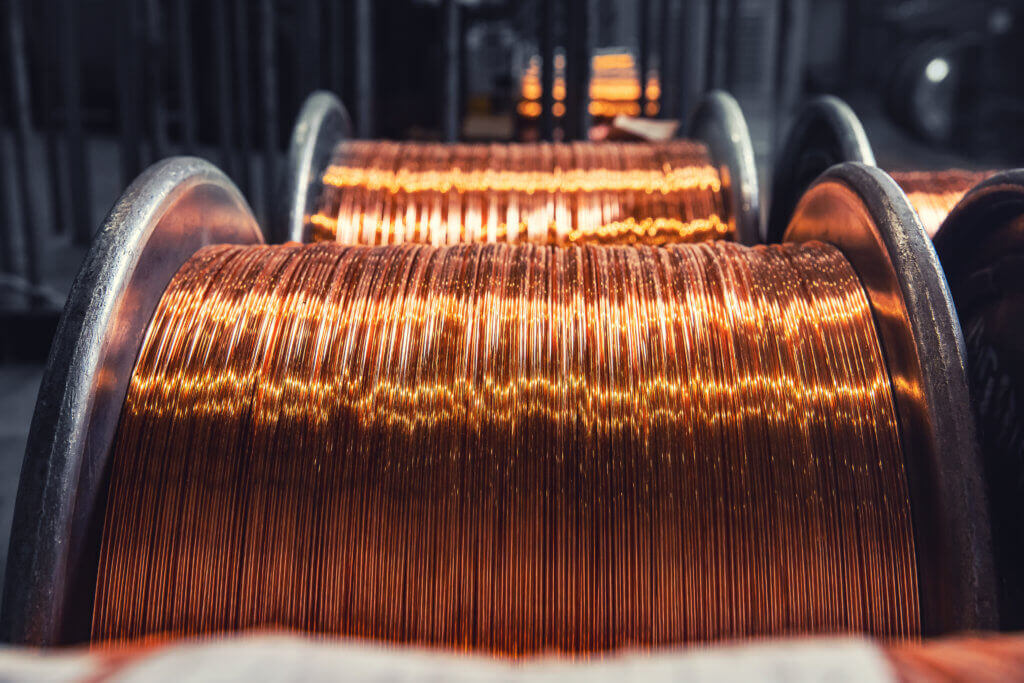

Copper’s New High Amid Central Bank Policies

Quick Look Copper reached an eleven-month high in London, fueled by US equity market rallies and positive global economic outlooks. Central bank meetings worldwide this week put a spotlight on monetary policies and interest-rate directions. Supply tightness and lower production in Chinese smelters raise alarms for the copper market. The U.S. dollar index’s stability could …