GIGAFINANCING REVIEW

Home > Broker Reviews > GigaFinancing Review

GENERAL INFORMATION

Broker Name:

GigaFinancing

Broker Type:

Forex & CFDs

Operating since year:

/

Regulation:

/

Address:

212 Prospect Ave, Brooklyn, New York United States

Broker status:

Active

CUSTOMER SERVICE

Phone:

/

Email:

Languages:

English

Availability:

24/5

TRADING

Trading platforms:

Web

Trading platform Time zone:

/

Demo account:

No

Mobile trading:

No

Web-based trading:

Yes

Bonuses:

No

Other trading instruments:

Yes

ACCOUNT

Minimum deposit ($):

$250

Maximal leverage:

1:500

Spread:

Floating From 1 Pip

Scalping allowed:

Yes

Broker Review: GigaFinancing

General Information & First Impressions

GigaFinancing is a broadly-reaching online brokerage, providing trading on various asset groups globally. It’s a CFDs broker that operates from the US and has gained a ton of attention from investors recently. As such, we set out to figure out whether the company is a good fit for our readers. Our GigaFinancing review will tell you more about the broker’s features and how they compare against other options.

CFDs have recently earned a bad reputation due to a lot of scams posing as them. That has led people to escalate things and spread falsities like “all CFD brokers are scams.” However, if you’re an experienced trader, you’re likely well aware that’s untrue.

CFDs have a series of benefits for traders, including lower costs and higher liquidity. As such, CFD brokers are actually more beneficial to the average trader than standard ones. If you buy into the misinformation that they’re all scams, you’re denying yourself a fantastic subset of online brokers.

And with that removed, we can revert our focus to gigafinancing.com. Namely, we wanted to note that the broker drew us in, even at a quick glance. After that, the website structure and technical qualities guided us through exploring the brokerage comfortably.

We want to emphasize two qualities: fluidity and sectioning. The broker guarantees a smooth experience with how well its site runs and eliminates potential frustration. Meanwhile, the deliberate placing of information makes it easy to ingest without feeling overwhelmed or bored. The two combine to create a fantastic customer experience and a great introduction for our GigaFinancing review.

Fund and Account Security

Security is a baseline quality any broker you choose to trade with should have. Unfortunately, some treat it as a luxury and treat security mishaps as small issues to be forgiven. The same people often fall for scams losing thousands of dollars along with the time they spent to make them.

As a CFDs broker, GigaFinancing has a lot to prove. Scammers in the industry have earned it a negative reputation, so it’s fighting as an underdog. However, there are numerous qualities we can look at that can reassure us of its integrity.

One fact that removes nearly all doubt straight away is that the broker operates from the US. The country is the financial hotspot of the world and as such, has some of the most rigid regulatory bodies. Even if the broker were to intend to scam customers, it wouldn’t get very far before getting shut down.

But there’s no chance the broker intends to harm users in any way, either. If it intended to steal from its customers, it had no real reason to open its offices in one of the world’s most well-regulated places. Some offshore locations will gladly accept brokerages and other financial companies, so scammers often just move there. GigaFinancing’s approach guarantees that it’s honest with its intentions.

And its website and overall approach to informing and treating customers reaffirm that. As we said earlier in our GigaFinancing review, it lays out its information comprehensively and in a manner where it’s easy to find out anything. That’s just not something scam brokers do. GigaFinancing differentiates itself from scams every step of the way. Besides extremely rare occurrences, like sophisticated cyber-attacks, we doubt you’ll have any problems with the broker’s security.

Account Info at gigafinancing.com

One major hurdle every broker has to surpass is how to appeal to the right people. That’s where most brokers, even good ones, struggle with finding the sweet spot for themselves. Either their accounts are too specific and detract other traders, or they’re too loose and not the best choice for everyone.

Even once their accounts are set up well, there’s the question of budget. If you give everything to everyone, you likely won’t be able to introduce high-end features since the upkeep would be too expensive. However, if you’re too exclusive, you’ll alienate most of your potential users straight away. And since you can’t run with just a few high-end users, that’s a recipe for failure.

