OPTICAPITAL REVIEW

Home > Broker Reviews > Opticapital Review

GENERAL INFORMATION

Broker Name:

Opticapital

Broker Type:

Forex and CFDs

Country

England

Regulation:

FCA

Address:

7 Westferry Circus, London E14 4HD, United Kingdom.

Broker status:

Active

CUSTOMER SERVICE

Phone:

+442039961423

Email:

N/A (There is a Contact Form)

Languages:

English, French, German.

Availability:

24/5

TRADING

Trading platforms:

MetaTrader

Trading platform Time zone:

(GMT+1)

Demo account:

No

Mobile trading:

Yes

Web-based trading:

Yes

Bonuses:

Yes

Other trading instruments:

Yes

ACCOUNT

Minimum deposit ($):

$250

Maximal leverage:

1:500

Spread:

Floating From 0.0 Pips

Scalping allowed:

Yes

First Impressions

First impressions

In the fast-growing world of trading, staying abreast of the latest technologies and security measures is paramount to achieving success. With countless individuals engaging in online trading and reaping profits, it is equally important to exercise caution and avoid potential losses.

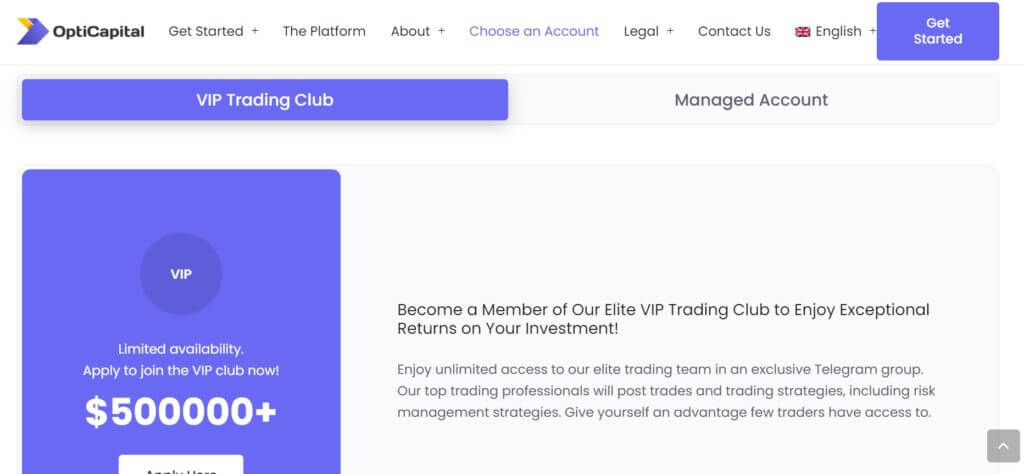

Our team has been diligently exploring new and promising brokerages, and today we turn our attention to opticaliptal.com. Through our comprehensive research for this Opticapital review, we are delighted to discover that this brokerage offers a range of compelling benefits, including VIP club membership and managed account options. With advanced security features and the ability to operate in multiple nations, Opticapital.com presents itself as an exciting new player in the industry. Let us delve deeper into what this brokerage has to offer.

Opticapital, established in Cyprus, has garnered international recognition with numerous prestigious accolades. Notable highlights among its accomplishments include:

-Best Broker in the Asia Pacific Area 2015

-Best FX IB Program in China

-Most Progressive FX Broker in Europe in 2019

These accolades serve as a testament to the company’s competitive edge and the exceptional value it provides to its clientele. Furthermore, Opticapital goes the extra mile by offering educational services to its customers. Engaging seminars and special events are conducted in a warm and welcoming environment. For a comprehensive assessment of this broker, we invite you to continue reading and discover more about the remarkable features of Opticapital.

Security

Security is a crucial aspect to evaluate when selecting a brokerage. In our thorough research for this Opticapital review, we discovered that this brokerage places a strong emphasis on security and regulatory compliance. Opticapital is subject to oversight and regulation by esteemed agencies such as the Financial Sector Conduct Authority (FSCA), the Australian Securities and Investment Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). This multi-level regulatory framework ensures that Opticapital operates in accordance with established industry standards and best practices.

