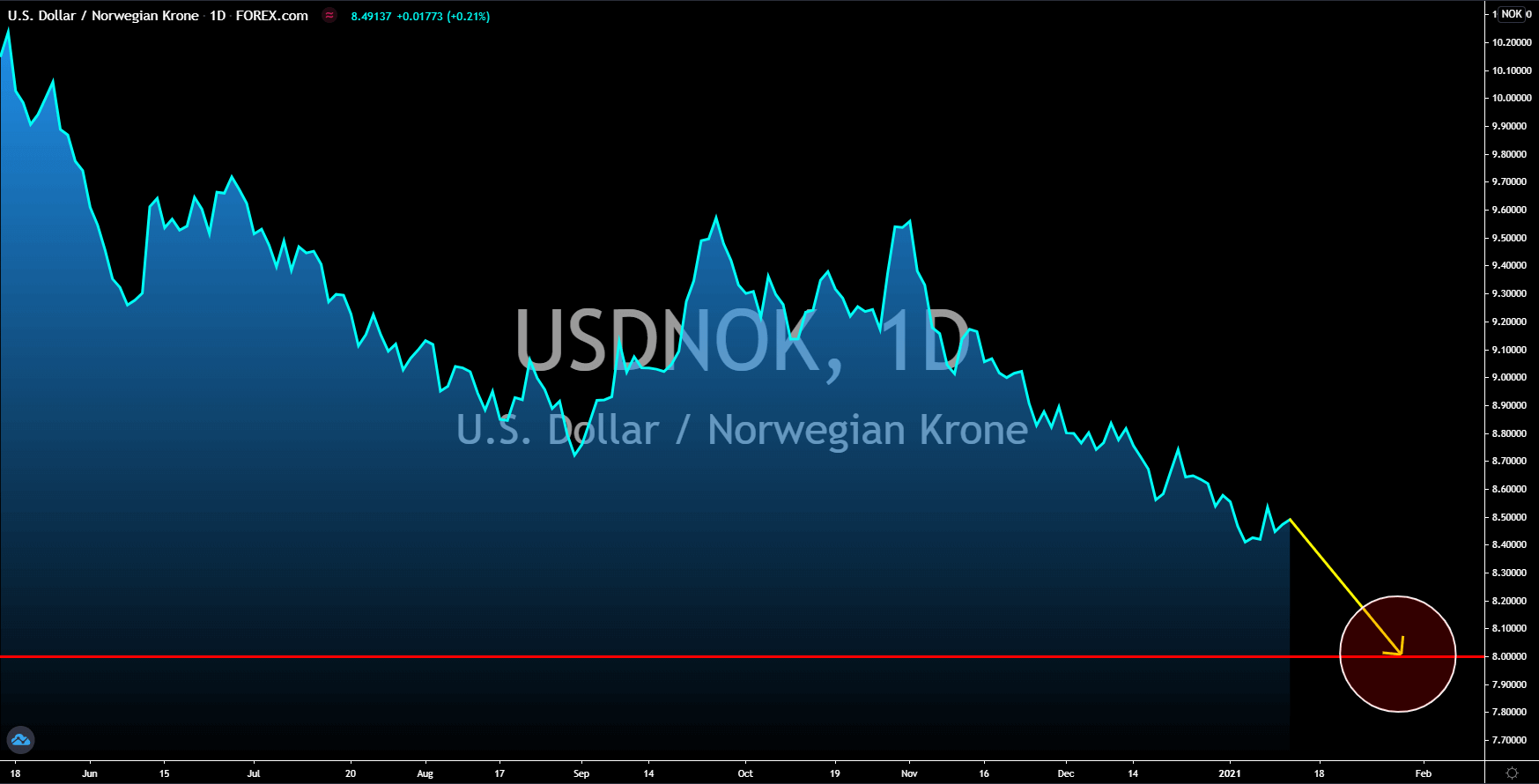

EURCZK

The third-largest economy in the European Union, Italy, posted disappointing results on Tuesday, January 12. Retail sales plunged by -6.9% in November. This was the steepest decline recorded in the past nine (9) months. The prior result was 0.5% growth. Meanwhile, the report declined by -8.1% on an annual basis. This also represents a major reversal from October’s 2.8% growth. On Monday, January 11, Italy also posted a worse-than-expected figure of -3.8% on its industrial production report. The forecast was a decline of -2.6% while the previous record showed a negative growth of -1.6%. The fears of the new COVID-19 strain spreading throughout the bloc also concerns investors. The UK recorded its largest single-day increase in coronavirus infections on Friday, January 08, at 68,053. Analysts expect governments to inject money in the market to keep the economy afloat. This will have negative implications for the single currency.

