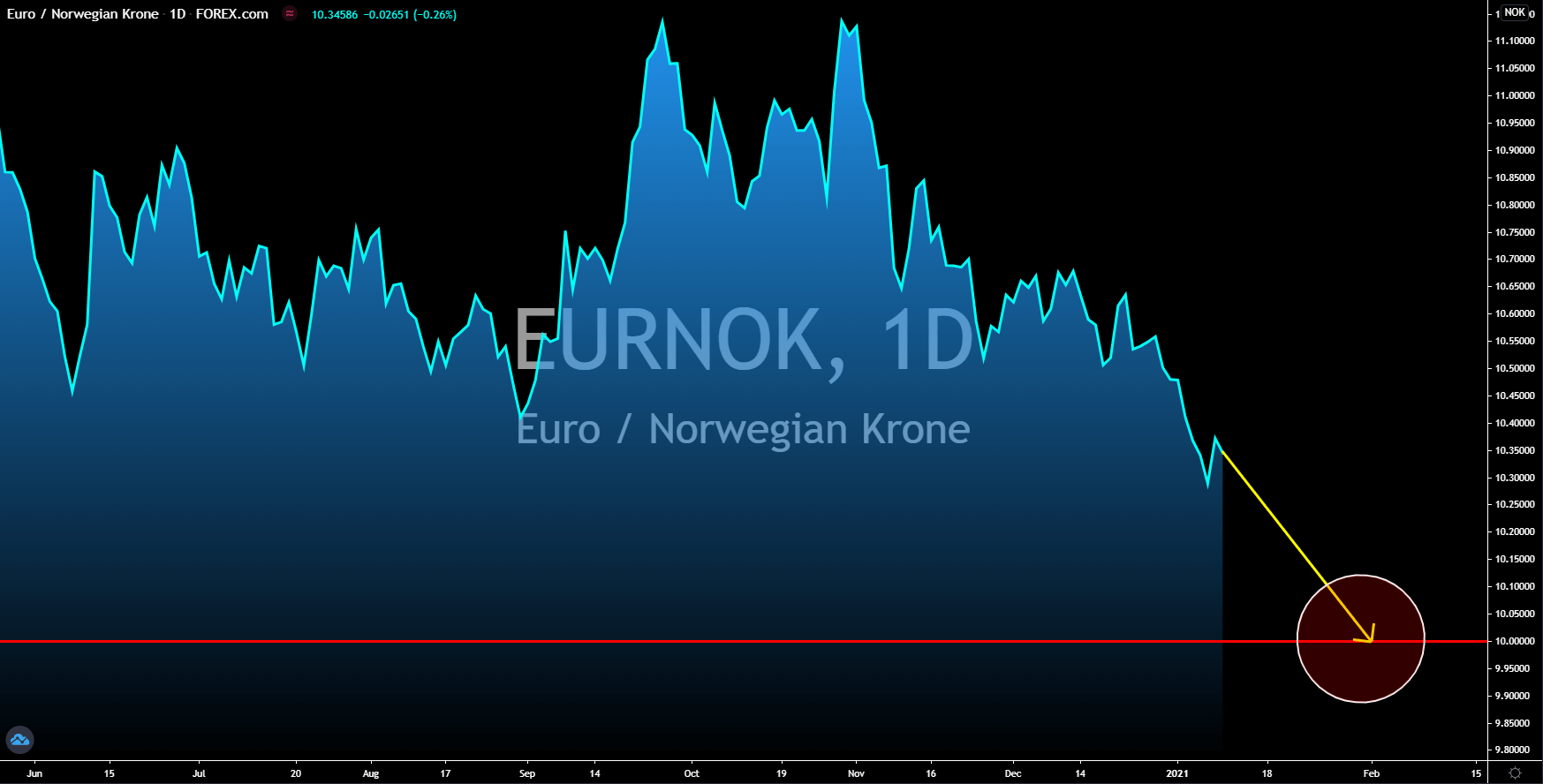

GBPBRL

The stellar performance of the British pound since December is about to end. This was amid speculations that the UK government will continue to support the local economy through stimulus. As for Britain’s recent reports, the Halifax House Price Index slowed down in December. The report grew by 0.2%, a significant decline from the prior month’s 1.0% data. Meanwhile, analysts were expecting Halifax to grow by 0.5%. On a yearly basis, the figure recorded was 6.0%, lower compared to November’s result of 7.6%. BRC Retail Sales Monitor also slowed down to 4.8%, the lowest data since September. As for Brazil, industrial production in November inched higher to 1.2% from October’s 1.1%. Meanwhile, it showed a remarkable improvement of 2.8% against 0.3% recorded in the prior month. Both CPI reports, MoM and YoY, are also expected to post higher numbers at 1.21% and 4.89% on Tuesday’s report, January 12.

