are instruments are affordable and deals are profitable.

Did you find this review helpful? Yes No

Good tradong trainers

They have trained me do trading properly. Had given me free educational materials, too.

Did you find this review helpful? Yes No

No regrets joining

No regrets joining the team. Trading terms are fair, good leverage and tight spreads, too.

Did you find this review helpful? Yes No

Great trading services

Great trading services. I am happy with my trading results and will surely recommend.

Did you find this review helpful? Yes No

Good broker service

This is my long-time broker. What I love about the services are great customer service, fast withdrawals, and profitable signals.

Did you find this review helpful? Yes No

Favorable trading results

Trading results have always been favorable for the past six months. Good broker.

Did you find this review helpful? Yes No

Wonderful signals

Wonderful trading signals. It gives me good profit. They are consistently great.

Did you find this review helpful? Yes No

Happy with services

Been using this broker for a month only but my impression are on the services is really great. Hope this continues. Happy with the services, overall.

Did you find this review helpful? Yes No

Good broker

I finally found a very good broker to trade with. Withdrawals are always fast and services are always good.

Did you find this review helpful? Yes No

Reliable broker

Reliable and great services. I had so many great options to earn money and I have a good return on my investment.

Did you find this review helpful? Yes No

Amazing broker

Amazing broker for online trading. I get good profits and awesome services.

Did you find this review helpful? Yes No

Good broker

Friendly and enthusiastic customer service. I am okay with the terms and happy with the services.

Did you find this review helpful? Yes No

The best customer service

The best customer service. They are very patient and responsive online. I love their attitude towards me as well.

Did you find this review helpful? Yes No

Excellent broker

I joined this broker company last month and as early as 2 weeks I see potential. I must admit they are one of the best among any other brokers in the industry.

Did you find this review helpful? Yes No

Great trading services

Great trading services. I am happy with my trading results and will surely recommend.

Did you find this review helpful? Yes No

Commendable broker

Highly commendable broker services. I get really good returns on my trades.

Did you find this review helpful? Yes No

Fast withdrawals

With this broker deposit and withdrawals are always fast and seamless. Services are prompt as well.

Did you find this review helpful? Yes No

Perfect broker

Perfect broker to trade forex. They are experienced and skilled. Gives out good trading advice all the time.

Did you find this review helpful? Yes No

Happy with this broker

I am dealing with very responsible brokers and good customer service. I am overall satisfied and happy with this broker company.

Did you find this review helpful? Yes No

Great trading services

Great trading services. I am happy with my trading results and will surely recommend.

Did you find this review helpful? Yes No

Huge profit

I tried trading with them and gain huge profits after a month. I have no regrets spending my time and money with this broker, it is worth it, indeed!

Did you find this review helpful? Yes No

Trusted broker

My trusted trading broker. Signal are profitable.

Did you find this review helpful? Yes No

Friendly customer service

Friendly customer service and fast withdrawals. I am happy and satisfied.

Did you find this review helpful? Yes No

Dedicated trading broker

Happy to leave a review for this trading broker. They are very responsible and dedicated in helping me succeed in trading.

Did you find this review helpful? Yes No

Overall satisfied

It’s good to trade with this broker, they have great brokers and good service. I am happy with my profit, and overall satisfied.

Did you find this review helpful? Yes No

Good profit

Easy withdrawals and good signals. I gain real good profit.

Did you find this review helpful? Yes No

Great broker

A great forex broker to deal with. I consistently withdraw 10 to 15 percent profit on a monthly basis, something that I never had with my previous broker.

Did you find this review helpful? Yes No

Honest and transparent

Very honest and transparent broker. I am fully aware on the what’s what if’s, hows, and why’s of my trading account.

Did you find this review helpful? Yes No

Good trading brokers

Good trading brokers, their trading advice are so much profitable. Services are consistently good and people are very professional.

Did you find this review helpful? Yes No

Overall very impressed

I am overall impressed with all of the services. The signals are profitable and accurate.

Did you find this review helpful? Yes No

Responsible and professional

Responsible and professional people. They are very transparent on all transactions. I am gaining good profit and satisfied with the services.

Did you find this review helpful? Yes No

Best forex broker company

Generally, one of the best company for forex brokerage. Fats withdrawal and smooth transactions.

