RENTALZI REVIEW

Home > Uncategorized > Rentalzi Review

GENERAL INFORMATION

Broker Name:

Rentalzi

Broker Type:

Forex and CFDs

Country

Hong Kong

Regulation:

N/A

Address:

The Gateway, Harbour City, 15 Canton Road, Tsim Sha Tsui, Kowloon

Broker status:

Active

CUSTOMER SERVICE

Phone:

+18007953704

Email:

Languages:

English

Availability:

24/5

TRADING

Trading platforms:

Proprietary

Trading platform Time zone:

N/A

Demo account:

No

Mobile trading:

Yes

Web-based trading:

Yes

Bonuses:

No

Other trading instruments:

Yes

ACCOUNT

Minimum deposit ($):

$250

Maximal leverage:

1:200

Spread:

Floating 0.0 Pips

Scalping allowed:

Yes

Broker Review: Rentalzi

First Impressions

The most crucial term in the financial world is trust. Before sending money to a broker, traders must ensure they are properly regulated.

That’s why in our Rentalizi review, we will first look at the broker’s safety. We were pleased to find that rentalizi.com operates under many regulatory entities. Please keep in mind that regulators could differ based on where you are located. Rentalzi Markets UK plc and Rentalzi Spreadbet plc, for instance, are under the Financial Conduct Authority’s supervision (FCA).

Rentalzi Markets complies with stringent laws, offers its clients negative balance protection, holds client funds in segregated accounts, and is a participant in the traders’ compensation plan.

Remember that negative balance protection is only offered to retail clients in order to protect traders from the risks associated with margin trading. Margin trading is a highly leveraged activity that allows participants to place bets using borrowed money and risk capital that they do not possess. It is possible for a trader’s balance to fall into the negatives on occasion when markets are extremely volatile and trade goes against prediction, leading the trader to accrue debt to the broker.

Retail traders can only use the leverage of up to 30:1 when trading Forex pairs, whereas professional traders can use levels of up to 200:1 to offset this. In order to avoid the balance from being negative, the broker also employs automatic Stop Out levels. In the unlikely event that your account experiences a negative balance, you can contact customer service, and they will make the balance zero.

In the next section of our Rentalizi review, we will go over trading assets like Forex, cryptos, and shares as CDFs, which we think is an amazing option, but more on that later.

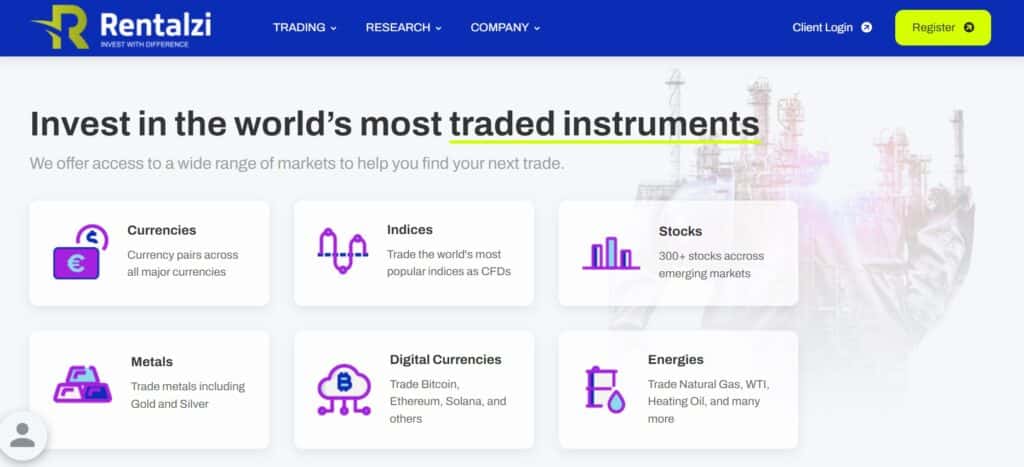

What is available for trading on Rentalzi Markets?

At Rentalzi Markets, an expansive range of Forex trading pairs is available. Additionally, the broker offers access to trading equities that are both physical and CFD. Contract For Difference, or CFD, has some benefits over trading physical assets. Physical assets, on the other hand, are ideal for long-term investment because there are no expenses associated with holding an open position overnight.

For short-term investments or speculation, CFDs are favoured because they can be traded long or short in both bullish and negative markets. Also, because more individuals trade CFDs than actual assets at any given time, spreads are tighter, and CFDs are more liquid.