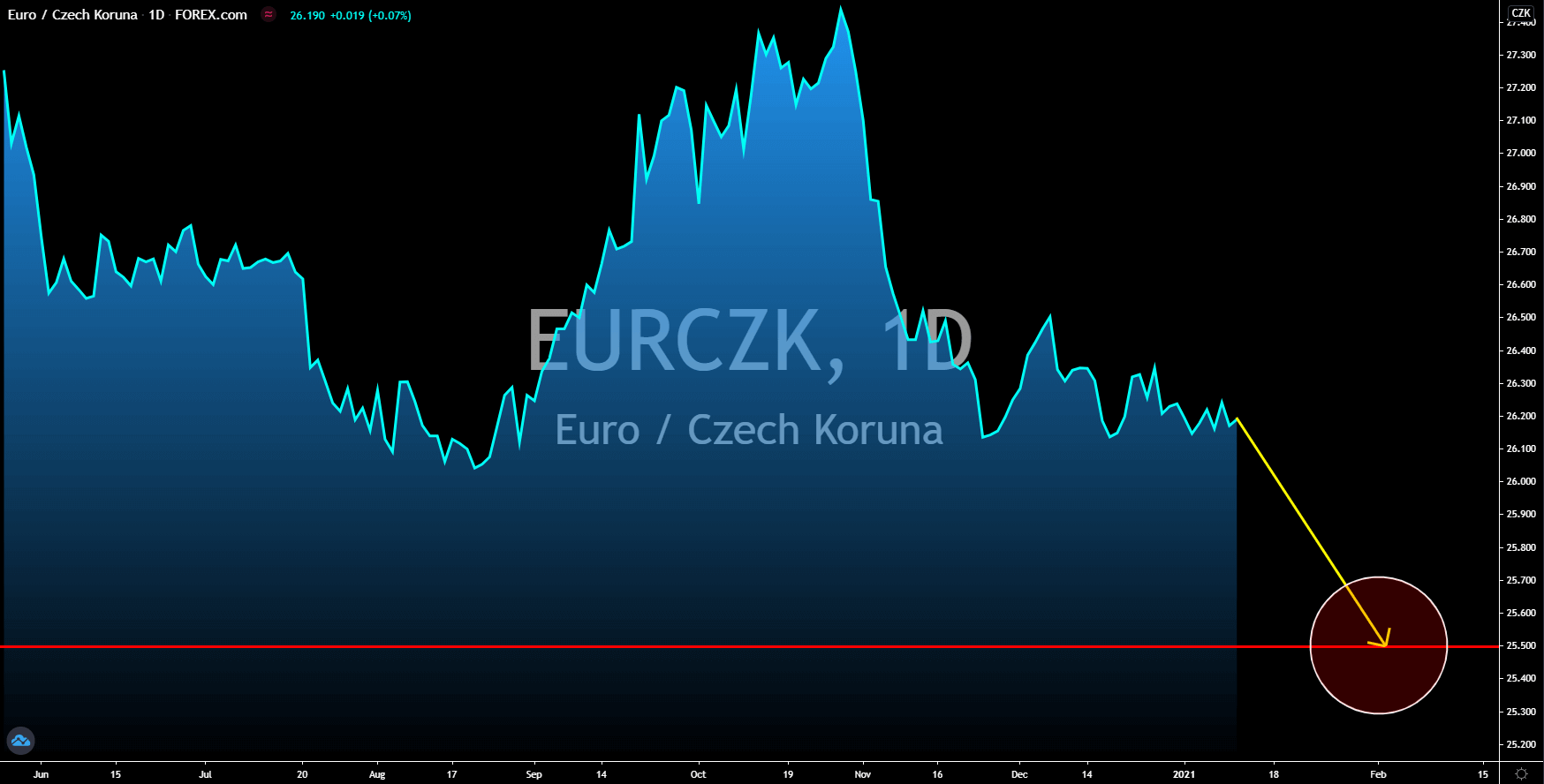

USDHUF

Hungary’s economy showed resilience after it posted consistent results on this week’s reports. Industrial output on Wednesday, January 13, grew by 3.5%. The same number was recorded for the month of October. The 3.5% growth in the two (2) consecutive months were the highest recorded growth since April 14’s 3.8% jump. Also, the trade balance report on Monday, January 11, showed 811.0 million net export. The positive figure indicates that exports are larger than imports. The amount mentioned was the same amount posted in October. Meanwhile, expectations were lower at 524.0 million. The Hungarian economy is expected to contract by 6% to 7% this 2020 while recovery was forecasted to be around 3.5%. This means that the government failed to support the economy despite the stimulus packages. The unattractiveness of the local economic outlook will be the driving force behind the strength of the Hungarian forint.

