USD/SGD

The Singaporean dollar encountered a downfall last week, this was in direct correlation with Singapore having the highest number of Covid-19 cases in their region. Despite this, the number of fatalities is still relatively low to its surrounding countries, so investors are hopeful in the currency’s recovery. In fact, the behavior of the country’s stocks have been interpreted as a prelude to a bullish phase for the currency, which has been in need of some reinforcement. The US dollar in the meantime, has not improved on its stock due to a continued trend in risk sentiment.

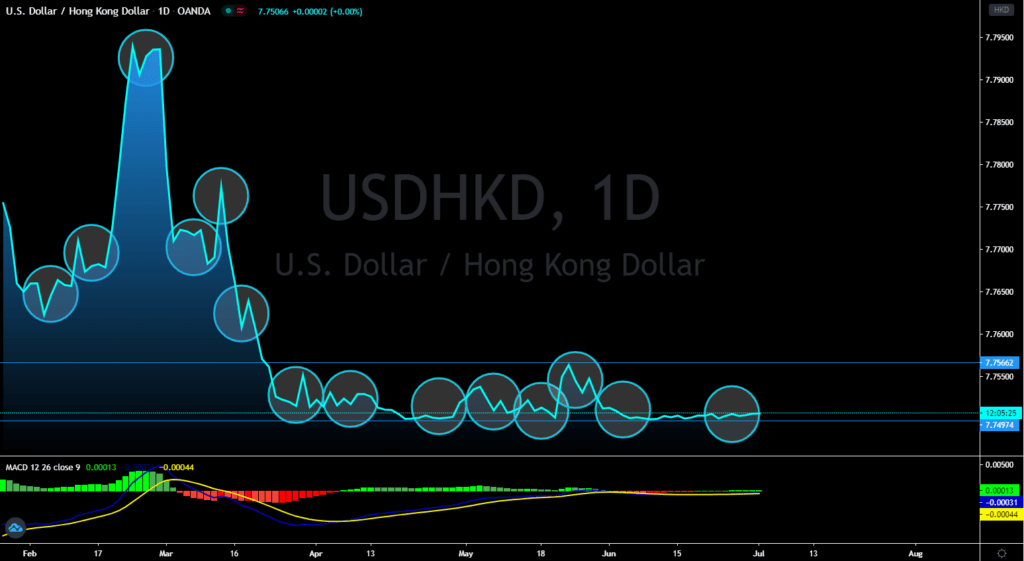

USD/HKD

The trade dispute between the United States and China has had an insignificant if any effect on the USD/HKD pair, as such, it has been at a more or less steady level for thee and a half months. Furthermore, this 50 day moving average is considerably lower than the 200 day average. This bearish trend seems to be directly connected to the outbreak of the Covid-19 virus in the United States and doesn’t seem to be slowing down. Bullish investors have had attempts to push the currency exchange past its resistance level, however their efforts have fallen on deaf ears. If anything, the pair might pass its support level as the bears seem to have a better grip on the currency at the moment.

