IG GROUP REVIEW

Home > Broker Reviews > IG Group Review

GENERAL INFORMATION

Broker Name:

IG Group

Broker Type:

Forex

Country

United Kingdom

Operating since year:

1974

Regulation:

ASIC, FSCA, DFSA, FCA, NFA

Address:

Cannon Bridge House, 25 Dowgate Hill, London, EC4R 2YA, United Kingdom

Broker status:

Regulated

CUSTOMER SERVICE

Phone:

(44) 207 896 0079

Email:

Languages:

English

Availability:

24/7

TRADING

Trading platforms:

MT4, IG Web and Mobile Platform, ProRealTime

Trading platform Time zone:

N/A

Demo account:

NO

Mobile trading:

YES

Web-based trading:

YES

Bonuses:

NO

Other trading instruments:

YES

ACCOUNT

Minimum deposit ($):

$300

Maximal leverage:

200:1

Spread:

Floating

Scalping allowed:

YES

IG GROUP REVIEW: GENERAL INFORMATION

IG Group was established in the United Kingdom in 1974 and is one of the largest CFD brokers in the world. The broker has regulation by several regulatory bodies worldwide, including top-tier regulators such as the Financial Conduct Authority (FCA) and the Federal Financial Supervisory Authority (BaFin). IG Group lists on the London Stock Exchange. IG Group is safe because it lists on a stock exchange, discloses its financials, and is oversees by top-tier regulators.

FUNDS TRADING AND SECURITY

IG Group is a registered RFED with the CFTC and an NFA. Additionally, IG Markets Ltd and IG Index Ltd are authorized and regulated by the FCA in the U.K. and ASIC in Australia. Furthermore, it is listed on the U.K.’s FTSE 250 and has signed up for the “FX Global Code of Conduct, which contributes a standard set of guidelines for good practice in the markets.” IG (U.K.) also steps to ensure that client funds are not co-mingled with corporate funds, following the U.K.’s FCA client money rules. Clients also have additional asset protection through the Financial Services Compensation Scheme (FSCS), up to £85,000. IG (U.K.) provides clients with a guarantee that they will never lose more than they have in their accounts via the negative balance protection rules mandated under ESMA that went into effect in 2018. Guaranteed stop-loss orders also offered, which mitigate exposure to potentially catastrophic losses in extreme market conditions, like the 2015 Swiss franc currency shock.

TRADING ACCOUNTS

The broker offers a few trading accounts depending on the markets a client is interested in trading on:

- CFD trading account

- Spread betting account

- CFD trading & spread betting account

- Share dealing & CFD trading account

The lowest amount to trade or bet size is $1. Each account comes with full access to trading platforms, free market data, learning resources, and clock support.

There is also a professional account that allows for greater leverage levels in exchange for smaller regulatory protection. To qualify for an advanced account, a trader must have placed ten significantly leveraged trades per quarter for the last four quarters, including having a portfolio exceeding £50,000, plus have a minimum of one year’s professional derivatives trading experience.

TRADING CONDITIONS

Spreads & Fees

Spreads at IG Index are highly competitive, and they start at 0.6 pips on major Forex pairs, such as the EUR/USD.

However, on major indices, such as the FTSE 100, spreads start at 1 point, and on Spot Gold, spreads that go from 0.3 pips are applicable.

Other trading costs influence trade, beginning with overnight rollover charges. Details of rolling daily prices and rules are accountable to change but shown on the broker’s website. An inactivity fee also charged to inoperative accounts.

Leverage

The broker offers leveraged trading on shares, indices, Forex, and cryptocurrencies. For retail clients, 1:30 leverage is available on Forex. However, the leverage levels on indices and commodities are 1:20, and when it comes to cryptocurrencies, they’re 1:2.

IG Markets is clear about the margin call process and trading options that leveraged. The website also has an effective margin calculator.

