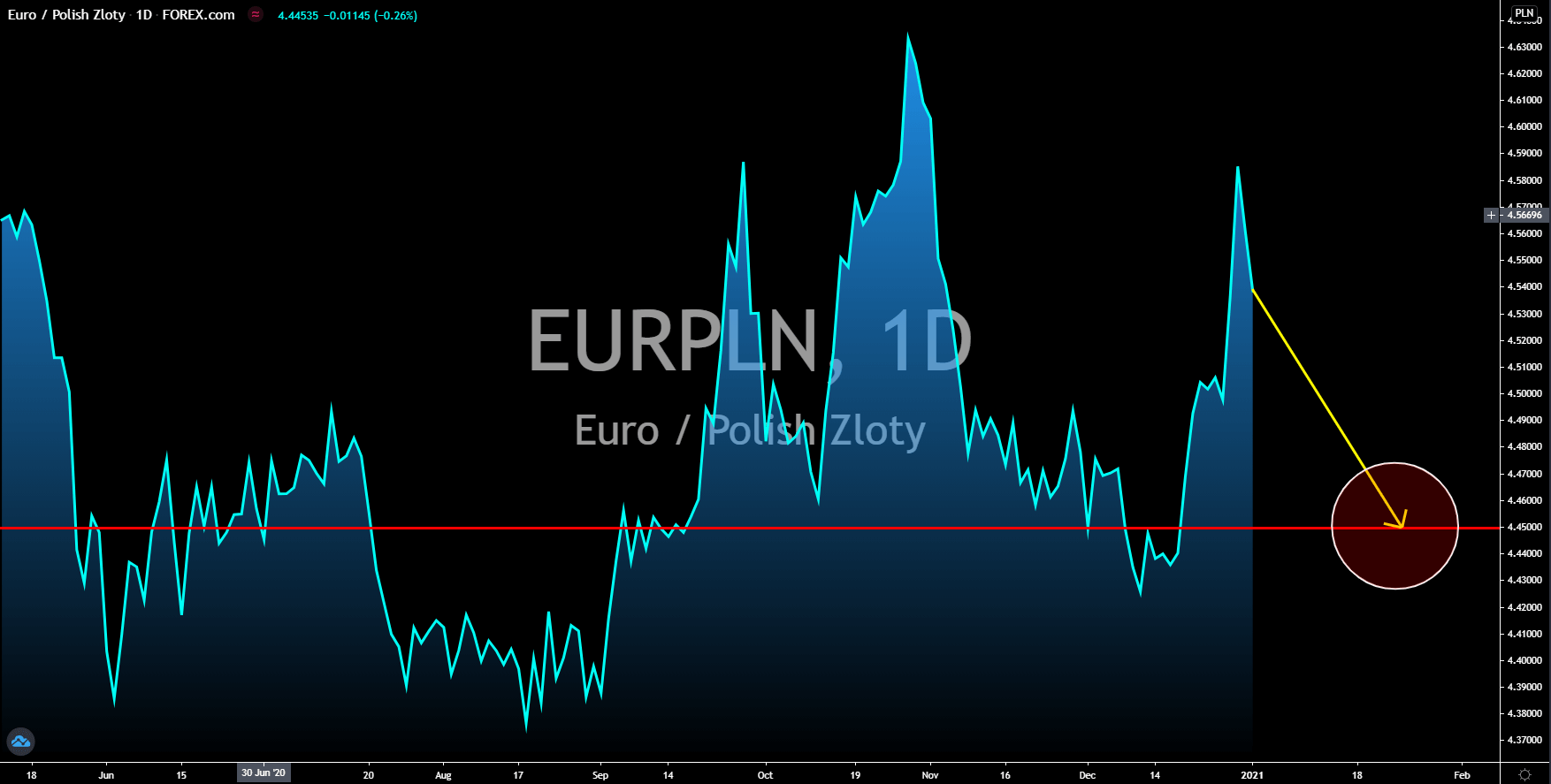

EURNOK

Norway’s Manufacturing PMI report is expected to inch higher against its previous record of 51.9 points with consensus estimate of 52.3 points on Monday’s report, January 04. It the actual figure comes close to the forecast, it will be the report’s second largest increase during the pandemic and fourth consecutive month of expansion. The optimistic outlook on Manufacturing PMI was backed by a strong core retail sales report in Norway. Last week, the report recorded a 2.9% growth for the month of November, the largest increase in sales since August. Meanwhile, the currency purchases by Norges Bank, the country’s central bank, is expected to decrease by 800 million for the month of January. The high liquidity in the market provides business and individuals an additional support, which is bullish for Norway’s economy. The figure sits at the middle of the two (2) previous records for the months of November and December.

