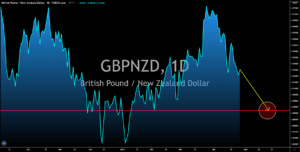

GBPNZD

The appeal of the British pound will continue to fade as the UK economy recovers from the coronavirus pandemic. With the lifting of several COVID-19 restrictions in mid-March, retail sales jumped by 5.4%. On a year-over-year (YoY) basis, this translates to an increase of 7.2%, a major reversal from the -3.6% decline in the prior month. Also, the reported data is twice higher than estimates of 3.5%. Analysts believe that growth will be higher for the month of April as further easing of restrictions were made during the month. Meanwhile, Goldman Sachs is anticipating growth to record 7.2%, which is higher than the economic expansion projection for the United States at 7.1%. The forecast for the United Kingdom is the fastest economic growth since World War II or 1941. As of Sunday, April 25, there were 46.7 million Britons who were able to receive partial or full vaccine shots against COVID-19. This represents 70% of the population.

USDCNY

Recent economic data from the world’s second-largest economy, China, showed continued growth in March. Year-to-date (YTD) profit from the industrial sector grew by 137.3% while year-over-year (YoY) results recorded 92.30% jump from the same month last year. Despite the massive increase in the sector, the technology-based products and services remain to contribute a huge chunk of the country’s economy. Digital economy is up by 2.4% in 2020, accounting for 38.6% of China’s gross domestic product (GDP) or $6 trillion in monetary value. Meanwhile growth of internet and software related products advanced by 9.7% during the pandemic. Many analysts believe that Beijing will outgrow its 6.0% economic growth target this year as the reopening of the global economy pushes demand for Chinese exports higher. As for the United States, Goldman Sachs sees a 7.1% growth in 2021 driven by the massive stimulus program by the government.

USDTRY

The narrowing relationship between the United States and Turkey spells trouble for the lira. President Joe Biden has publicly announced that his government is acknowledging the death of Armenian immigrants on Ottoman Empire, now modern Turkey, as an act of genocide. Aside from external factors, investors are losing interest of Turkish assets after President Recep Tayyip Erdogan sacked the central bank governor and his deputy after the benchmark interest rate was increased to 15.00%. The new central bank head hinted a dovish tone on his public appearances, which indicates a continued increase in the USDTRY pair. Erdogan believes that a high interest rate causes inflation. In relation to this, cryptocurrency exchange Thodex and Vebitcoin, which became the haven for Turks to beat inflation, collapsed. The Turkish central bank announced that it will tighten regulatory measures on digital currencies, which could further drag the fiat currency.

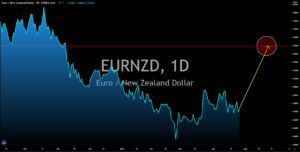

EURNZD

The weak data from Germany this week will push the single currency higher. All PMI data from Europe’s largest economy were a decline from their previous results in March. The manufacturing sector continues to lead the PMIs with 66.4 points while services almost fell below the benchmark for expansion with 50.1 points result. Meanwhile, the Composite PMI recorded 56.0 points. On Monday, April 26, the same disappointing numbers can be seen on Business Expectations, Current Assessment, and Ifo Business Climate reports. Figures came in at 99.5 points, 94.1 points, and 96.8 points, respectively. Last week, European Central Bank President Christine Lagarde retained its benchmark interest rate at a record low of zero percent while making no changes with the central bank’s spending plan for the 2.2 trillion PEPP (Pandemic Emergency Purchase Programme). The lack of new efforts from the EU to support the trading bloc will help the euro to regain its losses.