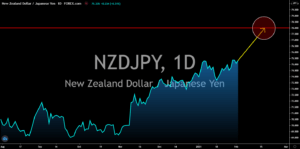

NZDCAD

Canada’s economy grew by 0.7% in November, which beats the previous record of 0.4%. Despite this, however, the 2020 annual GDP shank by -5.1%, the largest recorded contraction in Canada’s history. In addition to this, several key reports still point out the weakness for the North American country. Budget Balance report for the same month plunged by -232.02 billion on an annual basis. Meanwhile, Manufacturing PMI has slowed down to 54.4 points for January’s report. But recent articles suggest that Bank of Canada might lead the interest rate hike trend globally this 2021. The BOE also reaffirmed its commitment to keep the rates above the zero percent benchmark at least until 2024. The optimism in Canadian central bank’s policy has already created waves across the local economy. Some analysts suggest that borrowing costs might start to increase, which, in turn, will derail the expected recovery of Canada until the second half of 2021.

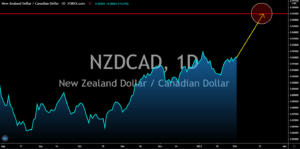

GBPUSD

Despite the threats of the UK’s COVID-19 variant and uncertainty of the post-Brexit economy, recent reports still posted better-than-expected results. Consumer credit in December declined by -0.965 billion against November’s -1.467 billion data. M4 Money Supply has also slowed down on the same month by 0.7%, which is positive news for the British pound. While the United Kingdom is in a lockdown, Britain’s Manufacturing PMI soared to 54.1 points. The result of the Purchasing Managers Index for the manufacturing sector suggests the world’s fifth largest economy’s resilience amid the pandemic. Meanwhile, the US had a mixed result for its recent reports. While personal income advanced by 0.6% in December, consumers are still reluctant to spend as shown in a personal spending report. Figure came in at -0.2% for December. Meanwhile, personal consumption shrank by -0.6% for the same month.

EURCAD

The euro currency will soar against its Canadian counterpart in coming sessions. This was amid the upbeat data from the EU and its member states. The EU bloc’s Manufacturing PMI for January inched higher to 54.8 points. The same is true for France, which had 51.6 points result against 51.5 points prior. Meanwhile, Germany’s data has slowed down to 57.1 points, but is still above the 57.0 points expectations. Italy had the best result from the eurozone after beating December’s 52.8 points result and 52.4 points expectations with 55.1 points actual data. Results from Friday, January 29, was also better-than-expected. French consumer spending was up by 23.0% despite the resurgence of COVID-19 in the country during the same month. The drawback for the single currency was a possible introduction of fresh stimulus to further support the EU bloc’s economy. The latest stimulus package was unveiled in December at $2.2 trillion.

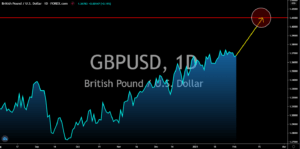

NZDJPY

Japan is set to publish its Services PMI report on Tuesday, February 02. While the government didn’t provide any estimate for the looming report, analysts are expecting lower figures just like the data posted for the manufacturing sector. On Sunday, January 31, the Manufacturing PMI came in at 49.8 points against a 49.7 points result in December. While the number was comparatively higher than the previous record, it still failed to increase to the 50-point benchmark. In other news, Prime Minister Yoshihide Suga has extended the country’s lockdown until March 07, which will further delay the economic recovery in the world’s third-largest economy. The Japanese government has also allowed the Tokyo Olympics to resume in June. However, the rise in COVID-19 cases during this time could send the Japanese economy lower. As for New Zealand, coronavirus infections were still under control, which will result in a robust recovery.