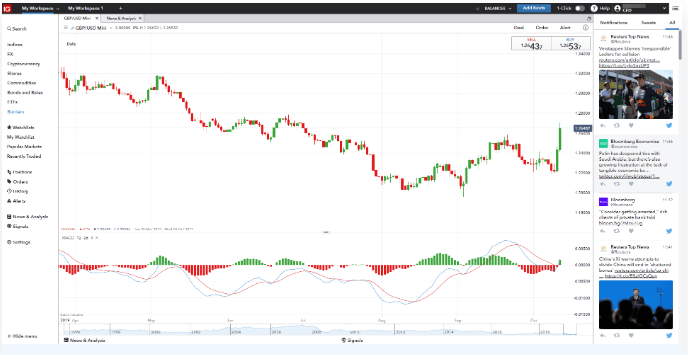

TRADING PLATFORM

IG Markets focuses on its proprietary web trader, which is also available as a mobile version. It is made fully customizable, offers very clean and informative deal tickets, and comes supplied with a large-scale charting package. IG Live, this broker’s streaming market coverage, is accessible together with analytics, alerts, and signals. Over 86 million trades executed in 2019, with an average speed of 0.014 seconds. ProRealTime fully integrates with the web trader and enables professional traders to automatize their strategies. It promotes market analysis with over 100 indicators and presents additional custom indicators. IG Markets asserts to be the only UK-based brokerage to provide ProRealTime.

This broker also offers the retail proven MT4 trading platform. It provides full automation of trading strategies, and IG Markets provides a range of add-ons that are generally required to unload this trading platform’s full functionality. The clients may take advantage of 18 unique indicators besides Autochartist. The L2 Dealer allows direct market access (DMA), but it may come with an additional cost for live price feeds. It features advanced liquidity and pricing, expert order control, and improved trading technology. This brokerage has done an outstanding job of delivering three distinct trading portals.

The proprietary web trader is where most traders will manage their portfolios.

TRADING PRODUCTS

IG Index clients complemented with a wide variety of over 17,000 tradeable financial instruments:

• Indices – Reflect on the world’s biggest indices, counting the US S&P 500, NASDAQ, and Dow Jones, Germany’s Dax 30, plus the UK’s FTSE 100

• Shares – Share deal is accessible on some of the world’s largest companies, such as Tesla and Netflix

• Forex – 90+ FX pairs, majors, minors, and exotics included

• CFDs – CFDs offered on multiple markets

• Commodities – Trade precious metals, such as gold and silver, plus energies, such as Brent Crude Oil

• Spread betting – The tax-free derivative provides a client speculating on Forex, commodities, shares, and much more

• Cryptos – Bitcoin, Ethereum, and many other blockchain-based cryptocurrencies

• Digital options – A variety of binary equity options available

Also provided for trading are ETFs, bonds, futures, and interest rates.

CUSTOMER SERVICE

IG Group’s customer support team is available worldwide from 08:00 GMT Saturday to 22:00 GMT Friday. Help is accessible in multiple languages via:

Telephone contact number – 0800 195 3100

Email address – [email protected]

Twitter – @IGClientHelp

Also, fantastic peer support granted via the Community portal. Clients will find forums, blogs, tutorial videos, and webinars. IG Group’s online trading community is among the most extensive ones, with help provided on a whole array of issues, including if the website falls or if charts are not working/experience an outage. Information on closing an account and critical terms and conditions interpreted too. There is also a well-established complaints process to ensure that the clients can get any issues appropriately resolved.

IG GROUP REVIEW: CONCLUSION

IG Group is one of the largest and most trusted CFD brokers. Several financial authorities around the world regulate it.

IG has one of the best web-based trading platforms. The deposit and withdrawal conditions are excellent. You can also educate yourself with high education materials.

However, there are some drawbacks. The stock CFD fees are high, and most countries’ product portfolio is limited to Forex, CFDs, and options. The phone customer service also has lower response quality.

You are more than welcome to test IG’s first-class trading platform since there is no minimum funding amount for bank transfers, and you can easily open a demo account.

Thank you for taking your time and reading our IG Group review.

However, in case you need more information on the broker, feel free to do further research. We hope this review was helpful, and we wish you suitable luck trading!

COMMENTS

Recommended for You

Cryptocurrency Market Update: March 3

Recommended for You

Recommended for You

Recommended for You

Recommended for You

Recommended for You

IG Group Review

-

Support

(4.5)

-

Platform

(2)

-

Spread

(2.5)

-

Trading Instrument

(2)

3 Comments

Severely limited experience in my country, perhaps others can get better use out of it.

Did you find this review helpful? Yes No

Fees

The fees make it so the broker isn’t worth it for me. Unfortunate since I found some stuff interesting.

Did you find this review helpful? Yes No

Had to call support about signup problems, the representative sounded dismissive at best. I’m not using a service that doesn’t want me as a customer.

Did you find this review helpful? Yes No