Furthermore, Opticapital demonstrates its commitment to safeguarding client interests by participating in the trader’s compensation fund. This provides an additional layer of protection for traders, offering recourse in the event of unforeseen circumstances.

With Opticapital’s robust regulatory framework and participation in compensation programs, traders can have peace of mind knowing that their investments are supported by stringent security measures. The brokerage’s dedication to maintaining a secure trading environment further solidifies its position as a reliable and trustworthy choice for traders.

Opticapital Review: Comprehensive Account Types

Opticapital offers a diverse range of account types, catering to the specific needs and preferences of traders. Choosing the right account type is crucial for optimizing your trading experience. Let’s delve into the various account options provided by Opticapital.

Bronze Account

The Bronze account is an ideal choice for traders looking to start with a modest investment of just $250. With leverage of up to 1:500 and no commission, this account allows you to test your trading strategies or gain experience in the market. Floating spreads, starting at 1 pip, are determined by market liquidity. Market execution speed begins at 0.3 seconds, providing efficient trade execution.

Silver Account

For traders seeking a fixed spread option, the Silver account is worth considering. It requires an initial deposit of $500, offering fixed spreads starting at 3 pips with no commission. The leverage available is up to 1:500. It’s important to note that while high leverage can amplify profits, it also carries the potential for increased losses. Exercise caution when utilizing high leverage. Market execution speed for the Silver account starts at 0.30 seconds per Straight Through Processing (STP).

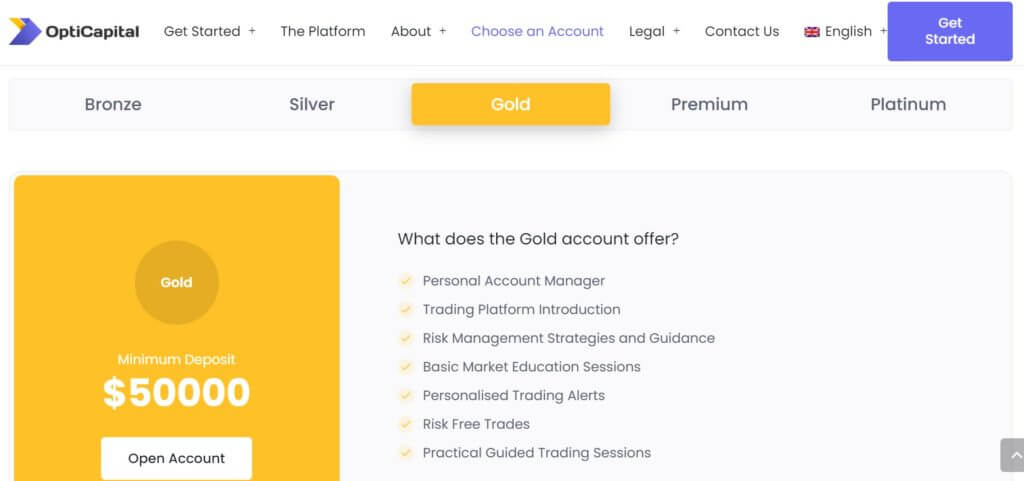

Gold Account

The Gold account is a standard account type with a minimum initial deposit of $1,000 and leverage of up to 1:500. With no commissions and competitive spreads starting at 0.5 pip, the Gold account appeals to traders across various trading styles and timeframes. It caters to traders who are not specialized in a particular trading style or period.

Premium Account

Traders looking for commission-based trading without spreads can opt for the Premium account. With a minimum initial deposit of $500, this account offers leverage of up to 1:500. Traders pay a commission starting at $20 per lot. The Premium account is suited for those who prefer a commission-based structure and desire direct market access.