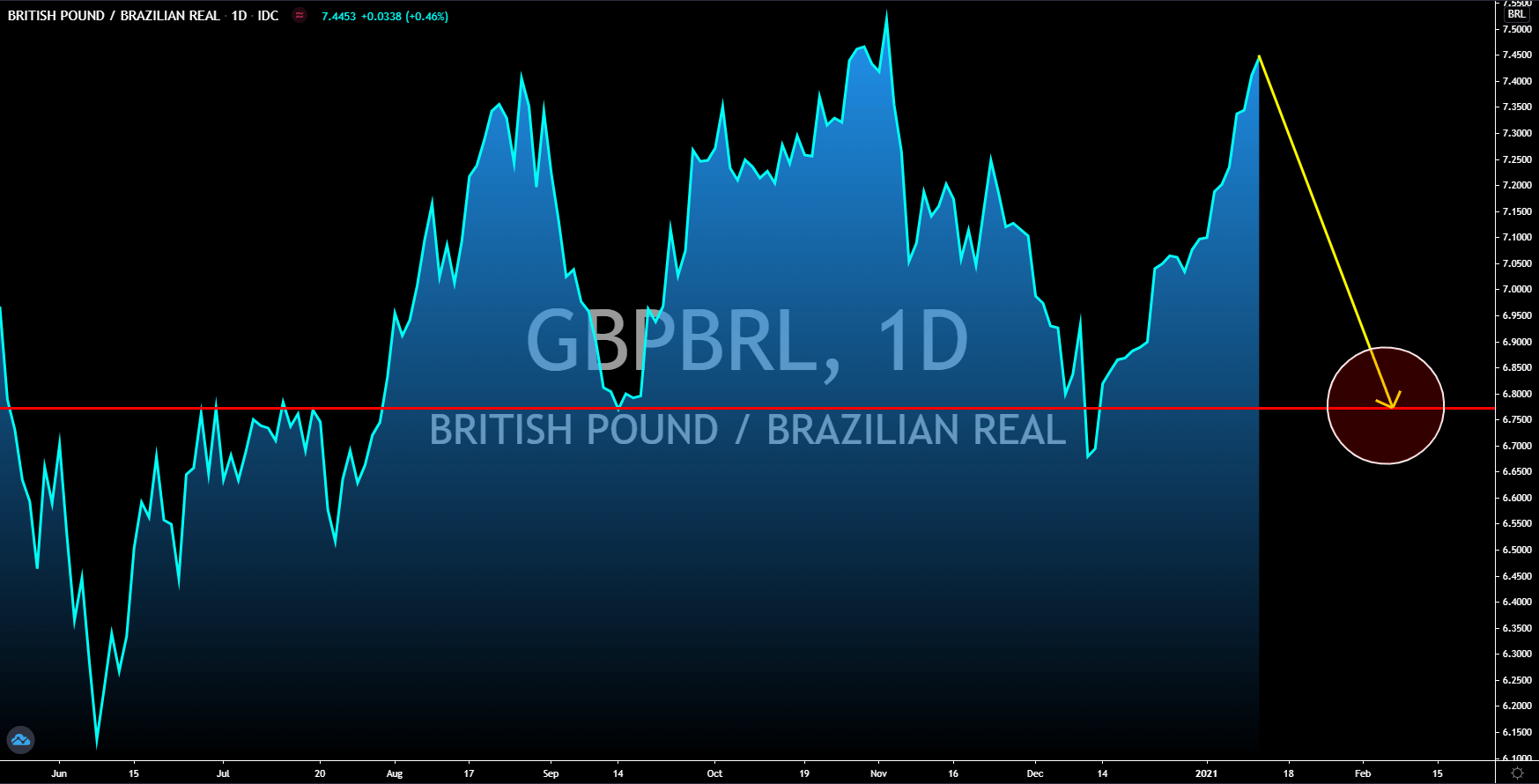

USDBRL

The USDBRL pair trades in the second half of 2020 between 4.8125 and 5.7828. The US dollar is expected to plunge towards the pair’s second steepest pullback since June 2020. The catalyst for this was the recent comment made by President-elect Joe Biden. The Democratic leader promised trillions of dollars in stimulus this year on top of the $6.6 trillion aid passed in fiscal 2020. He also backed the $2,000.00 stimulus check, which was higher from the proposed $600.00. Investors see new stimulus before the end of the first quarter of 2021. Joe Biden just received a certification from the US Congress for his win in the 2020 election amid the protests from Trump supporters. He will be inaugurated on January 20 at the White House. Meanwhile, the Democrats also took control of the Senate after the Georgia runoff election elected two (2) Democrats. The US Congress and the White House is under the control of the Democrats, making it easier to pass new stimulus.