Did you find this review helpful? Yes No

Favorable trading results

In general, it is great to deal with this broker. The services are all efficient and trading results are favorable.

Did you find this review helpful? Yes No

Good profit

I have joined them last year and decide to stay because I am consistently getting good profits. I was able to get approximately 10-15 percent on a monthly basis.

Did you find this review helpful? Yes No

Great trading services

Great trading services. I am happy with my trading results and will surely recommend.

Did you find this review helpful? Yes No

Good trading instruments

Offers a large selection of trading products. I’ve been trading a few stocks, and I consistently make nice returns.

Did you find this review helpful? Yes No

Great broker company

Transparent and respectful brokers. Their support has always been very good in helping me. Indeed, a great broker company.

Did you find this review helpful? Yes No

Best trading company

This is one of the best trading company. They laid down so many good offers and the services are great.

Did you find this review helpful? Yes No

Good broker

Good trading services. I always get my money on time.

Did you find this review helpful? Yes No

Excellent brokers

Excellent is not enough to describe their services. I am impressed with their support, their broker signals as well as their platform.

Did you find this review helpful? Yes No

Attractive trading profit

I get attractive trading profits and good services overall. Very minimal slippage.

Did you find this review helpful? Yes No

Expert brokers

Expert brokers. I find this trading company good and the services are efficient.

Did you find this review helpful? Yes No

Great trading service

Extremely great trading services. Signals are always amazing.

Did you find this review helpful? Yes No

Excellent broker

Excellent trading broker. Withdrawal is fast and easy.

Did you find this review helpful? Yes No

Efficient services

Extremely recommended services. Profitable and efficient.

Did you find this review helpful? Yes No

Great broker services

I would continue trading with this broker. Services are beyond expected. Results are always awesome.

Did you find this review helpful? Yes No

Commendable services

Commendable trading services. Fast and easy withdrawals.

Did you find this review helpful? Yes No

Fully satisfied

I’ve got no complaints with their services. I am truly satisfied with this broker service.

Did you find this review helpful? Yes No

Good broker

It’s been a pleasure dealing with this broker. I was able to gain good profit and they have become a family to me.

Did you find this review helpful? Yes No

Good profit

I never had any problem with the services for the past six months. I am getting really good profit.

Did you find this review helpful? Yes No

Good broker

Good broker for forex trading. They have been very professional in all dealings.

Did you find this review helpful? Yes No

Good trading company

This is a good trading company. They are very professional and they never fail to pay profit on time.

Did you find this review helpful? Yes No

Great profit

I am so much thankful to this broker service for giving me really great services and profit.

Did you find this review helpful? Yes No

Professional customer service

Customer service are very professional. They are dedicated in helping me make money via online trading.

Did you find this review helpful? Yes No

Exceptional broker service

Exceptional broker services. I am impressed on broker signals and even services.

Did you find this review helpful? Yes No

Warm customer service

Brokers and customer service are very warm and helpful. The signals aren’t really good but the people are nice.

Did you find this review helpful? Yes No

Great trading opportunities

They have given me so many great opportunities to earn money. I am glad to have traded with the right broker. I gain good profit and recieved my withdrawals earlier than expected date.

Did you find this review helpful? Yes No

Good broker

Good trading services. I always get my money on time.

Did you find this review helpful? Yes No

Excellent brokers

Excellent broker service specially in terms of signals and withdrawals. Withdrawals are always fast and signals are always profitable.

Did you find this review helpful? Yes No

Happy with this broker

I am happy with the services. Signals brings good profit and withdrawal is smooth and fast.

Did you find this review helpful? Yes No

Good brokers

They are good brokers. They let me see their company and regulation prior trading. Also, they explain all the things I need to know including risk. Very transparent.

Did you find this review helpful? Yes No

Affordable trading

I can trade at a lower cost. Very affordable initial deposit and trading assets. SIgnals are very much reliable.

Did you find this review helpful? Yes No

Good broker company

Good broker company. There are so many good trading instruments to choose from.

Did you find this review helpful? Yes No

Profitable broker

I would like to commend their customer service for being so professional and helpful. Also, their profitable signals that had to help me grow my investment.

Did you find this review helpful? Yes No

Reliable signals

Reliable trading signals and accurate market analysis. I can fully trust them, they’re very good in helping me gain good profit.

