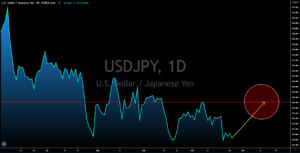

GBPCHF

The British Pound will advance against the safe-haven Swiss franc in coming sessions. Last Friday’s retail sales reports, October 23, posted impressive numbers that regained investors confidence on the world’s 5th largest economy. MoM report increased by 1.9% against the 0.4% expectations. Meanwhile, the year-over-year result almost doubled from its prior result of 2.7% to 4.7%. Core Retails Sales MoM and YoY were also up at 1.6% and 6.4%, respectively. Another key reports from Friday were the Composite, Manufacturing, and Services PMI which recorded above 50-points figures at 52.9, 53.3, and 52.3 points. On the other hand, Switzerland’s COVID-19 cases are surging. The highest daily infections were recorded on Thursday, October 22, with a total of 5,596 new cases. On Friday, October 23, the number of new cases were 4,968. The rising cases in the country threatens a nationwide lockdown.

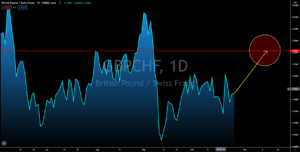

EURAUD

Germany, France, and the European Union’s reports from last week were a disaster. These, coupled with the third wave of coronavirus, will send the single currency lower in coming sessions. On Friday, October 23, the Producer Price Index (PPI) reports from the EU’s economic powerhouses recorded lower numbers compared to their previous results and from analysts’ expectations. France had Manufacturing PMI at 51.0, Germany at 58.0, and the Eurozone at 54.4 points. Both Germany and the EU beat expectations and previous records. Meanwhile, all Services PMI reports were lower than their September results and expectations. Figures came in at 46.5, 48.9, and 46.2 points, all of which were below the 50-points benchmark. Finally, Markit Composite figures were 47.3, 54.5, and 49.4 points. Of all of these reports, only Germany and the EU’s Manufacturing reports published a better result than the previous month or 2 out of 9.

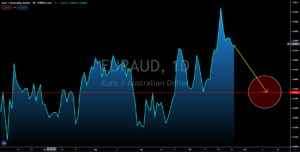

EURUSD

The US dollar will benefit from the recent slum in US indices. On Monday, October 26, the Dow Jones declined by 650.19 points or 2.29 percent. The meltdown in prices was due to the recent spike in COVID-19 cases. In the US, it saw its largest daily increase of cases on Friday, October 23, with 85,085 new recorded cases. On Monday, October 26, the number of new cases were 74,323 which was the third largest single increase in coronavirus infected Americans. The same is true in Europe. However, the weak figures on its PPI reports are not helping the single currency to advance. On the other hand, the US posted its lowest number of claimants for unemployment benefits at 787K from 898k in the previous week. In addition to this, hopes are high that a new stimulus bill will be passed before the November 03 elections. House Speaker recently hinted that negotiations are almost over for the $2.2 trillion stimulus.

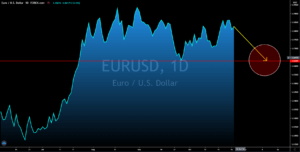

USDJPY

Most reports from Japan were flat, making it better compared to other struggling economies but underperforming compared to recovering countries. Japan’s Manufacturing PMI advanced by 0.3 points, from 47.7 points to 48.0 points. Meanwhile Services PMI has slowed down from 46.9 points to 46.6 points. It also published its National CPI reports, MoM and YoY, on Thursday, October 22, with -0.1% and 0.0% growth, respectively. On the other hand, the US economy is being pushed by the tech and consumer sector and housing marketing. Existing home sales in the US stands at 6.54 million compared to its previous result of 5.98 million and expectations of 6.30 million. Investors should expect volatility in the pair as the election looms. On Thursday, the initial jobless claims report will confirm if the recovery in the US will continue over the short-term. And finally, on Tuesday next week, results will be out for the US Presidential Election.