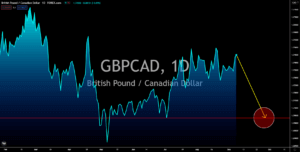

GBPCAD

The UK’s Purchasing Managers Index shows a slowdown in Britain’s economic activity in August. The fourth wave of the pandemic peaked in July, but cases continued to rise in the next month. August’s gradual increase in new infections is despite the alternation of “pingdemic,” a covid-19 tracking app. With a high number of Britons told to self-isolate, economic activity plunged. The Composite and Services PMIs released on September 03 was down to 54.8 points and 55.0 points. Both reports failed to beat analysts’ consensus estimates of 55.3 points and 55.5 points. As for the Construction PMI on September 06, the result showed a decline to 55.2 points. Retail sales in the month are also down to 1.5%. In other news, PM Boris Johnson is under pressure to raise the government’s revenue amid high expenses in 2020. Analysts worry that a tax hike in income would trigger an increase in inflation and lead to a new stimulus in the form of government subsidies.

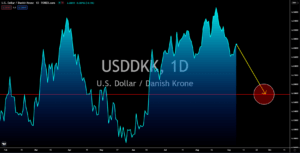

USDDKK

The United States had a mixed Friday result. August’s unemployment rate fell to 5.2%, its lowest level since the onslaught of the pandemic. On the other hand, the US Bureau of Statistics added 235,000 jobs based on the Non-Farm Payrolls (NFP) report. The September 03 record is below the 750,000 expectations and 1.05 million in July. Adding to worries is the end of some unemployment benefits this week. In relation to NFP, the initial jobless claims hit a pandemic low of 340,000. Meanwhile, the country’s PMI records in the month are down by 4.5 points and 4.8 points to 55.4 points and 59.9 points. US President Joe Biden blamed disappointing data on the delta variant. In September, the top leader called congress to approve the 1.2 trillion infrastructure bill and the 3.5 trillion stimulus. Meanwhile, US House of Representatives Speaker Nancy Pelosi said that low jobs creation suggests passing the key bills. The stimulus will negatively impact the US dollar.

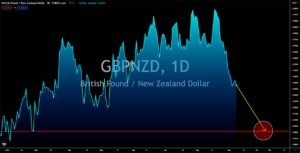

GBPNZD

New Zealand Prime Minister Jacinda Ardern put an end to a three-week lockdown. The success of the country in containing the virus raises speculations of an interest rate hike. On August 18, the Reserve Bank of New Zealand kept the interest rate at a historic low of 0.25%. Analysts anticipate a 25-basis point hike amid the improving economic outlook. However, the resurgence of covid-19 put the RBNZ’s plan on hold. Governor Adrian Orr maintained a bullish outlook and said that the delta variant would not impact monetary tightening. The upbeat comment defended the kiwi dollar from the bleak economic reports. On September 05, the ANZ Commodity Price Index fell -1.6% month-on-month. The figure is worse than -1.4% in the previous month. Meanwhile, the Global Dairy Trade Index is up 4.0% from 0.3%. The recent figure is the highest in five months, or since March 2021, when the index hiked by 15.0%. The target price in the short term is around 1.90000.

USDCNY

China’s trade activity saw minor improvements, with August’s trade balance printing 58.34 billion. Analysts anticipate a 51.05 billion result for the month, while the July report shows a 56.59 billion record. Imports and exports deliver a 33.1% and 25.6% increase, higher than the 26.8% and 17.1% estimates. However, concerns remain as recent articles show a possible falsification of economic data by some officials. China’s National Bureau of Statistics had its inspections in the last two years and found evidence of manipulation. In 2017, the province of Liaoning was the first to acknowledge malpractices in some of its economic reports. Despite the news, analysts anticipate the investors and traders to price the USDCNY pair in the recent report. A high trade balance data from China suggests a large trade deficit in the United States. On September 02, America had a deficit of -70.10 billion. The US reached its lowest data of -75.00 billion in the revised July report