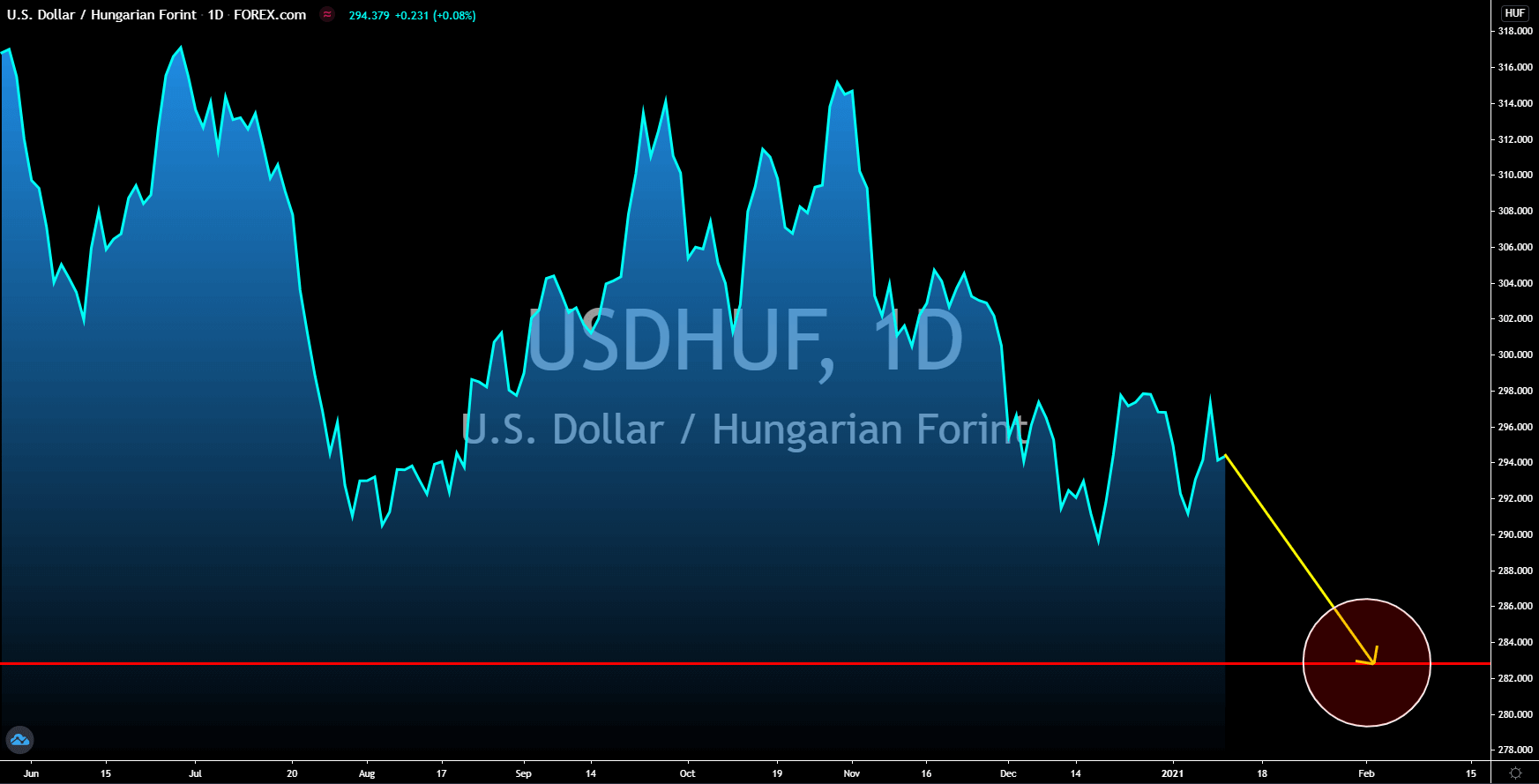

USDMXN

The US-Mexico relationship is expected to experience turmoil in the coming months following the inauguration of President-elect Joe Biden. Mexico’s AMLO revitalized the relationship between the neighboring countries under the Trump administration. As for Mexico’s recent reports, industrial production in November advanced by 1.1%, which is higher than 0.7% expectations. Despite this, the number was still below October’s 2.0% data and was the sixth consecutive month of declining figures. Meanwhile, the report nosedived by 3.7% on an annual basis, which, on the other hand, ended the recovery since August’s -30.7% result. Analysts believe that Mexico’s refusal to fund public spending was the main culprit for the weak industrial production report. In addition to this, Moody’s Investor Service said that the government’s forecast for tax collection and economic growth were too optimistic.