Did you find this review helpful? Yes No

The best trading coach

The best forex trading coach I have ever used. The signals are spot on. I am very sucessful on my trades because of their sound trading advise.

Did you find this review helpful? Yes No

Good brokers

Easy to deal with brokers. They do listen and understand me all the time.

Did you find this review helpful? Yes No

Good broker

Cheers to a great start with this broker. I have just started using the services for a few weeks and so far I am amazed with its performance. Hoping for consistency.

Did you find this review helpful? Yes No

Good brokers

Really good in what they do. Never fail to bring good profit on my trading account.

Did you find this review helpful? Yes No

Good customer service

One of the brokers with good customer service. They attend to trading needs promptly.

Did you find this review helpful? Yes No

Professional brokers

I am dealing with very professional people. They attend to trading needs promptly and are very responsive.

Did you find this review helpful? Yes No

Perfect forex broker

This is the perfect forex broker I found. Fast and easy withdrawals with excellent customer service.

Did you find this review helpful? Yes No

Wonderful broker

Wonderful trading platform and good services. I am very satisfied with all of their services.

Did you find this review helpful? Yes No

Decent brokers

Decent trading brokers. They paid all my withdrawals on time and attend to all my trading terms promptly.

Did you find this review helpful? Yes No

Good broker

Good broker signals and trading tools. I’ve gained good profit consistently.

Did you find this review helpful? Yes No

Good brokers

Really good in what they do. Never fail to bring good profit on my trading account.

Did you find this review helpful? Yes No

Excellent brokers

Excellent is not enough to describe their services. I am impressed with their support, their broker signals as well as their platform.

Did you find this review helpful? Yes No

Great services

Great services. Happy and satisfied!

Did you find this review helpful? Yes No

Good broker

I had fun trading with this broker. I get good trading returns and I am dealing with good people.

Did you find this review helpful? Yes No

Good brokers

Really good in what they do. Never fail to bring good profit on my trading account.

Did you find this review helpful? Yes No

Happy with services

My account manager, the brokers, and support has always been very good to me. I get a good profit on a monthly basis and I am very happy with the services.

Did you find this review helpful? Yes No

Good trading company

Good trading company for online trading. Very friendly and are highly skilled in online trading.

Did you find this review helpful? Yes No

Exemplary services

Exemplary customer service and sound trading advice. I will surely keep the services.

Did you find this review helpful? Yes No

One of the best broker

I am happy to leave a review for this broker company. I can consider them as one of the best brokers in the forex industry.

Did you find this review helpful? Yes No

Transparent broker

Terms are well explained at the start including possible risks. I don’t see any gray areas, very transparent.

Did you find this review helpful? Yes No

Impressive

Impressive broker services. They are very professional and helpful.

Did you find this review helpful? Yes No

Highly recommended

Enthusiastic customer service and great signals. Highly recommended broker company.

Did you find this review helpful? Yes No

Skilled and experience brokers

Nothing beats this broker service. among the ones I have traded with they have the most profitable signals. Brokers are highly skilled and experienced.

Did you find this review helpful? Yes No

Highly recommended

Enthusiastic customer service and great signals. Highly recommended broker company.

Did you find this review helpful? Yes No

Highly recommended

I am successful on all of my trades because I have a very good broker helping me. Highly recommended trading brokers.

Did you find this review helpful? Yes No

Best trading company

This is one of the best trading companies. They laid down so many good offers and the services are great.

Did you find this review helpful? Yes No

Good broker service

Good broker service. Withdrawal is fast, trading instruments are affordable and trading signals are very accurate.

Did you find this review helpful? Yes No

Good broker service

Good broker service I can say. Services are one of a kind and never fail to give good returns.

Did you find this review helpful? Yes No

Good company

Good company. They process withdrawals smoothly and are very professional at all times.

Did you find this review helpful? Yes No

Recommended broker

I would love to recommend this forex broker. They have been very professional and show expertise in forex trading.

Did you find this review helpful? Yes No

Good place to trade

This is a good place to trade forex. Services and signals are both reliable.

Did you find this review helpful? Yes No

Reliable broker

Lucky to have them as my trading broker. They’ve been very reliable.