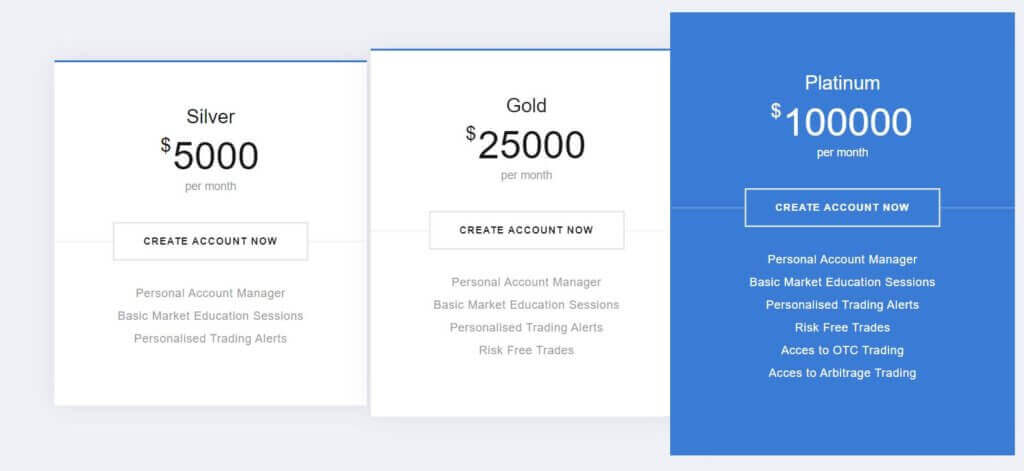

However, as we said earlier in our gigafinancing.com review, the broker manages to appeal to everyone. It does that with a tier-based account structure that has a little bit of something for everyone. That starts with the budget account, which has full core functionalities.

By meeting the $250 deposit minimum, you get full access to the broker’s asset library and platform functionality. That alone is enough to make for a competitive and pleasant trading experience. But then GigaFinancing also throws some luxury features, such as the personal account manager on top of that.

So it’s got the budget accounts more than covered, but what about the more high-end options? After all, traders that commit more also expect more from the brokerage. Well, the great thing is that it also provides its luxury users with numerous assistance and trade improvement features. As such, the broker positions itself to be a great choice, no matter your budget preferences.

Here are some of the gigafinancing.com account properties:

• Silver

- Min. Deposit: $250

- Personal Account Manager

- Basic Market Education Sessions

- Personalised Trading Alerts

• Gold

- Min. Deposit: $25,000

- Personal Account Manager

- Basic Market Education Sessions

- Personalised Trading Alerts

- Risk Free Trades

• Platinum

- Min. Deposit: $100,000

- Personal Account Manager

- Basic Market Education Sessions

- Personalised Trading Alerts

Risk Free Trades

GigaFinancing’s Trading Platform

The software that the broker provides for trading is quite a formidable tool and has the advantage of easy access. Unlike most brokers who base their service around a downloadable terminal, GigaInvesting does so for a WebTrader. That allows traders much more mobility and is overall easier and more intuitive.

On top of that, it eliminates any potential security concerns you might have had left. Unlike other brokers, it doesn’t require you to download anything that could potentially harm your device. Just log in and start trading.

The platform itself focuses on usability while remaining powerful and feature-rich. There are numerous visual indicators you can use to help your analysis and improve your predictions. On top of that, there are features that can help the platform automatically react to sudden market shifts.

As we already said earlier in our GigaInvesting review, it’s a well-rounded broker, and its platform definitely aids that.

GigaFinancing Review: Conclusion

GigaFinancing has numerous features and conditions that propel it ahead of competitors. When you look at objective features, it’s simply cheaper. The broker provides features at lower price points than alternatives and has lower service costs.

But even that doesn’t paint the full picture. Namely, the brokerage also focuses a lot on comfort, enabling lengthy and focused trading sessions. Using it is pleasant and doesn’t cause tedium or mental fatigue like other brokers do.

To end our GigaFinancing review, we’d like to conclude by saying it’s a fantastic choice for any trader. If you’re searching for a new online broker to trade with, be sure to keep it in mind.

FAQ

1. Is GigaFinancing in the USA?

Yes, GigaFinancing is a US-based broker.

2. Is GigaFinancing regulated?

GigaFinancing complies with all local laws and regulations.

3. Can GigaFinancing be trusted?

Yes, you can find more information in the fund and account security section of our GigaFinancing review.

4. What kind of broker is GigaFinancing?

GigaFinancing is a CFD broker.