Although Rentalzi Markets offers a variety of trading assets, keep in mind that some of the assets are only accessible through specific account categories, and the number of assets and policies offered may vary slightly depending on your area.

Forex

Rentalizi.com has 330 currency pairings. These include Major, Minor, and exotic pairs, which are less liquid and feature wider spreads are exotic pairs. The most tightly spread major pairings, such as EUR/USD, USD/JPY, and AUD/USD, start at 0.7 pip. The broker just charges spread markups; there are no other expenses.

Also, traders have the option of trading currency indices like the USD, EUR, GBP, and others. For trading forex, big international institutions like Deutsche Bank, JP Morgan, Barclays, Goldman, UBS, Citibank, and HSBC provide liquidity to Rentalzi Markets.

Shares as CFDs

As we already mentioned in our Rentalzi Markets review, the brokerage offers 10,000 shares as CFDs. Leverage is offered for trading in addition to other advantages. The maximum leverage offered for shares is 20:1.

Using a dedicated share trading platform, you may trade CFDs for shares of Tesla, Google, Amazon, Meta, and other well-known corporations. The prices are fair and start at 0.10 points on Tesla. Also, traders can predict the values of penny stocks and various instrument categories, including growth, technology, banking, ETFs, consumer & retail, and share baskets.

Actual shares

Long-term investors prefer physical shares since no expenses are associated with holding assets for a long time. On the other side, since there is no available leverage, you need more money to begin investing. Around 35,000 shares are available for trade in total. Remember that trading can only be profitable in one direction. The good news is that trading costs on US, UK, Canadian, and Japanese exchanges begin at zero dollars.

Cryptocurrencies

Speculative traders use cryptocurrencies more frequently than ever before. The broker offers 19 important cryptocurrencies and other coins. Keep in mind that when trading cryptocurrencies with Rentalzi Markets, you only trade these assets as CFDs rather than buying or selling actual coins. As a result, since you don’t truly own the assets, you don’t need to worry about where to keep or cash out gains.

Although Rentalzi Markets does not charge a commission, the broker imposes spread markups on traders. The spread on the most popular pair, BTC/USD, starts at as little as 75 pips, and markups for cryptocurrencies start at 0.5 pips on MATIC.

According to our Rentalzi review, the most leverage that can be used for trading cryptocurrencies is 2:1, which is less than what other brokerages are willing to offer. Cryptocurrencies are considered high-risk assets by Rentalzi, which limits the risks in an effort to safeguard individual investors from losing money.

Indices

Indexes are a very accurate indicator of the state of particular economies and businesses. The top 500 American corporations that are traded publicly on the stock market are measured by the S&P 500, for instance. The S&P 500 and US 500 can be traded as CFDs or used as indicators.

Rentalizi offers 80 indexes, including the UK 100, US 30, Germany 40, Hong Kong 50, Australia 200, and others. On the US 500, spreads begin at 0.5 pip, and leverage can reach 20:1.

Commodities

There are two categories of commodities that can be found on the markets. Commodities are the basic resources needed to make consumer goods. Commodities that can be farmed are referred to as soft commodities, whilst those that must be mined are known as hard commodities.

While researching for our Rentalizi review, we were pleased to find that you can trade both hard and soft commodities, such as precious metals, energy, agriculture, and commodity indexes. On gold and natural gas, spreads begin at just 0.3 points.

Prices for commodities fluctuate in response to shifts in global demand and supply. Remember that the provided assets are CFDs and that you can trade them both ways.

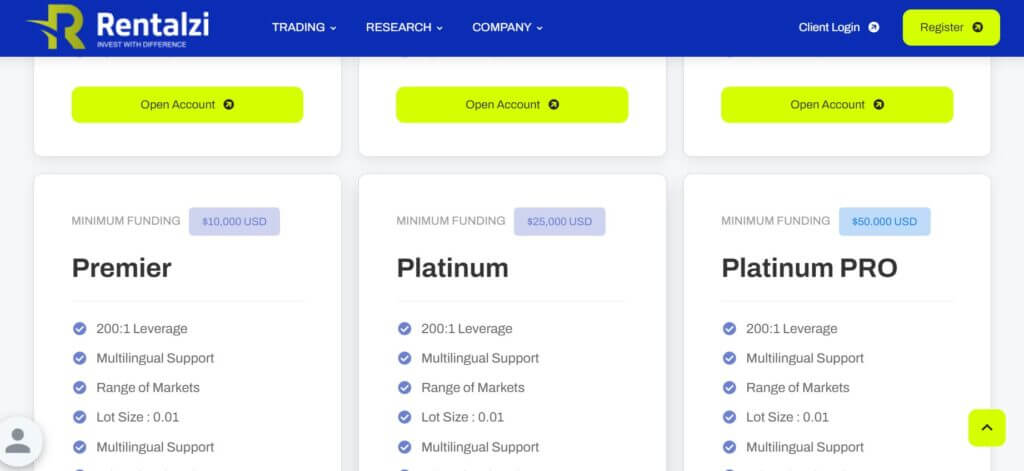

Which account kinds does rentalzi.com provide?