Did you find this review helpful? Yes No

Excellent broker

I can say that this is one of the best brokers in the forex industry. I am getting approximately 15 percent profit and it progresses depending on the volume of trades I place. I don’t have any problem with software nor services. The same goes for withdrawals, it is always swift and easy.

Did you find this review helpful? Yes No

Excellent brokers

Excellent is not enough to describe their services. I am impressed with their support, their broker signals as well as their platform.

Did you find this review helpful? Yes No

Outstanding broker

Outstanding broker signals and good trading software. They’ve made trading easier and more productive for me.

Did you find this review helpful? Yes No

Excellent broker

I decided to stick with this broker because I gain good profit, Highly commendable customer service, and excellent signals.

Did you find this review helpful? Yes No

Excellent broker

Excellent in all aspects. I have no problem with services or signals. They’ve always been so amazing.

Did you find this review helpful? Yes No

Swift withdrawals

Swift withdrawals. I never experience any hassle requesting withdrawals. They are easy to be with.

Did you find this review helpful? Yes No

The best broker

Of all brokers I have used, this one is the best. They have a fast and easy withdrawal process with so many good trading options.

Did you find this review helpful? Yes No

Highly recommended

Efficient broker services. Signals are also the best. I got good profits, will keep the services and will surely recommend.

Did you find this review helpful? Yes No

Friendly broker

They have shown expertise in forex trading. I admire the brokers and customer service which are very friendly.

Did you find this review helpful? Yes No

Good trading company

Good trading company. I have no complaints so far and I am truly satisfied with the services and tools.

Did you find this review helpful? Yes No

Expert broker

They are experts on market trends. Always do intensive research before we place trades. Two thumbs up for this broker.

Did you find this review helpful? Yes No

Good broker

Easy to deal with brokers and customer service. What’s good about them, aside from getting a decent profit is that they listen and assist me in the best possible way.

Did you find this review helpful? Yes No

Good services

Good service for forex trading. No problem with any of the services, all good.

Did you find this review helpful? Yes No

Skilled broker

Professional in all transactions. They are very friendly and skilled in the forex market.

Did you find this review helpful? Yes No

Fully satisfied

Great trading terms and good services. Fully satisfied.

Did you find this review helpful? Yes No

Good broker

I had fun trading with this broker. I get good trading returns and I am dealing with good people.

Did you find this review helpful? Yes No

The best broker

This broker defines excellence very well. I am speaking based on experience and the profit I get. They’re one of the best.

Did you find this review helpful? Yes No

The best broker

The best trading guide. Aside from getting good profit from their accurate signals, they also have good educational materials to take advantage of.

Did you find this review helpful? Yes No

Excellent trading terms

Excellent trading terms and services. I have no regret choosing them to be my forex broker. They are really very good.

Did you find this review helpful? Yes No

Smooth withdrawals

Awesome broker services. Withdrawal has never been this easy. I am able to withdraw profit smoothly, with no hassles and runarounds.

Did you find this review helpful? Yes No

Good trading broker

They’re exactly what I am looking for in forex trading. I need a trading partner to help me gain good profit. I am glad to have them as my forex broker.

Did you find this review helpful? Yes No

Accurate market forecast

I can merely rely on their daily analysis provided to me. The very accurate market forecast and signals are profitable.

Did you find this review helpful? Yes No

Great tools

Great trading tools. I find it easier to trade and accounts are more organized.

Did you find this review helpful? Yes No

Good broker service

This is my long-time broker. What I love about the services are great customer service, fast withdrawals, and profitable signals.

Did you find this review helpful? Yes No

Honest brokers

This is the only broker I am confident in trusting my money with. They are very transparent and honest in all transactions.

Did you find this review helpful? Yes No

Professional broker

They were able to hit the forecast. Always on time and meet commitments all the time.

Did you find this review helpful? Yes No

Good broker

Always maintain a good connection with me. Trading results are good and I am happy with customer service.

Did you find this review helpful? Yes No

Awesome trading results

Awesome trading results I have ever seen in my entire time of trading forex. Signals and instruments are so much productive.

Did you find this review helpful? Yes No

Profitable signals

They are one of the best forex brokers I have dealt with. Signals are accurate and profitable.

Did you find this review helpful? Yes No

Best forex broker

For me, this is the best broker. Signals are very good, accurate, and timely which gives so much profit. Their customer support is very responsive to any concerns.