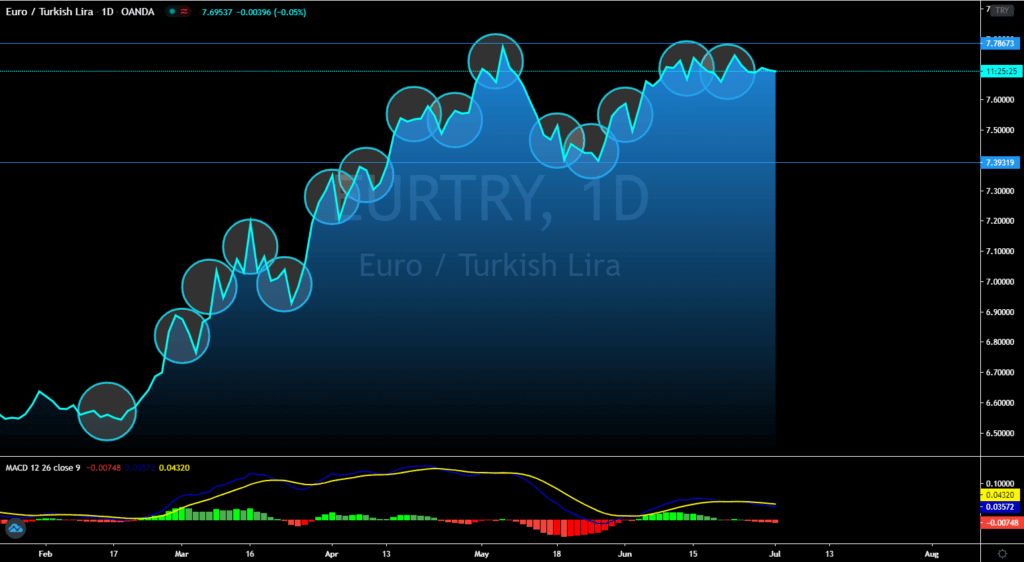

EUR/TRY

As Covid-19 continues to wreak havoc on markets all across the world, the Turkish lira is one of the currencies that has been affected, and in relation to the Euro, it struggles to keep the resistance position it reached in the first week of May. The pair has had a considerably higher 50-day moving average than its 200-day moving average, however, the exchange rate seems to have peaked and is starting to regress to what might turn out to be a new support level. The Turkish central bank has kept its repo rate fixed for June, this coupled with the poor standing of the Euro at the moment has reassured bearish traders.

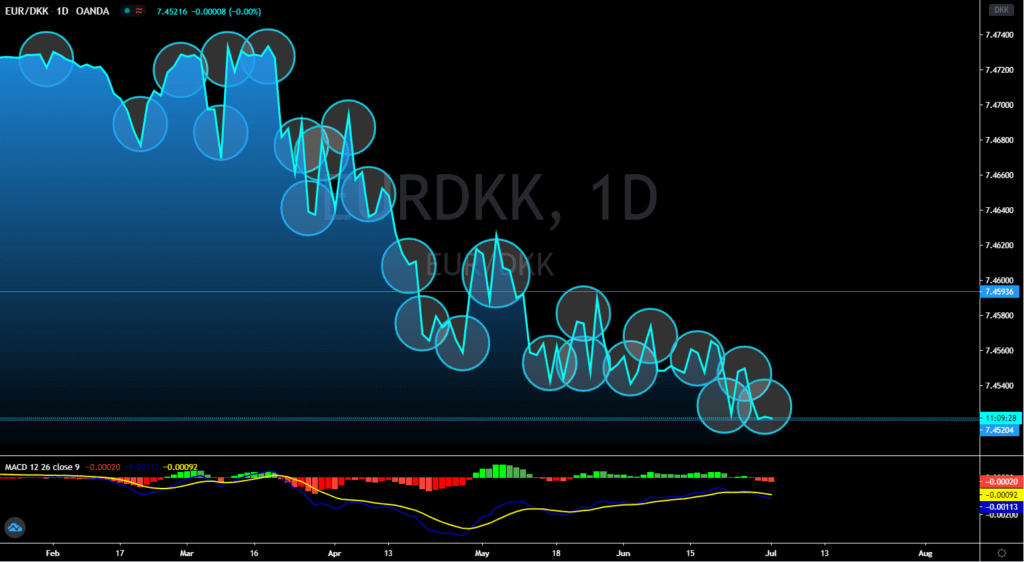

EUR/DKK

The Danish economy has been surprisingly resistant to the effects of the Covid-19 virus and the Danish krona has held its own against the weaker Euro, forcing the pair to fall to its lowest level since August of last year. This bearish trend is expected to continue as there is no sign of the Danish currency weakening. The pair is expected to reach its support level by mid July. As the retail sales figures skyrocket in comparison to previous months and reaching the support level for the exchange rate seems all but inevitable, the 50-day moving average is moving towards being staggeringly lower than the 200-day moving average.