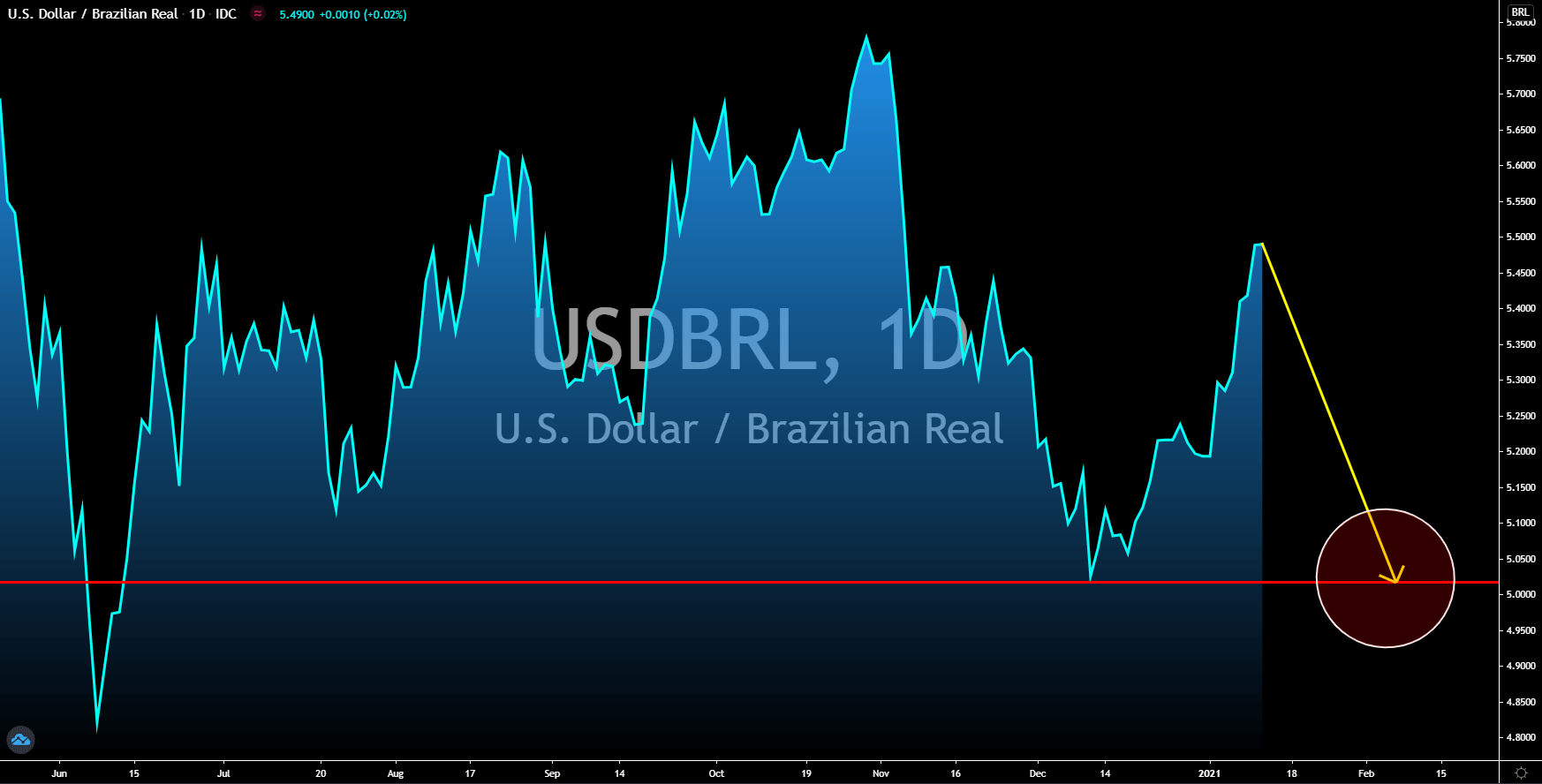

USDRON

Romania’s key reports had improved. The country incurred a trade deficit of -1.573 million in November, which is cyclical. However, the reports from 2020 to date showed that the deficit has been declining not just on a seasonal basis but also in the overall trend of the report. Meanwhile, Romania is starting to catch up with its gross domestic product (GDP) in Q3 after recording -5.7% decline on Tuesday’s report. The final data for Q2 was a decline of 10.3%. However, the World Bank lowered its 2021 forecast for Romania. The country is now expected to grow by 3.5%, which is lower by 1.9 percentage points from the initial forecast. But the upgrade in 2020’s prediction is expected to boost the Romanian leu in coming sessions. For fiscal 2020, the country is expected to contract by -5.0%, which is better than June’s forecast of -5.7%. Meanwhile, the global financial institution is also expected to downgrade its 2021 forecast in Europe and Central Asia.