The CFD and Corporate accounts are two of Rentalzi Markets’ six live account types for trading CFDs. Although the offerings of the two account types are fairly similar, the CFD account is intended for amateur traders, and the Corporate account is for experienced investors. You can also join the website as an exclusive VIP member which has a plethora of benefits.

Demo account on Rentalzi Markets

We were pleased to find that Rentalizi offers demo accounts while researching for this review. Trades can be placed using demo accounts without putting real money at risk. All CFD account types have demo versions of the genuine account types available. For both experienced traders and newcomers, demo trading is crucial.

While more experienced traders utilize demo accounts to create, test, and backtest their trading methods, novice traders can become familiar with the trading software and learn about the broker’s policies. Demo trading is quite helpful; however, it should be noted that it cannot adequately train traders for trading live. Live trading necessitates controlling one’s emotions, which demands self-control and diligence.

Rentalzi Markets' CFD account

With a CFD account, it is possible to trade 10,042 products, including more than 300 Foreign Exchange pairs, plus over 100 indices, over 100 commodities, above 10 cryptos, over 50 bonds, and over 9,000 shares as Contract for Differences.

Furthermore, both account types support fractional trading sizes. Retail investors are the major target market for CFD accounts. Several asset classes have different leverage percentages. Leverage for forex pairings can reach a maximum of 30:1. Leverage for indices is 20:1. 2:1 for cryptocurrency, and 5:1 for shares. Remember that while leverage can be an excellent tool for increasing your profits, it can also lead to greater losses.

High-level Rentalzi Markets accounts

Professional traders should use the platinum pro, platinum, or premier accounts. The maximum leverage for trading Forex pairs using these account types is 500:1.

When investing in share CFDs, a fee of 7 USD is charged for each completed trade.

Rentalzi.com review: Final Verdict

In conclusion, Rentalzi Markets is a worldwide, active, well-recognized broker (some countries excluded). The broker’s ability to provide a variety of asset kinds is undoubtedly one of its strongest points, including both actual shares and CFDs of shares. The teaching materials are vast, and the broker’s fees are fair. It is regulated under strict laws and is customer oriented. Without a doubt, Rentalzi Markets is an excellent option for multi-asset trading.

COMMENTS

Recommended for You

Cryptocurrency Market Update: March 3

Recommended for You

Recommended for You

Recommended for You

Recommended for You

Recommended for You

-

Support

-

Platform

-

Spread

-

Trading Instrument

73 Comments

Fast execution

Fast execution, on-time withdrawals and good customer service. I have been using their services for quite some time and so far everything works well.

Did you find this review helpful? Yes No

Swift withdrawals

I was able to withdraw profit swiftly. I also get prompt replies from customer service.

Did you find this review helpful? Yes No

Great trading experience

I had a good trading experience with this broker. I was able to withdraw profit monthly. I never had any problem with any of their transactions.

Did you find this review helpful? Yes No

Good profit

I’ve got no regret in choosing this broker over a few options. They can consistently help me gain good profit.

Did you find this review helpful? Yes No

Excellent broker

Excellent broker, the signals are always accurate and profitable, with great customer service, too. Both are skilled in assisting me to succeed in trading.

Did you find this review helpful? Yes No

Good signals

Good signals and services. They offer a good platform as well. I trade based on the market analysis and is gaining profit from it.

Did you find this review helpful? Yes No

Reliable signals

If you are looking for a good trading broker to deal with, can recommend this broker company. Signals are so much reliable.

Did you find this review helpful? Yes No

Exceptional broker service

Exceptional broker services. I am impressed on broker signals and even services.

Did you find this review helpful? Yes No

Passive source of income

A good passive source of income. I wouldn’t have to spend more time on this, I just have to place trades and wait for results.