Did you find this review helpful? Yes No

Good services

They attend to all of my trading needs promptly. Very efficient in all services and signals are worthwhile.

Did you find this review helpful? Yes No

Good profit

Competitive trading conditions and broker signals. I gain good profit consistently.

Did you find this review helpful? Yes No

Awesome services

Awesome trading services. Withdrawal is always quick and easy, I never had any hassle dealing with this broker.

Did you find this review helpful? Yes No

Easy withdrawals

I find it easier and faster to withdraw profit here. Will surely recommend it.

Did you find this review helpful? Yes No

Respected broker

Respected and trustworthy broker company. I have been with them for a few months and have decided to keep the services.

Did you find this review helpful? Yes No

Fast withdrawals

Fast and easy to withdraw money. They respond quickly, too.

Did you find this review helpful? Yes No

Accurate signals

Outstanding trading signals. Trading advise are very profitable. There are so many opportunities to earn.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker for online trading. Highly recommended services.

Did you find this review helpful? Yes No

Satisfied with this broker service

Good customer service, a stable platform, fast execution, and hassle-free withdrawals. Overall satisfied with this broker’s service.

Did you find this review helpful? Yes No

Good and reliable

A good & reliable company. Convinced on me. I’ve opened a minimum account here and began to trade. After a month of trading, I ordered a withdrawal, it was received quickly by me, after another month I sent an application for the second one, it also came in time, and now after six months of regular withdrawals I became convinced of the reality of everything that was happening, and that everything is perfect here.

Did you find this review helpful? Yes No

Reliable signals

Reliable signals and services. I earn a good profit and was able to withdraw it quickly.

Did you find this review helpful? Yes No

Happy with this broker

I am happy with the services. Signals bring good profit and withdrawal is smooth and fast.

Did you find this review helpful? Yes No

Great broker

I meet this broker just in time. I was about to give up due to consecutive losses, but they have helped me recover.

Did you find this review helpful? Yes No

Affordable and profitable

I have a lot of options here to trade with. The assets are very affordable and profitable.

Did you find this review helpful? Yes No

The best customer service

The best customer service. They are very patient and responsive online. I love their attitude towards me as well.

Did you find this review helpful? Yes No

Happy with my profit

Easy deposit and withdrawal process. No many hassles and no fancy documents to provide. I am happy with my profit so far.

Did you find this review helpful? Yes No

Good profit

I can withdraw my profit anytime without any hassle. All of the services are always very efficient and profit is really good.

Did you find this review helpful? Yes No

Reliable broker

Reliable and great services. I had so many great options to earn money and I have a good return on my investment.

Did you find this review helpful? Yes No

Good broker

Friendly and enthusiastic customer service. I am okay with the terms and happy with the services.

Did you find this review helpful? Yes No

Good customer service

Good customer service and excellent trading advice. I gain really good income from their offers.

Did you find this review helpful? Yes No

Happy and satisfied

A good trading experience overall. I am happy and satisfied.

Did you find this review helpful? Yes No

Good profit

I am getting good profit as a trader in this broker company. It’s really amazing how they had helped me grow my investment.

Did you find this review helpful? Yes No

Exceptional broker performance

Exceptional broker performance. I get really awesome trading results.

Did you find this review helpful? Yes No

Good services

The services are all good. People are very professional. I could not ask for more.

Did you find this review helpful? Yes No

Reasonable pricing

Reasonable pricing and good services. I could not ask for anything more.

Did you find this review helpful? Yes No

Favorable trading results

Trading results have always been favorable for the past six months. Good broker.

Did you find this review helpful? Yes No

Helpful and Accom,odating

Helpful and accomodating customer service. I’ve got no complaints at all.

Did you find this review helpful? Yes No

Great broker services

I get trading aids not only through signals and advice but also some materials and tools to do market research. I was able to see market status and movements myself. This builds a better understanding of the market movements and builds confidence in placing my trades.

Did you find this review helpful? Yes No

The best trading coach

The best forex trading coach I have ever used. The signals are spot on. I am very successful in my trades because of their sound trading advice.

Did you find this review helpful? Yes No

Smooth withdrawals

Smooth withdrawals and good customer service. Highly recommended trading brokers.

