Quick Look

- Copper reached an eleven-month high in London, fueled by US equity market rallies and positive global economic outlooks.

- Central bank meetings worldwide this week put a spotlight on monetary policies and interest-rate directions.

- Supply tightness and lower production in Chinese smelters raise alarms for the copper market.

- The U.S. dollar index’s stability could moderate copper price gains despite rising demand and shrinking supplies.

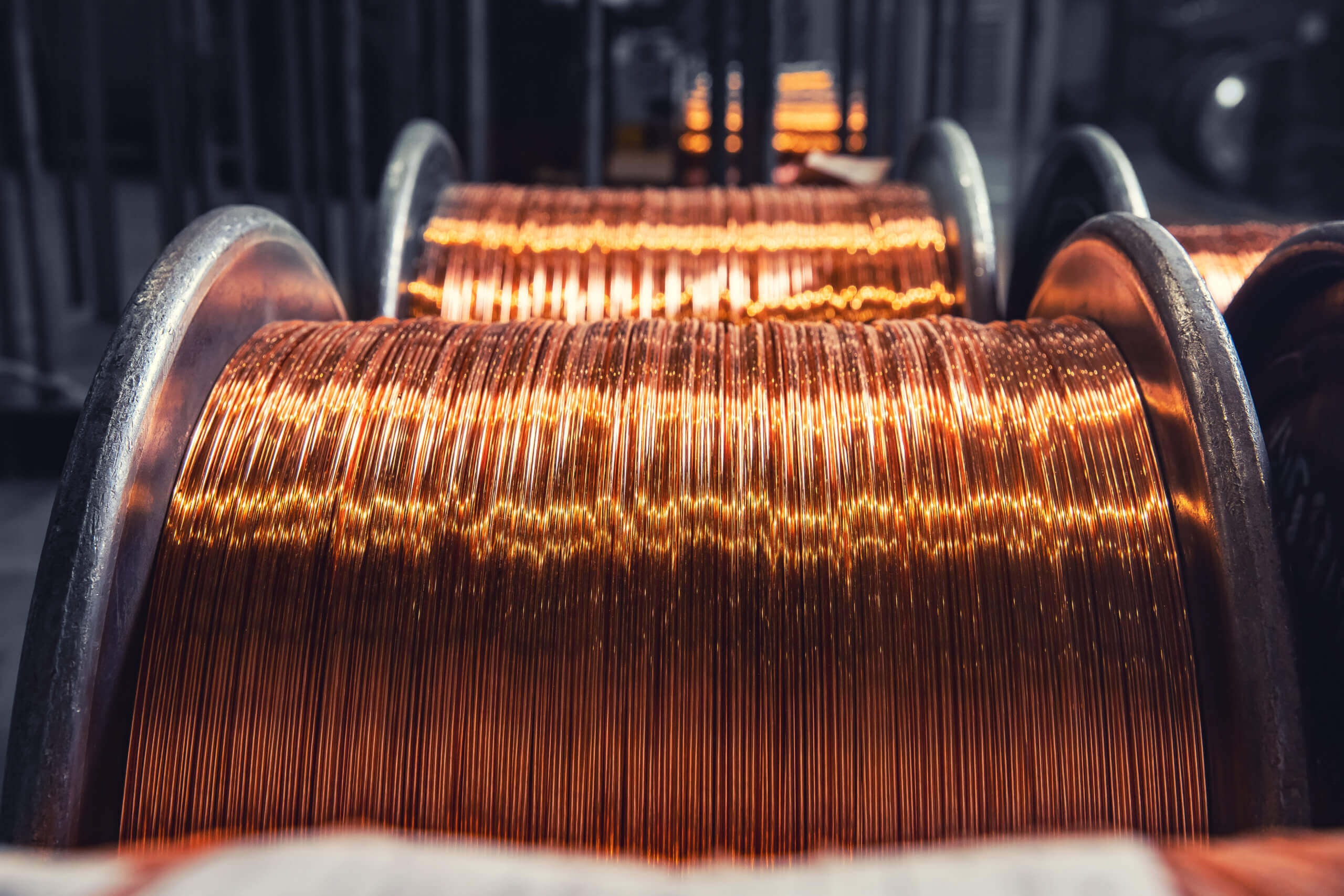

In a remarkable show of resilience, Copper prices Surged to an eleven-month high in London, encapsulating the broader sentiment of optimism in the global markets; as investors and analysts navigate through a week brimming with central bank policy meetings, the focus intensifies on the intricate dance between global monetary policies and commodity markets. Copper, often seen as a bellwether for economic health due to its wide-ranging industrial applications, has not only reflected but also anticipated shifts in economic outlooks and policy directions. The confluence of supply concerns, smelter production adjustments, and the ever-watchful eyes on central banks’ interest rate decisions paint a complex yet captivating picture of the copper market’s current dynamics. This article delves into the multifaceted factors driving copper’s price movements, exploring the undercurrents of supply and demand, monetary policies, and the overarching global economic sentiment.

Copper Prices Rally Amid Optimistic Outlooks

Copper’s ascent to a fresh eleven-month high underscores the growing optimism in global markets. Prices soared to £9,164.50 a ton on the London Metal Exchange, buoyed by a rally in US equity markets and a generally positive global economic outlook. This rally comes after copper ended a prolonged period of inertia, with investors increasingly focused on supply risks and positive economic indicators. The resurgence of copper prices is a testament to the market’s sensitivity to macroeconomic trends and specific industry challenges.

Central bank policy meetings are pivotal for global markets, offering clues on future monetary conditions. This week, investors are particularly attuned to any signals regarding interest-rate cuts, significantly influencing investment and market sentiment. The Federal Reserve’s stance, as highlighted by Powell’s recent congressional testimony, suggests a cautious approach to rate adjustments, pending further evidence of inflation targeting. Analysts, including ING’s Ewa Manthey, emphasize the critical role of the Fed’s interest rate path in shaping copper’s short-term outlook, noting the potential benefits of looser monetary policy on the metal’s price.

Supply Concerns and Monetary Policies Influence Market

The copper market is currently navigating through a period of supply tightness, exacerbated by reduced production in Chinese smelters. This situation stems from various factors, including plunging treatment and refining charges and warnings from industry associations about smelter overcapacity. The copper supply chain’s challenges are multi-layered, extending from mine output constraints to smelter production adjustments. Notably, the Las Bambas mine and the closure of First Quantum’s Cobre Panama mine have highlighted the fragile balance between supply and demand in the global copper market.

Monetary policies play a pivotal role. In particular, those set by central banks, like the Federal Reserve, are vital in shaping commodity prices. Meanwhile, the U.S. dollar index acts as a counterbalance. It mirrors the broader market’s reaction to inflation data and the Fed’s rate decisions. Despite this, expectations of rate cuts have surfaced. Yet, recent data indicates that inflation remains stubborn. This persistence affects market expectations and may temper the rise in copper prices.

On another note, copper prices are currently facing numerous challenges. These include global economic indicators, supply concerns, and central bank policies. Amid these complexities, the market maintains a stance of cautious optimism. Furthermore, the interaction of these elements will surely influence copper’s short-term outlook. This reflection of broader economic trends cannot be understated.

Therefore, investors and industry stakeholders must remain alert. It is essential to monitor these evolving dynamics closely. By doing so, they can adeptly navigate through both the opportunities and challenges in the copper market.