On Wednesday, copper prices were pulled down due to a gloomy demand outlook, weak economic data from China, and a higher dollar rate.

Copper futures for September delivery went down by -0.75% to $3.76 per pound on July 05’s Asian afternoon session.

The London Metal Exchange (LME)’s three-month base metal decreased by 0.40% to $8,366.50 per metric ton. On the other hand, the August contract on the Shanghai Futures Exchange rose by 0.10% to $9,437.18 a metric ton.

In June, factory activity in China slowed down, highlighting that the demand for metals is dropping. However, the government expects to undertake more encouragement measures to achieve economic recovery.

According to analysts, copper prices will remain volatile in the following months. The dollar movement and sentiments about the Chinese manufacturing and construction sectors bring it about.

Based on other experts, they expect that there will not be a sharp drop in metal prices in 2023. A lower dollar in the year’s second half and better Chinese demand in the coming months led to optimistic forecasts.

Moreover, metals traders said that global macro headwinds and slow Chinese growth continue pressuring prices. They added that, at this point, there is a lack of clarity on where triggers for buying and selling will come from.

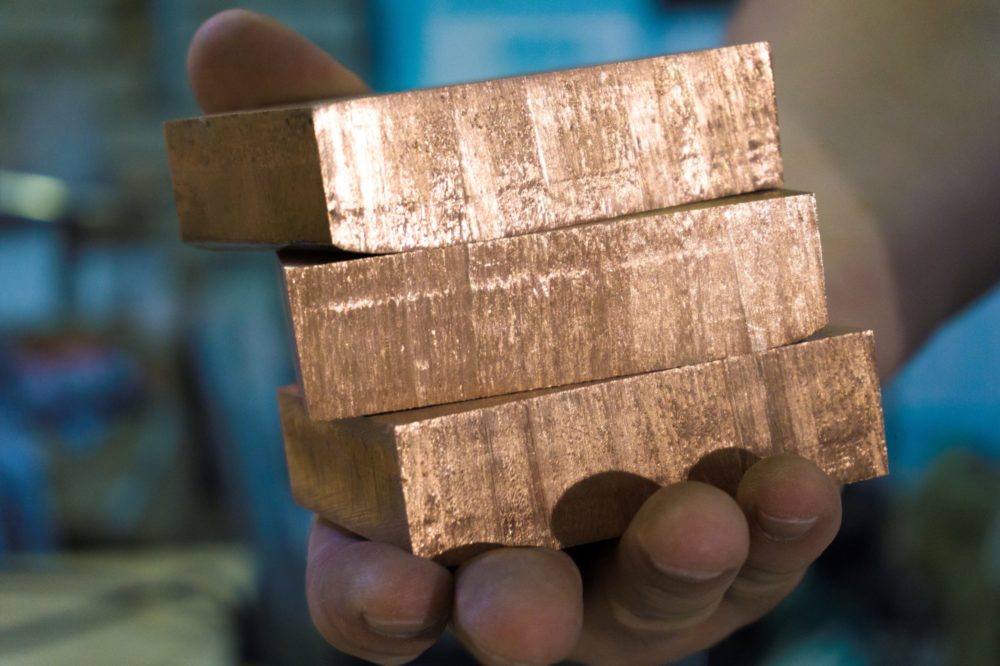

Supply of Copper Surpasses Demand

The ongoing inconsistency in demand and supply of base metals such as copper and aluminum will keep their prices low.

Also, the supply growth is overshadowing demand growth for most base metals. As a result, it may keep prices down.

Copper costs under pressure dropped 2.50% compared to the deeper fall of aluminum and zinc. Furthermore, producers’ relief came from more robust domestic demand, which supports volume and earnings outlook.

Other experts reported that the demand for copper in China is speculated to be strong in fiscal year 2024. This is despite the weak economic data and increasing inflation pressures. Additionally, demand will strengthen through green energy transition and more renewable power regeneration investments.