5. How do I use GigaFinancing’s trading station?

After you sign up and deposit the appropriate amount, you’ll be able to access the trading platform via your browser and start trading.

6. Can I trade crypto on GigaFinancing?

Yes, GigaFinancing has a broad asset library that includes cryptocurrencies.

7. How much do you need to trade on

GigaFinancing?

The minimum deposit amount is $250.

8. How much leverage does GigaFinancing give?

The max leverage is 1:500.

9. How much money can you make on GigaFinancing?

Although technically unlimited, the amount of money you will make depends on your trading skill.

10. For which type of trader is GigaFinancing best suited?

GigaFinancing is an open brokerage fitting for any type of trader.

COMMENTS

Recommended for You

Cryptocurrency Market Update: March 3

Recommended for You

Recommended for You

Recommended for You

Recommended for You

Recommended for You

GigaFinancing review

-

Support

-

Platform

-

Spread

-

Trading Instrument

54 Comments

Amazing broker company

It is really my pleasure to do business with this company. The services are amazingly good. I get good profit and services.

Did you find this review helpful? Yes No

Worth trading with

Good broker services. Withdrawal is always smooth and fast. They included free trading education in their packages which is really good. Worth trading with.

Did you find this review helpful? Yes No

Good profit

No regrets joining. I get good profit.

Did you find this review helpful? Yes No

Good broker

Good trading broker. I get tight spreads and good leverage. I get my withdrawals on time, too.

Did you find this review helpful? Yes No

Excellent broker

Excellent in all services. I have no regret choosing this broker, they are really very good.

Did you find this review helpful? Yes No

Good profit

Plenty of tradable instruments including cryptocurrencies. I am earning good from all of their offers.

Did you find this review helpful? Yes No

Good profit

I have opened an acount with this broker and got no regret in doing so. The signals are so much reliable and profit is good.

Did you find this review helpful? Yes No

Excellent trading advise

Excellent trading advise from the brokers. I simply follow instruction and wait for my profit.

Did you find this review helpful? Yes No

Delivers fast resolution

They always deliver a fast resolution. They have minimal losses, good services from the day I started till present. Been trading with them for a year now.

Did you find this review helpful? Yes No

Good broker

All services offered here are excellent. They’ve always been a good broker for forex trading, I am fully satisfied with the services.

Did you find this review helpful? Yes No

Satisfied with the services

They offer wide array of trading assets and great services. I am satisfied with all of their services and happy with my trading profit.

Did you find this review helpful? Yes No

Fast withdrawals

Withdrawal is faster than expected. I never had any long wait all transactions including withdrawals are always fast.

Did you find this review helpful? Yes No

Exceptional broker service

Exceptional broker services. I am impressed on broker signals and even services.

Did you find this review helpful? Yes No

Outstanding broker

Oustanding broker services. They perform well and I gain good profit from my trades.

Did you find this review helpful? Yes No

Favorable trading results

In general,it is great to deal with this broker. The services are all efficient and trading results are favorable.

Did you find this review helpful? Yes No

Amazing software

Amazing trading software. It has so many opportunities to make money. Easy to use s well.

Did you find this review helpful? Yes No

Good trading broker

“I get minimal to zero slippage. They are even transparent on all of their trading transactions. They are also dedicated in getting at least minimal or even zero loss if possible.”

Did you find this review helpful? Yes No

Accurate market forecast

They were able to hit the forecast. Always on time and meet commitments all the time.

Did you find this review helpful? Yes No

The best broker

Nothing but the best. Signals are always accurate. I guess they are really dedicated in doing market research in order to come up with sound trading advise.

Did you find this review helpful? Yes No

Good services

Great services from day 1 up to to present. They show consistently good services and I get a good profit, too.

Did you find this review helpful? Yes No

Amazing brokers

They deliver good services, offers good leverage and low spreads. I am truly amazed all the time.

Did you find this review helpful? Yes No

Good trading opportunities

There are so many opportunities to make money. Affordable initial deposit with good trading returns.

Did you find this review helpful? Yes No

Amazing services

This so far is my favorate trading broker.I am always amazed with both signals and services.

Did you find this review helpful? Yes No

Great trading brokers

Great trading brokers. I am using the service for a year and I am fully satisfied with my trading profit.

Did you find this review helpful? Yes No

Good signals

I have so many trading options. Signals are spot on and services are really good.

Did you find this review helpful? Yes No

Good services

Attentive customer service. They always turn concerns to positive experience.