Platinum Account

Experienced traders may find the Platinum account appealing. It requires a minimum initial deposit of $1,000 and offers leverage of up to 1:500. The commission for trades in the Platinum account is $6. This account type is often favored by scalpers and intraday traders due to its immediate market execution. Platinum accounts utilize Electronic Communication Network (ECN) technology, providing traders with direct market access.

Demo account

Opticapital also offers a demo account, which we found to be a valuable feature in our research for this opticapital.com review. A demo account serves as a valuable learning tool, especially for new traders. It allows you to practice trading strategies, develop a winning approach, and gain confidence without risking real funds. While a demo account provides an excellent learning experience, it’s important to recognize that trading with real money entails different emotions and considerations.

By offering a range of account types, including demo accounts, Opticapital ensures that traders can select the account that best aligns with their trading objectives, experience level, and risk tolerance.

Opticapital Review: Extensive Trading Instruments

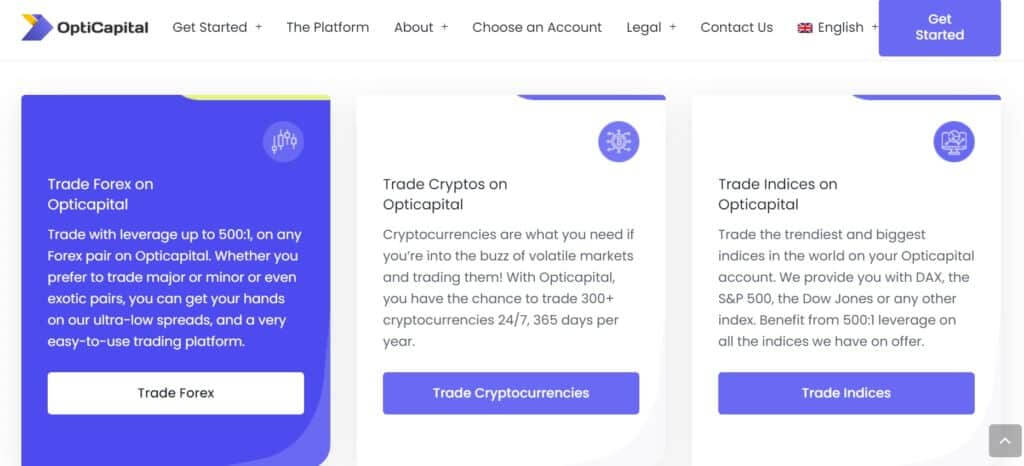

Opticapital Station offers a wide range of trading instruments to cater to the diverse needs and preferences of its traders. Let’s explore the various financial assets available for trading on Opticapital.

Currency Pairs

Opticapital provides access to a comprehensive selection of currency pairs, including popular and less common ones. Major currency pairs such as EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, USD/CAD, and NZD/USD are available for trading. These major pairs offer high liquidity and tighter spreads. It’s important to note that trading exotic currency pairs may involve higher risks due to wider spreads and lower liquidity. Novice traders are advised to focus on trading major currency pairs.

Commodities Opticapital

offers a range of popular commodities, which are valuable raw resources. Traders can trade commodities such as WTI crude oil, Brent oil, gold, silver, platinum, palladium, natural gas, and more. The account type and trading volume in a particular commodity can influence the leverage and spreads offered.

Stocks

Traders on Opticapital have the opportunity to trade popular stocks, representing ownership in various corporations. Stocks of well-known companies like Tesla, Apple, Alphabet, and Meta are available for trading. Trading stocks allows traders to capitalize on the performance of individual companies and their shares.

Indices

Opticapital also provides access to major indices, which are composed of individual equities and serve as indicators of market direction. Traders can find indices such as the S&P 500, Dow Jones index, and others. These indices not only offer tradable opportunities but are also used by many traders as indicators of market sentiment and overall economic conditions.

