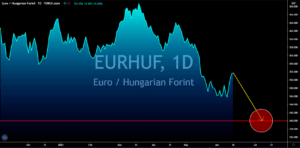

EURHUF

Hungary’s central bank has signaled last week an imminent interest rate hike after urging the government to reduce its deficit. However, Prime Minister Viktor Orban backed down on a 3.0% budget deficit in GDP until next year from the current 7.5%. The country’s top leader said reducing government support to the economy might shock investors, which will result in slower growth. Orban is eyeing a 5.9% deficit next year instead ahead of his re-election bid. Due to this, many analysts believe that the Hungarian National Bank will open the possibility of quarterly interest rate hikes. Budapest’s interest rate is at a record low of 0.60% and the market is expecting the figure to add 40-basis points to 1.0% in 2021. The next meeting by the central bank is on June 22. If the decision is a hike, Hungary will be the first European country to tighten its fiscal policy in 2021. Central bank Governor Gyorgy Matolcsy sees a 6.0% rebound this year to erase 2020 losses.

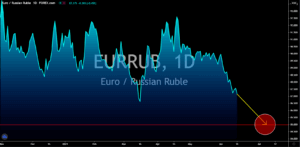

EURRUB

Russia had its third interest rate hike this year on Friday, June 11. The benchmark interest rate is now at 5.50% after adding 50-basis points to its previous rate. The Central Bank of Russia started to tighten its monetary policy in March amid concerns of rising inflation. Analysts believe that the central bank could push the interest back to the pre-pandemic rate of 6.00% before the end of the year. Aside from inflation, the improving economic data from Moscow triggers the interest rate hike. In the first quarter of fiscal 2021, Russia contracted by -0.7%. This is below the projected -1.0% decline for Q1. The figure is also lower compared to the Eurozone’s average GDP of -1.7% during the period. Also, the trade surplus in April was up by 10.59 billion from 10.2 billion prior. This was the highest reported number since March 2020 which suggests that trade activities in Moscow are back to its pre-pandemic level. Thus, GDP might soon follow and expand in 2021.

EURPLN

Poland recorded mixed results from its recent economic reports. Less than one-fifth of businesses in Warsaw plans to expand their operations within the next three (3) months. More importantly, 78.6% of the companies in the construction industry are pessimistic about Poland’s short-term economic performance. This was despite the rapid vaccination campaign in Europe and the easing of several coronavirus restrictions. However, the majority of the surveyed businesses will be increasing their workforce by 10.0%. Meanwhile, Finance Minister Tadeusz Koscinski plans to introduce further stimulus to encourage foreign direct investments in the country. In other news, the broader trade surplus in the Current Account report shows a 3-month high of 1.74 billion in April. However, the increase in CPI which came in at 4.7% in May could pressure the central bank to tame inflation. This will negatively impact Poland’s growth prospect in the short to near term.

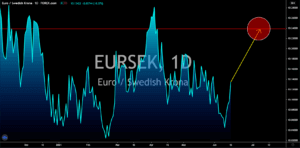

EURSEK

Sweden’s unemployment figure for May declined to 7.9% from 8.2% a month ago. This represents a 12-month low and the fourth consecutive month of decline in the report. The improved figure for the Swedish labor market will increase investors’ confidence in putting their money into riskier assets. Hence, demand for the Swedish koruna is anticipated in the coming weeks. Meanwhile, the increase in the inflation data from the EU’s largest economies sends bullish signals for investors of an interest rate hike. The French consumer price index (CPI) or headline inflation was up 1.4% year-over-year from 1.2% prior. As for Italy, the figure for the same report was 1.3% which is also a 0.2 percentage points increase from the previous result. Germany balanced the E3, or the three (3) largest economies inside the EU bloc, with an increase of 2.5%. This gives an average CPI figure of 1.73%, which is closer to the European Central Bank’s annual inflation target of 2.0%.