Did you find this review helpful? Yes No

Highly recommended

Highly recommended forex trading broker. The services are always good and I get good profit as well.

Did you find this review helpful? Yes No

Great services

It provides good support, great services, profitable signals, and low cost. These are my reasons for keeping this broker service.

Did you find this review helpful? Yes No

Warm customer service

This broker was recommended to me by a friend and I’ve got regrets about switching to their services. They have the most reliable platform and signals. And a very warm customer service

Did you find this review helpful? Yes No

Good broker

Good broker company. Signals are amazing.

Did you find this review helpful? Yes No

Expert brokers

This broker is just new and I’ve just used their services for a month now. But I am really amazed by the broker signals and market analysis. They are experts in what they do.

Did you find this review helpful? Yes No

Good profit

They have so many trading assets to choose from. I enjoy trading with them. Profit is good and people are very professional.

Did you find this review helpful? Yes No

Good profit

I get good profit and services are consistently good. Thumbs up for this forex broker.

Did you find this review helpful? Yes No

Good trading broker

Brokers always come up with good trading advice and signals. I gain decent profit trading with this broker and get really good services, too.

Did you find this review helpful? Yes No

Perfect forex broker

Perfect trading tools and signals to use. I am so happy that I found the perfect broker, I gain a good income here.

Did you find this review helpful? Yes No

Good broker

Good brokers to deal with. They attend to all my concerns right away.

Did you find this review helpful? Yes No

Good support

Good support and broker. I owe my trading success to this broker company.

Did you find this review helpful? Yes No

Good services

God services. For the past six months, I never had any issues with their services. Worth my time.

Did you find this review helpful? Yes No

The best broker

This broker defines excellence very well. I am speaking base on the experience and profit I get. They’re one of the best.

Did you find this review helpful? Yes No

Excellent services

Excellent services for forex trading. Tools are also awesome.

Did you find this review helpful? Yes No

Good brokers

Great trading options, very affordable and profitable. I gain good profit and I owe so much from these brokers.

Did you find this review helpful? Yes No

Good profit

Happy and blessed to have them as my forex adviser. I am on the right track and I get good profit.

Did you find this review helpful? Yes No

Acceptable signals

Acceptable trading signals and services. I gain real good profit from their signals.

Did you find this review helpful? Yes No

Good services

Consistently good services. I have been using their services for over six months now and they never fail to amaze me.

Did you find this review helpful? Yes No

Excellent

Excellent range of instruments to trade. Exemplary services.

Did you find this review helpful? Yes No

Good broker service

This is my long-time broker. What I love about the services are great customer service, fast withdrawals, and profitable signals.

Did you find this review helpful? Yes No

Good company

Good broker company. The results have always been favorable.

Did you find this review helpful? Yes No

Good customer service

Good customer service. They are very friendly and attentive.

Did you find this review helpful? Yes No

Fast and reliable services

Fast and reliable customer service. They are knowledgeable and always ready to help.

Did you find this review helpful? Yes No

Good returns

Affordable pricing and very good returns. I am happy with what I get from this broker company.

Did you find this review helpful? Yes No

Great broker company

Transparent and respectful brokers. Their support has always been very good in helping me. Indeed, a great broker company.

Did you find this review helpful? Yes No

Recommended broker

I would love to recommend this forex broker. They have been very professional and show expertise in forex trading.

Did you find this review helpful? Yes No

Great trading options

I have so many options to trade. All instruments are worthwhile.

Did you find this review helpful? Yes No

Highly recommended

Signals are accurate and profitable. Highly recommended.

Did you find this review helpful? Yes No

Impressive services

Impressive broker services. Two thumbs up for them.

Did you find this review helpful? Yes No

Good broker

Overall, this is a good broker. Withdrawals are always smooth and fast.

Did you find this review helpful? Yes No

Worthwhile signals

The best trading partner I have dealt with. Signals are worthwhile.

Did you find this review helpful? Yes No

Great trading broker

These are my favorite trading tools and services. I find the services really very efficient. They also offer high-tech tools that make trading easier for me.

Did you find this review helpful? Yes No

Best customer service

The best customer service I have ever talk to. They are very friendly and professional in all dealings.

Did you find this review helpful? Yes No

Easy and quick withdrawals

What I like about this broker aside from its profitable signals is that all transactions here smoothly process. That includes withdrawal which is very easy and quick.