Did you find this review helpful? Yes No

Good forex broker

I am currently using this broker service. Well, odd experiences in trading are normal. I have experienced those as well but overall I find their services great. No withdrawal issues and good support.

Did you find this review helpful? Yes No

Great forex tools

Great forex tools and signals. They provide not only profitable signals but also updated market news and forex educational materials.

Did you find this review helpful? Yes No

Great forex broker

It is a big and well-rounded broker service. They have proven to be a reliable company. I recommend putting your funds only in a good broker like them.

Did you find this review helpful? Yes No

Transparent broker

Terms are well explained at the start including possible risks. I don’t see any gray areas, transactions are transparent.

Did you find this review helpful? Yes No

Honest and transaparent

I can fully trust this broker. They are very honest and transparent on all transactions. Terms are fair and services are good.

Did you find this review helpful? Yes No

Great and trusted

Good and trusted company for forex brokerage. They are experienced and skilled in the forex market.

Did you find this review helpful? Yes No

Good trading broker

They are highly skilled and enthusiastic. I am glad to have all of these trading modules as well.

Did you find this review helpful? Yes No

Excellent adviser

Excellent trading adviser. I gain real good profit and I am happy with all of their services.

Did you find this review helpful? Yes No

Excellent broker

One of the best trading services to trade with. The software are also awesome.

Did you find this review helpful? Yes No

Great trading experience

I had a great trading experience with this broker company. I gained good profit and got the result that I expected to have.

Did you find this review helpful? Yes No

Good trading signals

I am happy to have found these tools and services for help me succeed in online trading. They use a advanced software with many exciting features which make trading easier and more organized. Good trading signals and tips, all of them are shown to be effective. I can personally vouch for the services.

Did you find this review helpful? Yes No

Trusted broker

I can fully trust their services. They are proven to be efficient brokers.

Did you find this review helpful? Yes No

Affordable assets

I have a lot of options here to trade with. Some assets are affordable and the deals are by far profitable.

Did you find this review helpful? Yes No

Good broker

I can consider them as a good broker. They are professional and skilled in the forex market.

Did you find this review helpful? Yes No

Smooth transactions

Fast and smooth transactions. Good customer service and easy withdrawals. There are so many tradable instruments to choose from.

Did you find this review helpful? Yes No

Good broker company

One of the best broker company. They provide good customer service and the most effective trading signals.

Did you find this review helpful? Yes No

Great trading experience

I had a great trading experience with this broker. I was able to withdraw a decent profit monthly. I never had any problem with any of their transactions.

Did you find this review helpful? Yes No

Good broker

For the past few years of trading in the industry, I have never met a broker as good as this. I get consistently good profits.

Did you find this review helpful? Yes No

Good forex broker

Good forex broker. Signals, withdrawals and services are uncomparable great.

Did you find this review helpful? Yes No

Skilled and enthusiastic brokers

They have shown expertise in forex trading. I admire the brokers and customer service that are both skilled and enthusiastic.

Did you find this review helpful? Yes No

Fast withdrawals

Fast and easy withdrawals. Good and profitable signals.

Did you find this review helpful? Yes No

Good source of income

I am fully satisfied with what I get from this broker. It is a good source of income.

Did you find this review helpful? Yes No

Exemplary performance

Exemplary performance. They bring really good profit. I can depend on market analysis all the time.

Did you find this review helpful? Yes No

Good tools and services

I have no complain against this broker. It is easy to use this broker in all aspect. Tools are easy to navigate and there is no withdrawal issues encountered.

Did you find this review helpful? Yes No

Wonderful forex broker

The most wonderful broker to trade forex. They’ve proven excellent in market forecast. I get good profit trading with them and I am happy with the services.

Did you find this review helpful? Yes No

Outstanding broker

Outstanding broker signals and good trading software. They’ve made trading easier and more productive for me.

Did you find this review helpful? Yes No

Reliable brokers

Reliable and professional brokers. They’ve been consistently providing excellent services to me since day 1 up until now.

Did you find this review helpful? Yes No

Easy withdrawals

Easy to withdraw money, no hassles and easy requirements for verification.

Did you find this review helpful? Yes No

No regrets joining

No regrets joining the team. Trading terms are fair, good leverage and tight spreads, too.

Did you find this review helpful? Yes No

Good profit

Happy to trade with them. I gain good profit.

Did you find this review helpful? Yes No

Brilliant broker company

Brilliant broker company. I am happy with both profit and services.

Did you find this review helpful? Yes No

Outstanding services

Oustanding trading services. They have good signals and really fast withdrawals.

