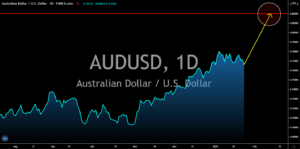

USDCAD

Canada ended last week on a positive note with its Retail Sales report beating consensus estimates. Retail sales in November advanced by 1.3% against the 0.1% reading. Its previous record was 0.4%. The same performance was seen in Core Retail Sales, which grew by 2.1%. The reported figure also beats analysts’ forecast of 0.3% and 1.0% in the prior month. Investor’s confidence in the Canadian economy was also boosted by Finance Minister Chrystia Freeland, who started negotiations with stakeholders regarding Canada’s 2021 budget. The Deputy Prime Minister also reaffirmed the government’s commitment in supporting the tourism industry over the course of the pandemic. In November, Freeland unveiled a possible $381.6 billion deficit in the budget up to $400.0 billion. Another long-term catalyst for the Canadian economy was the election of Joe Biden. In a survey, around 53% of the respondents agreed that Biden will be good for Canada.

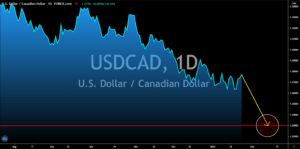

NZDUSD

The NZDUSD pair will see the 0.70000 price zone in coming sessions amid the impressive data from the US PMI reports. The Markit Composite and Services PMIs led the gains on Friday’s report, January 22. Both figures added 2.7 points on their November result to reach 58.0 points and 57.5 points, respectively, for the month of December. Meanwhile, Manufacturing PMI recorded the highest number with 59.1 points. The impressive performance of the United States was in contrast to the European countries, which saw a major decline in their reports. Another catalyst for the expected decline in NZDUSD prices was the possible appointment of Janet Yellen as Treasury Secretary. The former Federal Reserves governor was responsible for bringing the post-Global Financial Crisis (GFC) interest rate from 0.25% to 2.5% during her tenure from 2014 to 2018. This means that investors should see a stronger USD on her appointment.

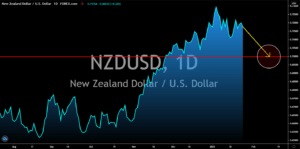

AUDJPY

Japanese’s lower house is expected to pass the controversial $183 billion budget or 19 trillion yen to promote domestic travel until June 2021. This was ahead of the Tokyo Olympics on July 23, 2021. Critics call for a solution on the rising COVID-19 cases instead. Japan added 2,785 new cases on Monday, January 25, which sent the total cases to 369,000. Japanese Prime Minister Yoshihide Suga defended his decision to allow the Olympics by saying that the event would create 460,000 jobs for the world’s third-largest economy. Japan’s $10 trillion public debt, which was twice the size of its economy based on gross domestic product (GDP), was the largest debt-to-GDP percentage among the developed economies. In other news, Bank of Japan Governor Haruhiko Kuroda said that Japan will return to pre-pandemic levels between the end of 2021 until the start of fiscal 2020. Japan’s economy is expected to expand by 3.9% this year.

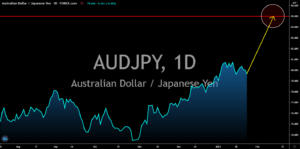

AUDUSD

Australian exports to China surged despite the trade barriers imposed by Beijing to Canberra in 2020. Barley, beef, wine, and timber were the Australian products that faced higher tariffs, but iron ore and wheat produce remains untouched. China is among the world’s biggest consumers of iron and wheat and imposing duties on these products will only hurt its recovery. As a result, iron ore shipments from Australia to China in December rose to 40.00 million tons from 34.44 million tons in November. This was a 16.14% increase. Meanwhile, wheat exports recorded the highest monthly increase in a single destination after reporting $250.00 million result. The tension between Australia and China started after the Australian government backed the proposed investigation of countries on the origin of the coronavirus pandemic and holding the country responsible. The Australian dollar will continue its impressive performance against the greenback.