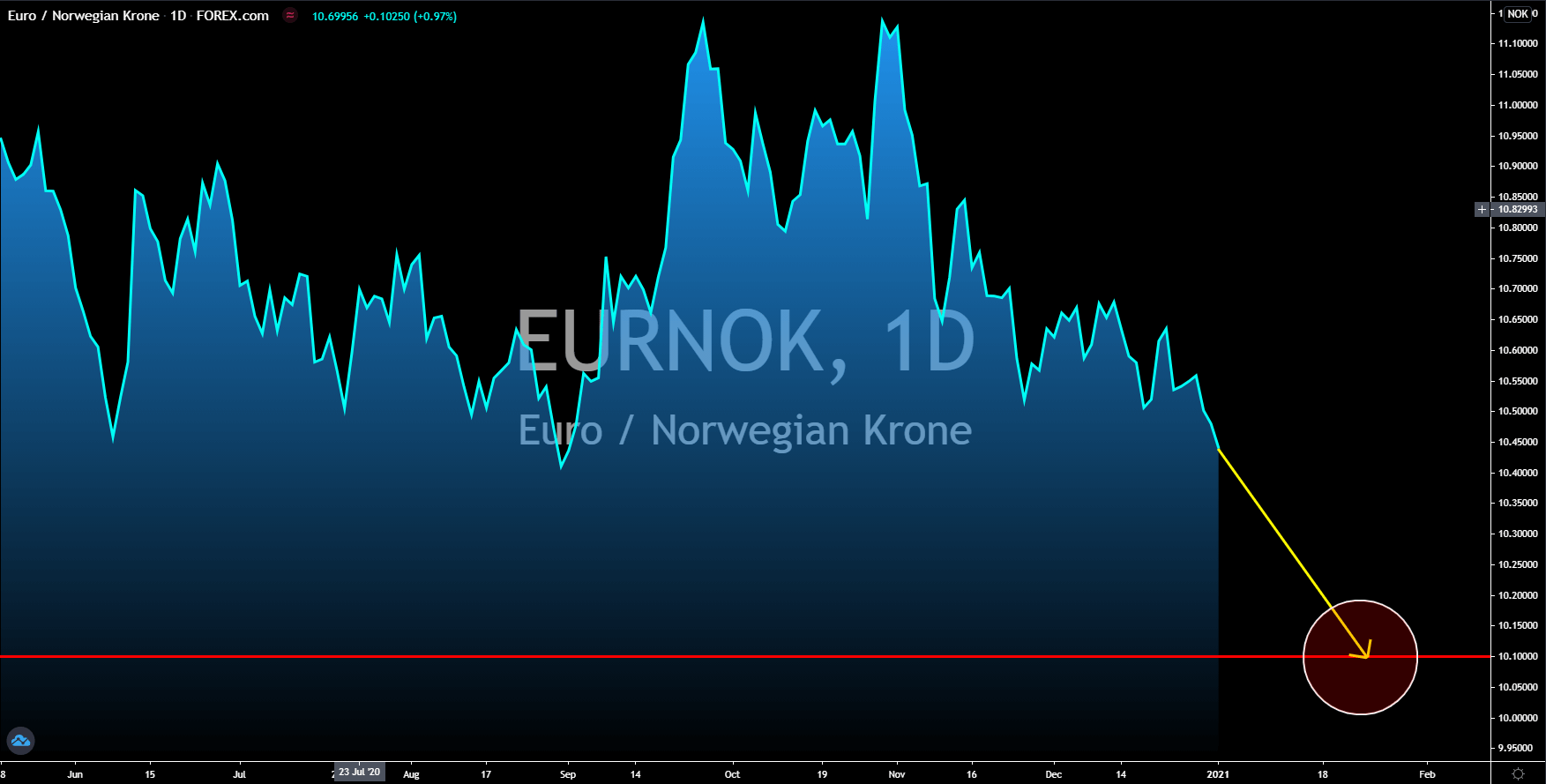

EURHUF

Hungary received the second shipment of COVID-19 vaccines on Wednesday, December 30, as the EU rolls out the bloc’s vaccination campaign. The 70,000 new vaccines co-developed by the US pharmaceutical company Pfizer and German biotechnology firm BioNTech will be used to inoculate around 35,000 individuals. The first shipment carried 10,000 doses, which was used to vaccinate the country’s health workers. Aside from the Pfizer-BioNTech vaccine, Hungary is set to receive 6,000 doses of Russian vaccine, a move that could further widen the gap between the eastern European countries and the European Commission. In December, Hungary and Poland blocked the $1.3 trillion 2021-2027 budget after the EU Commission added a condition that members who will receive aid from the bloc must adhere to the EU rule of law. The stalemate ended only after Germany brokered a deal between the two (2) parties.

