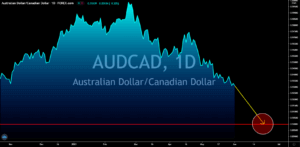

NZDUSD

Investors’ optimism for New Zealand’s economy is back following the recent reports and news. ANZ Bank’s Business Confidence Index returned to the positive territory in May following four (4) consecutive months of negative figures. Meanwhile, the Business Outlook Index was up 27.1% for the same month. This was the highest recorded result in almost four (4) years. As for the Reserve Bank of New Zealand, further stimulus is still needed to ensure full recovery from the pandemic. These numbers are expected to push the stock market higher at the expense of the NZD. Chances of the kiwi dollar extending its gains against the greenback is slim. Among the recent reports, only the Building Consent report shows bleak data. The monthly report shows a slowdown of 4.8% in April against the 19.2% prior month record. NZ is among the countries which successfully contained COVID-19, but economic output remains low.

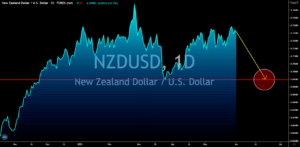

AUDJPY

Economic activity in the world’s third-largest economy remains limited. Spending by Japanese businesses in the first quarter of fiscal 2021 is down by -7.8% year-over-year (YoY). This results in a lower orders of construction materials, which slowed down by 3.3% in April. While the Industrial Production report advanced by 2.5% against 1.7% in March, it is still below the estimate of 4.1%. The same trend was seen in the retail sales figure. On an annualized basis for the month of April, consumer spending on retail stores jumped by 12.0%, which was below the 15.3% consensus estimate. Analysts expect the same numbers on the upcoming reports as reflected by lower Household Confidence in May at 34.1 points compared to April’s 34.7% record. The upcoming Tokyo Olympics in July has failed to lift investors’ mood over the disappointing figures from Japan. The AUDJPY could reach 90.000 in the coming sessions.

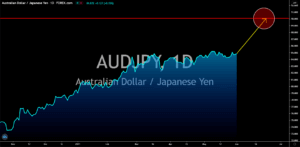

AUDUSD

As of Sunday, May 30, around 41.2% of the entire US population were already fully vaccinated against COVID-19. While the daily target for doses administered has slowed down, analysts were still certain that the US economy will recover to its pre-pandemic level before the end of the year. This optimism will translate to increase in share prices of leading companies in the United States. As a result, demand for the US dollar will start to fade along with concerns over the rising inflation. The 10-year treasury bill has been trading around 1.600% after hitting as high as 1.745% on March 31. In addition to this, spending has slowed down to 0.5% as personal income shrinks -13.1% in April. As for the OECD, the world’s largest economy could expand by as much as 6.9%, the fastest since 1984, as the second half of fiscal 2021 will see the US’ biggest quarterly growth in decades. The Q1 and Q2 records show 6.4% GDP increase.

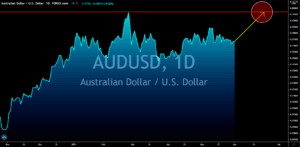

AUDCAD

The Reserve Bank of Australia maintained a near zero interest rate at 0.10% on Tuesday, June 01. This was despite the V-shaped recovery seen in the country. The central bank defended its decision saying that inflation remains below its 2.0% to 3.0% annual target. This gives a bearish impression among market participants that the RBA will not raise rates anytime sooner. As for the recently published reports, most of the numbers came in better-than-expected. However, these were notable declines from their previous records. Building approvals fell less-than-feared with -8.6% result. In March, the published result was 18.9%. Meanwhile, analysts were expecting Australian firms to be profitable in Q1 with gross operating profit anticipated to post a 3.0% growth. The actual result was down by -0.3%. Net exports also fell to -0.6% of Australia’s gross domestic product (GDP) amid the tension between Beijing and Canberra.