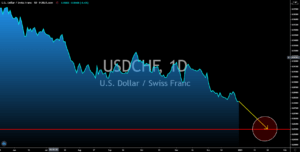

USDSEK

Manufacturing Confidence for the month of December plunged to 106.9 points, a 3-point cut from November’s result. The decline in the key report was brought by the new variant of COVID-19 in the United Kingdom, which could lead to a region wide lockdown in Europe. In addition to this, prior to the signing of Brexit agreement on Monday, December 28, businesses were skeptical that a no-deal Brexit could disrupt the economy in Europe. Also, the majority of Sweden’s export was from forest products, some of which are used in manufacturing. On the positive side, the Consumer Confidence report grew to 92.3 points in the current month from 88.6 points prior. The reported figure was the second highest grade in the report in 2020. This trend suggests the adaptation of Sweden to a consumption-based economy. As the UK and the EU reached a deal ahead of the deadline, investors should see an increase in local currencies in Europe.

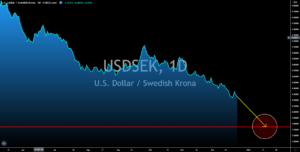

USDZAR

A new variant of COVID-19 was found not just in the United Kingdom but also in South Africa. This had resulted in some countries restricting travels from and to these two (2) countries. The official name for the mutated virus was 501.V2. As the new strain of virus was deemed more infectious, local health authorities in South Africa said that cases in the country could surpass 1 million within the next three (3) days. In addition to this, the officials said that around 80% to 90% of the new cases carried the new variant of coronavirus. The rising cases of infected individuals in the country could push the government to extend support to its citizens and businesses. The country had already disbursed the $26 billion stimulus package it had at the start of the second half of 2020. This amount represents about 10% of the country’s annual gross domestic product (GDP). A new stimulus package could increase the debt of Africa’s largest economy.

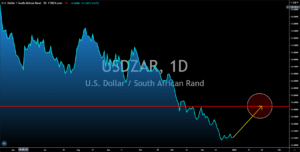

USDRUB

Under president-elect Joe Biden’s administration, the US is expected to crack down Russia’s political influence. In 2016, the Democrats lost the presidential race leading to the election of incumbent president Donald Trump. Moscow was accused of meddling during the election. First, the Democrats believed that Russian spies were the ones who leaked the emails of then presidential candidate Hilary Clinton. And second, there was growing evidence that Russia advertised Trump’s presidency during the election. While Biden is anticipated to be tougher with Russia, he was seen to take a softer stance to China. The reversal of geopolitical tension has major implications on the local currencies. While the signing of the $2.3 trillion federal budget by Trump is seen to weaken the greenback, the possibility of the US to cripple Russia’s influence will drag the ruble. Thus, a U-turn in the USDRUB pair is expected in the coming sessions.

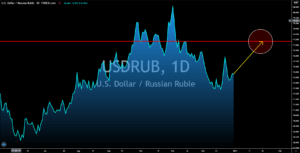

USDCHF

Both the US dollar and Swiss franc lost their appeal this week after the passing of the EU and US budget along with COVID-19 rollout and EU-UK Brexit deal. In mid-December, Poland and Hungary stood down and pulled out their veto vote on the $2.1 trillion 2021-2027 EU budget after Germany brokered a deal between these countries and the European Commission. Meanwhile, the US government and the congress have reached a deal with the $2.3 trillion federal budget, ending four (4) months of negotiations. The vaccines developed by Pfizer-BioNTech and Moderna also improved the global economic outlook. As for Europe, the Brexit deal was finalized on Monday, December 28, ending more than four (4) years of negotiations since 52% of the British citizens decided to leave the bloc in June 2016. However, the new variant of COVID-19 in the United Kingdom makes the Swiss franc a haven for investors.