Did you find this review helpful? Yes No

Pleased with services

Exemplary service from brokers and customer support. I am pleased with all of their services and happy with my profit.

Did you find this review helpful? Yes No

Skilled brokers

Skilled trading brokers. They always amazed me with good signals and accurate market analysis.

Did you find this review helpful? Yes No

Happy to trade with them

The signals are always accurate and withdrawal is fast. Happy to trade with them.

Did you find this review helpful? Yes No

Great forex broker

If you wish to make the most money in online trading, choose this broker. Signals will never fail you. I am impressed with forex signals, assets and services.

Did you find this review helpful? Yes No

Good broker

Fair trading terms and conditions. Good broker services as well. Been trading for a couple of months and had several withdrawals. So far, all is good.

Did you find this review helpful? Yes No

Good broker

Good trading broker. Signals are always timely and profitable.

Did you find this review helpful? Yes No

Good broker company

Good broker company. I gained good profit and have experienced good services, too.

Did you find this review helpful? Yes No

Good broker company

Great customer service and withdrawal is fast. A good broker to trade with.

Did you find this review helpful? Yes No

Good broker

Good broker to trade forex. They are experienced in the forex market. Signals are good are services are reliable.

Did you find this review helpful? Yes No

Helpful customer service

Helpful customer service. I always get the support I need promptly.

Did you find this review helpful? Yes No

Good trading broker

So far deposits and withdrawals were done smoothly. And the customer service is superb, too.

Did you find this review helpful? Yes No

Absolutely recommended

I absolutely recommend this service to all traders. I am consistently getting good profits and the perfect services that I deserve. Competitive brokers and good customer service.

Did you find this review helpful? Yes No

Transparent broker

There transparency is outstanding. I trust them high enough with my investment. They did well in what they do and works efficiently. I gain profit from my trades.

Did you find this review helpful? Yes No

Accurate signals

Market analysis and trading signals are spot on. They always give accurate advise. I get profit all the time.

Did you find this review helpful? Yes No

The best broker

Among the brokers I have traded with, this one is the best. I got more profit and was able to withdraw easier and faster.

Did you find this review helpful? Yes No

Good broker

They are good in what they do. They never settle for less but maximize their potential earnings.

Did you find this review helpful? Yes No

Good trading tools

Offers not only good trading services but also a good knowledge base about online trading. Good website and efficient trading tools.

Did you find this review helpful? Yes No

Fantastic broker signals

Fantastic broker signals and trading guidelines. Consistently bringing profit to my trading account.

Did you find this review helpful? Yes No

Efficient tools and signals

I am trading with ease and confidence. Tools and services are both efficient. I will be keeping this broker for good.

Did you find this review helpful? Yes No

High quality broker service

Trading with this broker is safe and the quality of service is really high. They had go beyond what I expected of them.

Did you find this review helpful? Yes No

Great trading signals

Been using their signals for a year and so far I am fully satisfied with the services. Signals are profitable and services are good.

Did you find this review helpful? Yes (1) No

Transparent brokers

I can trust this broker company. They are very honest and transparent in all transactions.

Did you find this review helpful? Yes No

Good trading signals

Glad to leave a review for this broker. They deserve good ratings. Signals are accurate and profitable.

Did you find this review helpful? Yes No

Amazing services

Amazing services and good profit are my reason of keeping this broker service. I have never traded with brokers as good as this before.

Did you find this review helpful? Yes No

Good broker

Good broker. They are friendly and efficient.

Did you find this review helpful? Yes No

Highly recommended

Highly recommended trading services. Prompt customer service, fast withdrawals, and excellent signals.

Did you find this review helpful? Yes No

Rentalzi for me is a very good broker for online trading. Signals are profitable and withdrawal is fast.

Good trading experience

I experience good trading services from this company. Also, I was able to withdraw profit swiftly.

Did you find this review helpful? Yes No

Excellent trading advise

Excellent trading advise. I simply followed their instructions and I am trading progressively.

Did you find this review helpful? Yes No

Honest broker

This is the only broker I am confident trusting my money with. They are very transparent and honest in all transactions.

Did you find this review helpful? Yes No

Good trading signals

Glad to leave a review for this broker. They deserve good ratings. Signals are accurate and profitable.

Did you find this review helpful? Yes No

Honest broker

This is the only broker I am confident trusting my money with. They are very transparent and honest in all transactions.

Did you find this review helpful? Yes No