Did you find this review helpful? Yes No

Profitable trading

I got so many trading options to choose from. All are very affordable and profitable.

Did you find this review helpful? Yes No

Good broker service

This is my long-time broker. What I love about the services are great customer service, fast withdrawals, and profitable signals.

Did you find this review helpful? Yes No

Trusted broker

A company I can truly trust. They are very honest and had greatly helped me in my trading needs.

Did you find this review helpful? Yes No

Smooth withdrawals

So far deposits and withdrawals were done smoothly. And the customer service is superb.

Did you find this review helpful? Yes No

Excellent broker

Excellent trading broker. They are skilled and are very professional.

Did you find this review helpful? Yes No

Wise choice

This is really a wise choice. Signals are profitable and withdrawal is easy.

Did you find this review helpful? Yes No

Smooth withdrawals

Smooth withdrawals and trading transactions. I have used this broker for more than 2 years and I am fully satisfied with the results.

Did you find this review helpful? Yes No

Professional broker

I am delighted with this broker’s services. They’ve been very professional and easy to deal with.

Did you find this review helpful? Yes No

Profitable trading assets

There is a wide array of trading assets to choose from. All are very affordable and profitable.

Did you find this review helpful? Yes No

Excellent offers

Excellent trading offers. I am gaining good profit on all of my trades.

Did you find this review helpful? Yes No

Good broker

Easy deposit and withdrawals. Profitable signals.

Did you find this review helpful? Yes No

Good broker service

Easy to deal with brokers and customer service. I gain good profit and is overall happy with the services.

Did you find this review helpful? Yes No

Good trading advice

Good trading advice. I had good trading returns and was able to withdraw it swiftly.

Did you find this review helpful? Yes No

Good broker

Good broker, signals, and services are amazing.

Did you find this review helpful? Yes No

Good profit

I am new to online trading. In fact, it is my first time trading. But I am happy that I made the right choice of choosing this broker. They have helped me gain good profit.

Did you find this review helpful? Yes No

Good trading company

Good trading company. Signals are always spot on and services are good. Have no regrets about trading with them.

Did you find this review helpful? Yes No

Commendable broker

Commendable broker and customer services. I have been using this broker service for almost a year and will surely keep the services.

Did you find this review helpful? Yes No

Professional brokers

Very professional and skilled forex brokers. Signals are really worthwhile and services are dependable.

Did you find this review helpful? Yes No

The best broker

The best forex broker. They’ve been my trading broker for a while and I am always impressed with the services.

Did you find this review helpful? Yes No

Smooth withdrawals

All transactions are smooth and quick. That includes withdrawals, I get my money earlier than expected. Customer service is very responsive.

Did you find this review helpful? Yes No

Impressed with this broker

I am so impressed with this broker’s performance. I got a really good profit.

Did you find this review helpful? Yes No

Great broker

Efficient and fast services. Two thumbs up for Vlom. A great broker likes no other.

Did you find this review helpful? Yes No

Good broker

I can say that this is a good broker because aside from getting good profit, I am able to withdraw my profit swiftly.

Did you find this review helpful? Yes No

Awesome broker

Very good execution, great chart, and excellent signals. I am so much impressed with its performance, really awesome.

Did you find this review helpful? Yes No

Friendliest customer service

Friendliest and most accomodating customer service among brokers I have trade with.

Did you find this review helpful? Yes No

Efficient broker

I have been using this broker service for quite some time now and I love their trading platform, it is easy to use. Services are also efficient.

Did you find this review helpful? Yes No

Efficient trading partner

I enjoy trading currency pairs with this broker. I am just new to this and so I started trading currencies for now. I am planning to trade other stocks soonest possible time. I am keeping these broker services, by the way, they are efficient trading partners.

Did you find this review helpful? Yes No

Profitable

Interesting broker services. The signals are so profitable. Worth trading with.

Did you find this review helpful? Yes No

Excellent services

This is my long-time broker. What I love about the services are great customer service, fast withdrawals, and profitable signals.

Did you find this review helpful? Yes No

Recommended

The account managers are friendly and skilled. Broker signals guarantee 99% of winning most of the time. Recommended broker.

