On Thursday, copper prices rose on hopes that the US interest rates would peak but fears of weak Chinese data restricted its gains.

Copper futures for September delivery went up by 0.25% to $3.89 per pound on July 28’s Asian afternoon session.

The three-month London Metal Exchange (LME) commodity was slightly higher at $8,618.00 a metric ton. It came after its 0.70% drop on Wednesday.

Moreover, the dollar index experienced more prolonged losses a day after the US Federal Reserve reported its last rate hike. Besides, a weaker dollar rate benefits commodities priced in the US currency. They become much more affordable for buyers who use other currencies.

According to analysts, the Fed gave opportunities for more rate increases. However, many people in the market consider it as dovish than expected.

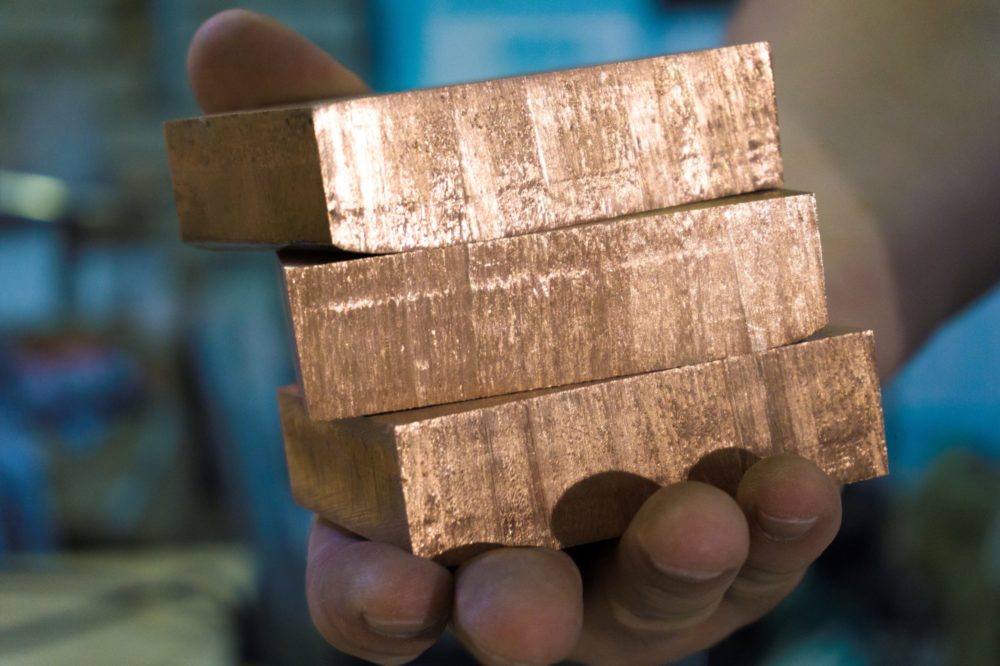

They added that there is repressed hope in metals like copper. They are not reaching new highs or anything similar.

Furthermore, the rally in metal prices like copper was led by expectations of Chinese stimulus in the property industry. It consumes a vast number of metals.

On the other hand, the weak economic data in China, the top metals consumer globally, restricted price rallies. In addition, skepticism about the length and effectiveness of the Chinese support measure affected it.

Chinese Stimulus Hopes Pull Copper Prices

On Friday, most metal prices, such as copper, were on their way to a weekly gain. This came after expectations of demand recovery were boosted by Chinese stimulus.

The commonly-traded September metal contract in the Shanghai Futures Exchange closed 0.10% lower at $9,649.36 a metric ton. However, it gained 0.50% more recently.

According to analysts, they trimmed price estimates for copper and other industrial metals. On the other hand, supply expands as demand in China stays flat.

In addition, the global copper market faced a 287,000-metric ton surplus from January to May. Last year, it had a 74,000-metric ton deficit.

Furthermore, demand for imported red metal into China continues to decline. Its premium prices fell to $34.5 per metric ton on Tuesday.