Did you find this review helpful? Yes No

Profitable options

This broker offers me very valuable and highly profitable trading options. I love the services and I am happy with my profit.

Did you find this review helpful? Yes No

Good and honest broker

Good and honest broker. What I like about this broker is that they are transparent and explains everything clearly. Overall performance is good also, based on my profit.

Did you find this review helpful? Yes No

Wonderful company for online trading

This is such a wonderful company to trade forex. The tools and services are both efficient. I’ve got no problem with this broker and I am satisfied with customer service.

Did you find this review helpful? Yes No

Good trading services

Good trading services. I am truly satisfied with my trading results and pleased with their trading services.

Did you find this review helpful? Yes No

The best broker

Nothing but the best. Signals are always accurate. I guess they are really dedicated in doing market research in order to come up with sound trading advice.

Did you find this review helpful? Yes No

Good broker

They are very good in providing trading advice. I get really good profit. If you are looking for a source of income, this one is my recommended. Worth my time.

Did you find this review helpful? Yes No

Highly recommended

Such a good broker for forex trading. Signals are always profitable and withdrawal is always fast and smoooth.Highly recommended forex broker.

Did you find this review helpful? Yes No

Good customer service

Customer service attends to trading needs promptly and broker delivers good trading advise.

Did you find this review helpful? Yes No

Good company

This is a good company for investments. There are so many opportunities to earn money. Both services and results are good.

Did you find this review helpful? Yes No

Quick withdrawals

Quick withdraw and excellent services. I have been trading with them for a year and got no complaints. Awesome forex brokers.

Did you find this review helpful? Yes No

I got excellent results here

I am expecting really good result from this broker. But I am amazed to get excellent once. Not just best results but really excellent results.

Did you find this review helpful? Yes No

Good forex broker

It is difficult to find a good forex broker. I am really glad I found one. I am impressed with both services and profits.

Did you find this review helpful? Yes No

Good profit

Worth my money and time. I got a decent profit and was able to withdraw it swiftly.

Did you find this review helpful? Yes No

Good offers

They are competitive and enthusiastic. I am glad to have all of these offers. I gain good profit from it.

Did you find this review helpful? Yes No

Good broker company

Been looking for a broker with fair spreads but never thought I’d find spreads like this broker have. Services and tools are also efficient. I haven’t had any withdrawal delays, my money is always credited on time.

Did you find this review helpful? Yes No

Amazing platform

Amazing forex trading platform. It made trading so much easier for me. There are so many good features.

Did you find this review helpful? Yes No

Good service

I encounter good services with this broker. Customer service is always prompt and efficient. Withdrawals are always fast. I encounter good services with this broker. Customer service is always prompt and efficient. Withdrawals are always fast.

Did you find this review helpful? Yes No

Amazing signals

They have been competitive. I get accurate market forecasts.

Did you find this review helpful? Yes No

Great brokers

Been trading with this for quite some time now. They are the best, without a doubt, never been in conflict with them.

Did you find this review helpful? Yes No

Profitable signals

Consistently profitable signals. I am fully satisfied with all of their services and will surely recommend.

Did you find this review helpful? Yes No

Amazing software

Amazing trading software. It has so many opportunities to make money. Easy to use as well.

Did you find this review helpful? Yes No

Good signals

I have so many trading options. Signals are spot on and services are really good.

Did you find this review helpful? Yes No

Fully satisfied

Great services since day 1 up to the present. I am using this broker service for a few months now and I am fully satisfied with the services, tools and profit.

Did you find this review helpful? Yes No

The signals are so profitable—worth trading with.

Interesting broker services. The signals are so profitable—worth trading with.

Did you find this review helpful? Yes No

I am consistently getting good trading advice from this broker.

It is proven and tested to have reliable and profitable signals. I am consistently getting good trading advice from this broker.

Did you find this review helpful? Yes No

Impressive broker service

Impressive broker service. All transactions are smooth, and they are so professional.

Did you find this review helpful? Yes No

I got really good offers, and I was able to gain profit from the offers.

Good trading company. I am fully satisfied with both signals and services. I got really good offers, and I was able to gain profit from the offers.

Did you find this review helpful? Yes No

Fantastic broker company.

Fantastic broker company. Services are pleasant, and there are many ways to earn money.

Did you find this review helpful? Yes No