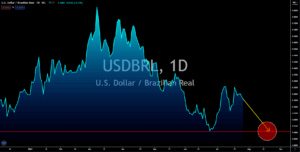

AUDNZD

Australia is expected to publish a 3.8% record for the country’s Q2 CPI on Tuesday, July 27. If the actual figure came near the estimates, it would be the highest quarterly increase since reporting began eight (8) years ago. The recent report is at 1.1% or below the 2.0% to 3.0% annual inflation range by the Reserve Bank of Australia (RBA). Meanwhile, the 3.8% projection will overshoot the target. Despite this, analysts don’t expect further monetary tightening measures in the near term. Two (2) weeks ago, the central bank slashed its weekly bond purchasing program from A$5.0 billion down to A$4.0 billion. But as Australia’s biggest cities, Sydney and Melbourne, entered lockdowns, the RBA might be forced to extend its support to the economy until the pandemic is contained. For the QoQ figure, the consensus estimate is an increase of 0.7% for the second quarter outpacing Q1 2021’s growth of 0.6%. The figure would mark the recovery in the CPI QoQ report.

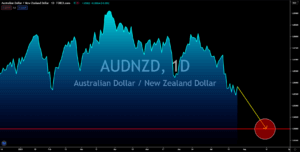

EURBRL

The European Central Bank retained its interest rate at zero percent. Meanwhile, the deposit and lending rate stood at -0.50% and 0,25%, respectively. In addition, President Christine Lagarde introduced a revised inflation target. Instead of a fixed 2.0%, the ECB allows flexibility to just around, but not below, 2.0%. This will allow the central bank to maintain its accommodative policy amidst inflationary fears. The rising coronavirus cases in Europe and throughout the rest of the world also adds uncertainty in the EU’s recovery. Germany’s coronavirus cases remain stable while France is experiencing a fourth wave of the pandemic. Thus, a continued support to the local economy is the best course of action for the government and the central bank. However, this can only be done at the expense of the local currency. The single currency will underperform against its Brazilian counterpart. The target price for EURBRL is at the 2021’s low from June 24 of 5.8500.

GBPBRL

EY Item Club published a report showing the economic trajectory of the United Kingdom. The economic forecasting group said it anticipates the world’s fifth-largest economy to expand by 7.6% in fiscal 2021. If the result is around the projections, it would be the UK’s fastest annual for the past 70 years. Meanwhile, the IMF anticipates Britain to become G7’s best performing economy in 2021 with 7.0% growth after its GDP lagged among the group last year with -9.8% contraction. The International Monetary Fund’s economic forecast for the UK is at par with the United States. Also, the UK will outpace the European region with Germany’s economy seen expanding by 3.6%, France at 5.8%, and Italy with 4.9%. However, the optimism could be overshadowed by a surge in coronavirus cases in the country. Analysts worry that this might result in another lockdown which will put the United Kingdom’s pandemic recovery on hold until the virus is contained.

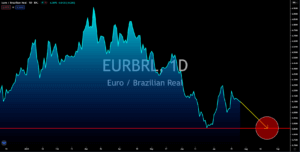

USDBRL

The Federal Reserve is due to meet on Tuesday, July 27, for a 2-day meeting. The FOMC members will discuss the current economic situation including factors that might impact the short-term and long-term performance of the American market. The immediate concern by the central bank would be inflationary pressure after June’s CPI soared to 13-year high at 5.6%. However, the most recent reports suggest the need for further support in the local economy. The housing market is cooling off with June’s new home sales dropping 6.6% against the 3.5% forecast. This translates to 676,000 houses from the expected 800,000 figure. As for the Purchasing Managers Index (PMI) report, the manufacturing sector continued to expand with 63.1 points from the projected decline to 62.0 points. However, the Services PMI fell to 59.8 points for July’s preliminary data. In contrast to Manufacturing PMI, analysts anticipate an upbeat result with a 0.2 points growth to 64.8 points.