Did you find this review helpful? Yes No

Excellent broker

This is a perfect broker for beginners like me. They are very patient in guiding me to place a good trade. They also offer good trading education

Did you find this review helpful? Yes No

Good broker overall

Overall this is a good broker to trade with. They have excellent broker signals and hassle-free withdrawals.

Did you find this review helpful? Yes No

Reliable broker

Good forex trading partner. I get a good profit and got no problem with withdrawals. I never worry about placing my trades because their trading advice is very reliable.

Did you find this review helpful? Yes No

Very kind customer service and brokers

Very kindly customer service and brokers. I feel safe and confident trading with them as well.

Did you find this review helpful? Yes No

Very profitable

No regrets about choosing their services. I am consistently having a good withdrawal. Very profitable.

Did you find this review helpful? Yes No

Competitive broker

Competitive trading conditions and broker signals. I gain good profit consistently.

Did you find this review helpful? Yes No

Excellent services

I can rate this broker’s services excellent. Signals are worthwhile and services are good.

Did you find this review helpful? Yes No

Good broker service

One of the best brokers I have ever dealt with. Signals and services are both good.

Did you find this review helpful? Yes No

Highly recommended

Highly recommended brokers. They have so accurate trading signals and a smooth withdrawal process.

Did you find this review helpful? Yes No

Good broker

Fast smooth deposits and withdrawals. Also, good customer service.

Did you find this review helpful? Yes No

Excellent broker

This broker is committed to excellence. They take time to do some careful research and provides great trading advice.

Did you find this review helpful? Yes No

Fast withdrawals

Easier and faster withdrawals. I have used several brokers in the past but among them, this broker has the smoothest withdrawal process.

Did you find this review helpful? Yes No

Amazing broker

I honestly don’t buy time to leave reviews such as this but these brokers deserve one. They are simply amazing. Would surely recommend them.

Did you find this review helpful? Yes No

No hassle withdrawals

It is easy and fast to request withdrawals. No hassle or whatsoever.

Did you find this review helpful? Yes No

One of the best broker

I have no problem dealing with this broker. They are one of the best.

Did you find this review helpful? Yes No

Transparent

A broker company I can fully trust. Very transparent on all transactions.

Did you find this review helpful? Yes No

Satisfied with this broker

Signals give good profit and services are great. I observe consistency for the past six months and I am very satisfied.

Did you find this review helpful? Yes No

Great signals

Great signals and goos trading platform. Have been using their services for a few months and it is really one of the best brokers.

Did you find this review helpful? Yes No

Prompt customer service

Prompt and friendly customer service. They are always ready and willing to help.

Did you find this review helpful? Yes No

Good broker

Easy and fast withdrawals. Good customer service, too.

Did you find this review helpful? Yes No

Great signals

Great signals and goos trading platform. Have been using their services for a few months and it is really one of the best brokers.

Did you find this review helpful? Yes No

Professional brokers

Professional forex brokers. They are highly skilled experienced in the forex market. It is very evident in my trading results.

Did you find this review helpful? Yes No

Good experience

Fun and good experience so far. I gain good profit.

Did you find this review helpful? Yes No

Exemplary services

Exemplary services. Will surely keep this broker service.

Did you find this review helpful? Yes No

Excellent

Excellent in terms of trading signals with a fast and easy withdrawal process. I never had any issues trading with them.

Did you find this review helpful? Yes No

Good trading advice

Good trading advice and good trading services. I have been trading with them for a couple of years. My length of stay with this broker tells you how good they are.

Did you find this review helpful? Yes No

Great trading mentors

They are more than a trading broker. Aside from getting good profit from their good signals, they are also providing me with great trading education.

Did you find this review helpful? Yes No

The best

The best trading partner. I never worry about getting losses, their signals are very reliable.

Did you find this review helpful? Yes No

Great services

Great services so far. It’s just a month of trading with them, I am not sure if it’s gonna be consistently good. But so far, I am fully satisfied.

Did you find this review helpful? Yes No

Excellent forex broker

Excellent. After trading with them for over a year, they always bring good profit to my trading account. Trading advice is always accurate.

Did you find this review helpful? Yes No

Great broker service

Great broker services. Withdrawal is fast and easy as if it is real-time. Trading transactions are always seamless and smooth.

Did you find this review helpful? Yes No