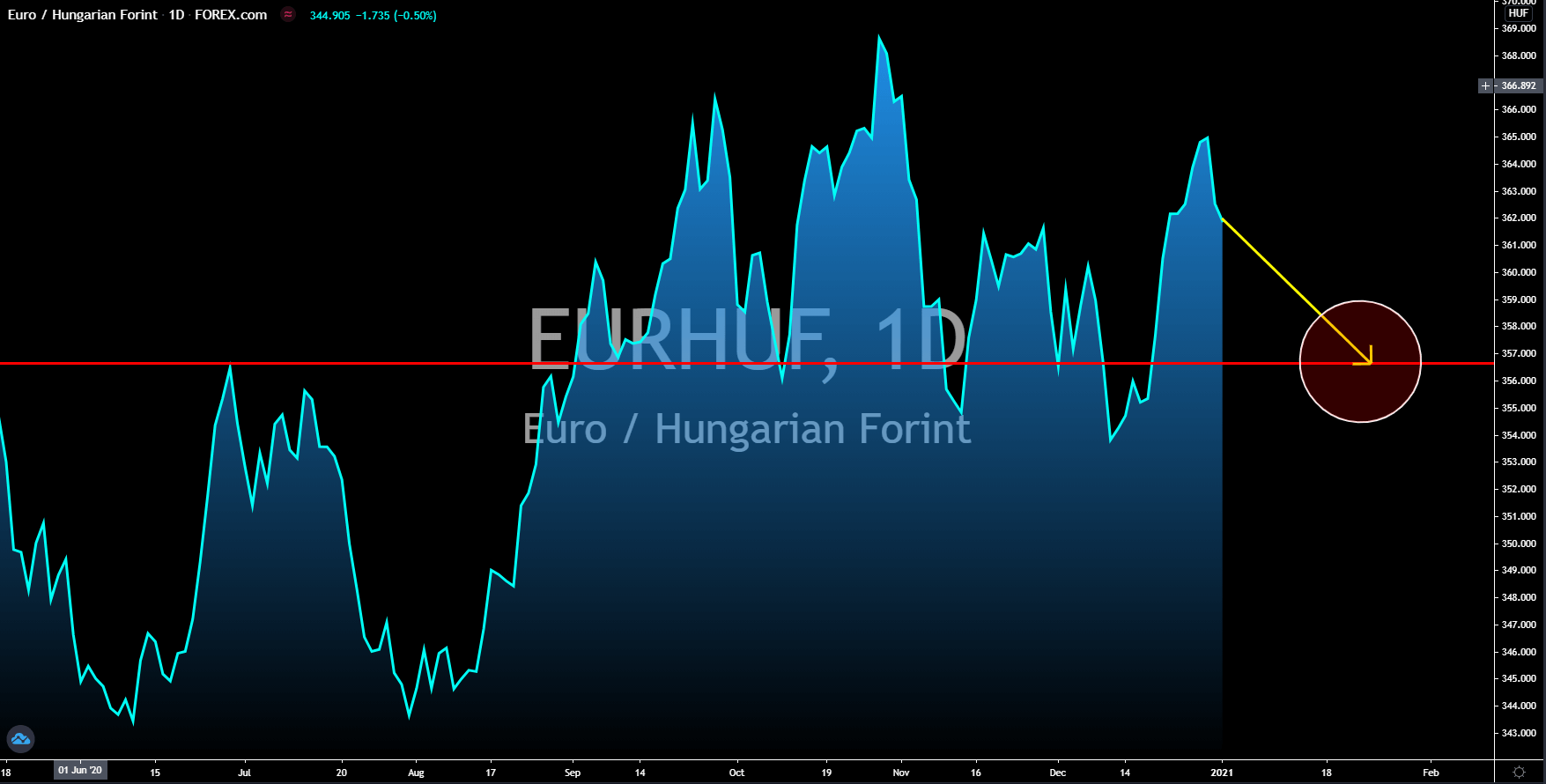

EURRUB

Russia posted disappointing results for its Markit Manufacturing and Markit Services PMIs last week. On Wednesday, December 30, the manufacturing sector scored 49.7 points for the month of December, below the 50.0 points benchmark. The same is true for the services sector, which slid from 48.2 points in November to 48.0 on the reported month. The country’s reserves of the US dollar also fell from 593.6 billion to 592.4 billion. Meanwhile, the Russian government said that it will be decreasing its support for the local economy this 2021. Although many analysts are bullish in the country this year, a spike in COVID-19 cases and prolonged strict measures could derail Russia’s recovery. Another challenge to Russia’s economy was the looming inauguration of president-elect Joe Biden on January 20. The Democratic leader is expected to crack down Russia’s military and political influence once he sits at the White House.