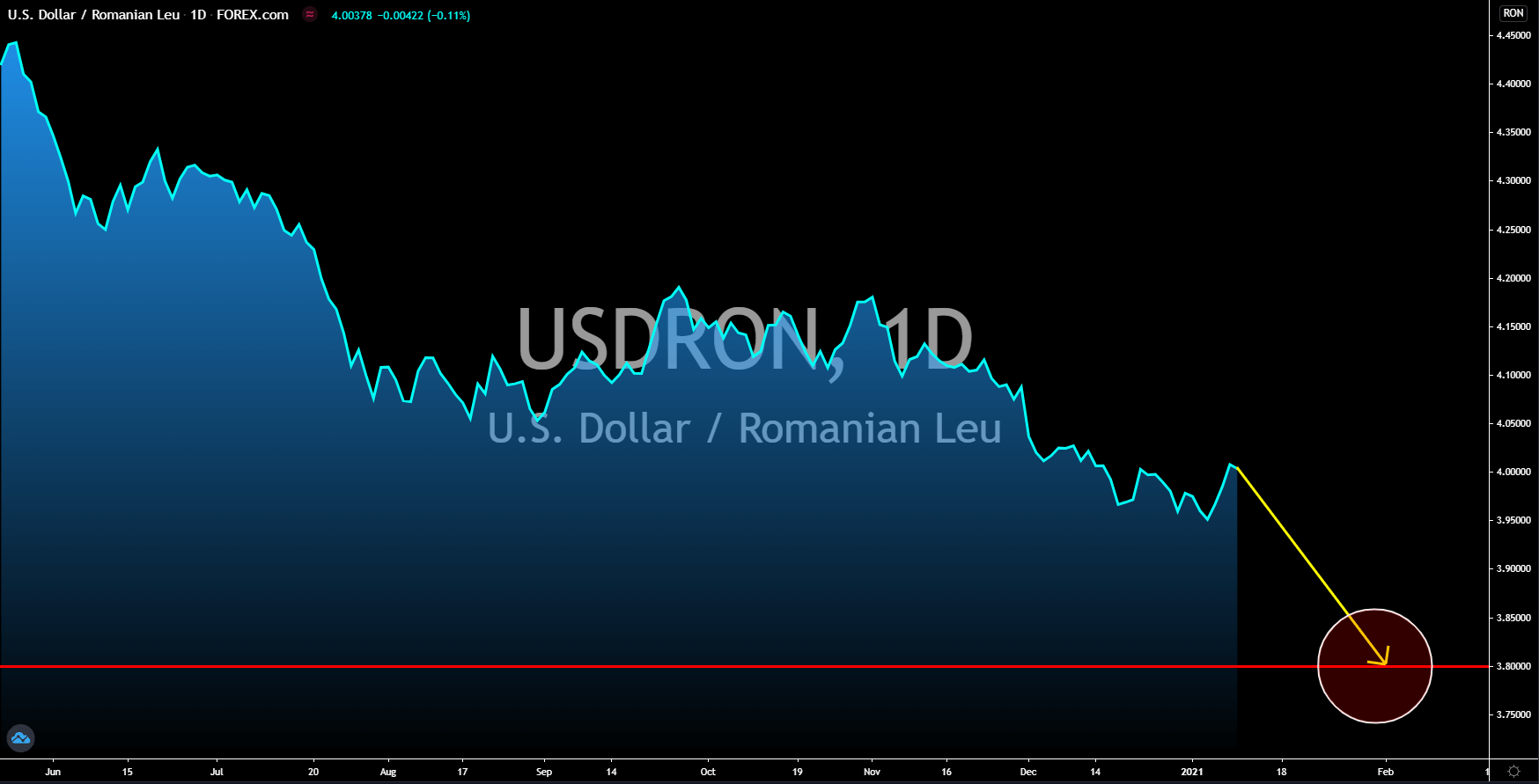

EURNOK

Norway’s economic activity increased in December amid the resurgence of COVID-19. Consumer Price Index (CPI) increased by 0.4%, the highest since August. The prior data showed a decline of 0.7%, which, on the other hand, was the steepest decline since September 2017. On a yearly basis, the report was up by 1.4%, higher than expectations of 1.2% growth and 0.7% record in November. As for the Eurozone, investors were concerned about the potential impact of the rising COVID-19 cases within the group and the UK’s withdrawal from the bloc in the upcoming reports. The UK can still access the single market, but the record-breaking coronavirus cases in the country, which now surpassed 3 million, is expected to drag the economic activity in the region. Germany and France’s imports, exports, and trade balance data remains strong in November at 4.7 points, 2.2 points, and 16.4 billion for Germany and 42.9 billion, 39.3 billion, and -3.6 billion for France.