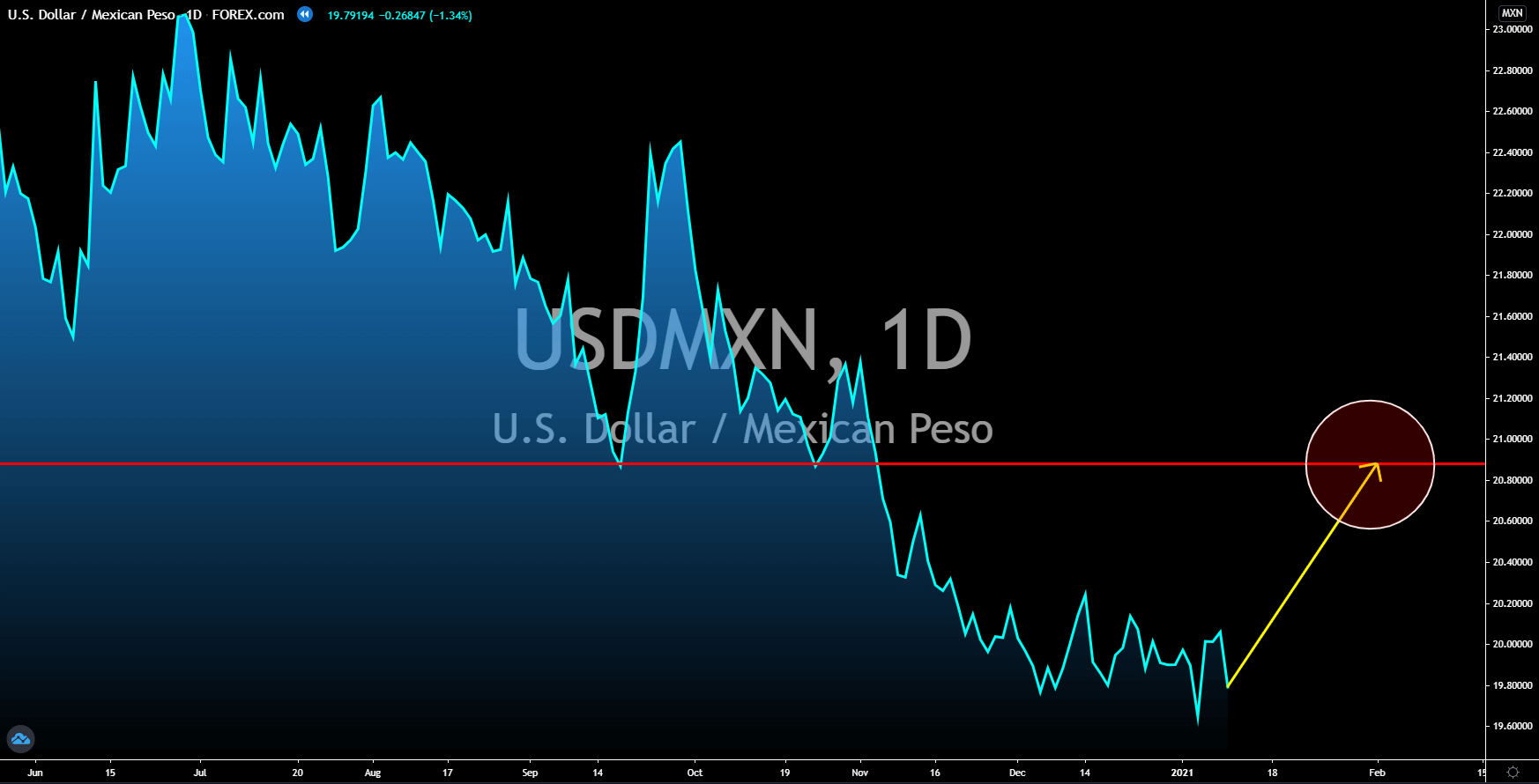

USDNOK

The US import price index is expected to surge on Thursday’s report, January 14. Forecast for the December’s report was a 0.7% growth. The government’s previous record was 0.1%. Meanwhile, the export price index is anticipated to slow down against its previous report. Analysts were expecting a 0.4% increase for the report. Higher imports negatively affect local currency. Thus, a decline in the greenback is expected. Another key report suggesting a weaker US dollar in the short-term was the expected increase in the number of unemployment benefits claimants. Analysts forecasted 795,000 additional individuals, which is higher by 8,000 count from last week’s report. Investors might also decrease their exposure in the USD in the coming days amid the looming inauguration of President-elect Joe Biden on January 20. Biden backs the $2,000.00 stimulus check and promised to inject trillions of dollars in the economy this fiscal 2021.