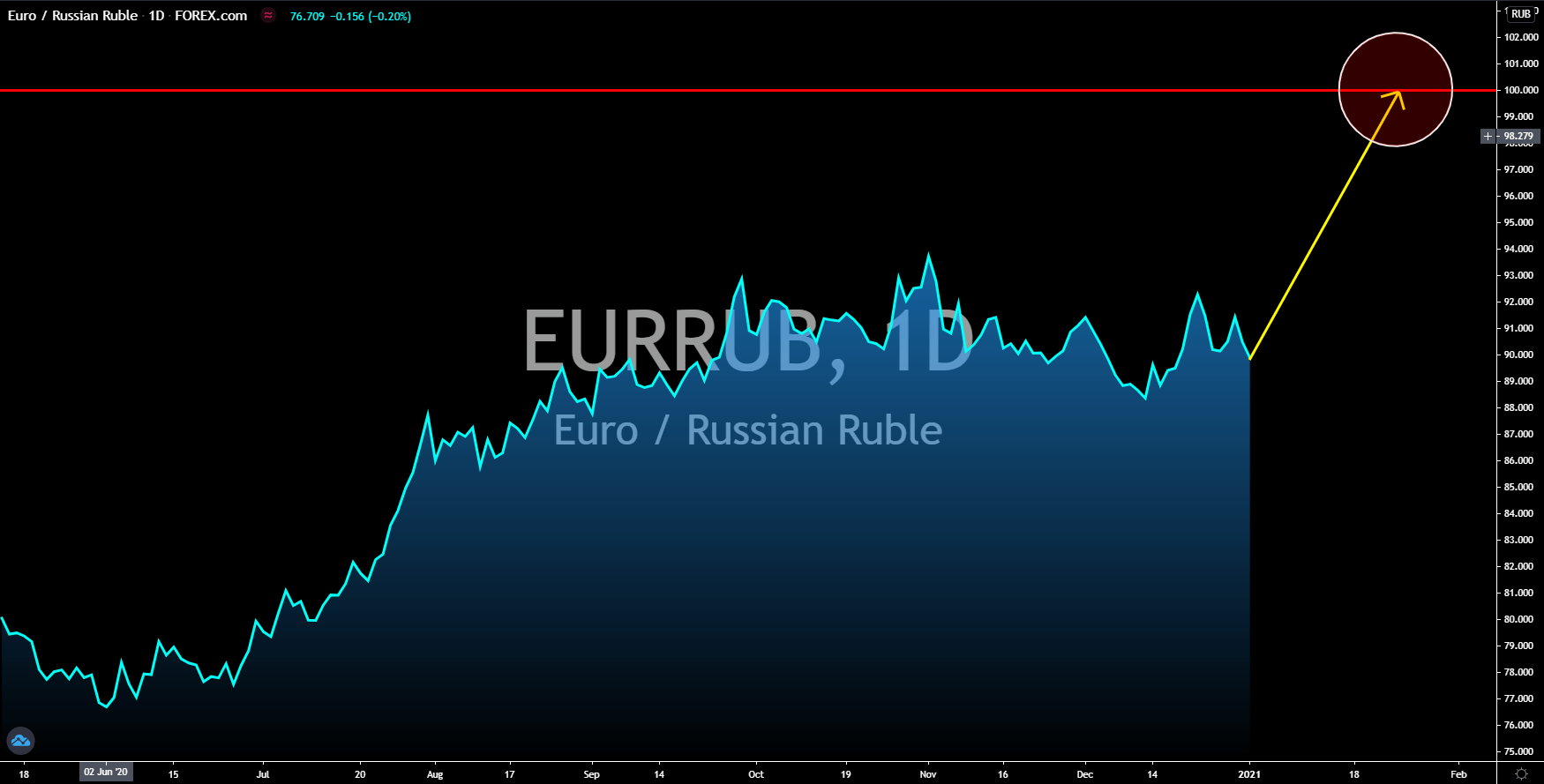

EURPLN

Poland posted a better-than-expected result for its Manufacturing PMI on Monday, January 04. The figure came in at 51.70 points, higher than the consensus estimate of 51.50 points and its record for the month of November at 50.80 points. Meanwhile, its neighbor Hungary had the same result of 51.1 points for the December. On the other hand, Germany, Spain, and Italy all posted disappointing results for the same report. The numbers were 58.3 points, 52.8 points and 51.0 points, respectively. France also had the same data for November and December report. Another key factor that will lead to an eventual downfall of the euro currency was Britain’s withdrawal from the bloc. Just days before the deadline, the EU and the UK agreed on a Brexit deal. The United Kingdom is the second-largest contributor in the EU budget. Poland, one of the fastest growing economies in Europe, is eyed as the next country to leave the bloc in the future.