Monitoring indicators is crucial for traders as they provide insights into market sentiment and potential market movements. For example, the S&P 500, representing the 500 largest American corporations, can indicate the health of the US economy. A negative performance in the S&P 500 may suggest a weakening US economy, which could present trading opportunities such as buying USD against the Euro.

By offering a diverse range of trading instruments, Opticapital allows traders to explore different markets, diversify their portfolios, and take advantage of various trading opportunities in the global financial markets.

Opticapital Review: Enhanced Resources and Excellent Customer Service

In addition to its impressive features, Opticapital goes above and beyond to provide its clients with valuable resources and exceptional customer service. Here are some key points to consider:

Educational Resources: Opticapital offers a range of educational resources to assist clients in enhancing their trading skills. Live webinars hosted by industry experts provide valuable insights into market analysis and the effective use of trading bots. Daily market analysis is also available, keeping traders informed about current market trends. These resources aim to empower clients and improve their trading strategies.

Customer Service: Opticapital prioritizes customer satisfaction and ensures prompt and reliable customer service. The support team is available Monday through Friday, except on major holidays. Clients can reach out to them via live chat, phone call request, or message during business hours. The customer service representatives are known for their kindness, competence, and willingness to assist clients effectively.

Competitive Fees: Opticapital stands out by offering lower fees compared to industry standards. Spreads for popular currency pairs start as low as 0.5 pip, with no commission fees. For minor pairs, spreads begin at 0.6 pip. The broker also does not charge any fees for deposits, withdrawals, or inactivity. It’s important to note that there is a 1.5% fee for debit/credit card deposits and a fee per request for bank transfer withdrawals.

Reliable and Secure: Opticapital is regulated by reputable agencies, ensuring the security and reliability of its services. Clients can trade with confidence, knowing that the broker adheres to industry regulations and maintains high standards of operation.

Final Recommendation: After conducting a thorough review of opticapital.com, it is evident that Opticapital is a standout brokerage. With its secure and regulated operations, competitive fees, and access to comprehensive educational resources, Opticapital offers a unique trading experience. The ability to choose an account type that aligns with individual trading preferences, combined with efficient and welcoming customer service, further enhances the overall trading journey. If you are in search of a brokerage, we highly recommend giving Opticapital a try. Good luck in your trading endeavors!

COMMENTS

Recommended for You

Cryptocurrency Market Update: March 3

Recommended for You

Recommended for You

Recommended for You

Recommended for You

Recommended for You

-

Support

-

Platform

-

Spread

-

Trading Instrument

40 Comments

Good trading company

Good trading company. Signals are accurate and profitable. I always get updated market news and reliable forecasts. I am using these as my trading guide and I get a good profit so far.

Did you find this review helpful? Yes No

Happy with this broker

Low fees and fast transactions. Withdrawals are hassle-free and swiftly processed. Happy with this broker.

Did you find this review helpful? Yes No

Competitive brokers

Competitive brokers, consistently effective signals, I never had any withdrawal issues and support is attentive. It is a pleasure to do business with this broker.

Did you find this review helpful? Yes No

Good profit

I’ve got no regret choosing this broker over a few options. They can consistently help me gain good profit.

Did you find this review helpful? Yes No

Good trading advise

One of the best trading advice I had ever used. Will surely stay with this broker for good.

Did you find this review helpful? Yes No

Smooth and easy withdrawals

Smooth and easy withdrawals. I’ve been dealing with them for a few months and had several withdrawals and all are fast.

Did you find this review helpful? Yes No

Responsible and professional

Responsible and competitive brokers. They are transparent on all transactions. I am gaining good profit and satisfied with the services.

Did you find this review helpful? Yes No

Favorable trading results

Trading results have always been favorable for the past six months. Good broker.

Did you find this review helpful? Yes No

Fast withdrawals

Easy and fast withdrawals. Great customer service also.

Did you find this review helpful? Yes No

Good broker

This broker has helped me recover my losses with the previous. They have good trading opportunities.

Did you find this review helpful? Yes No

Great forex broker

If you wish to make the most money in online trading, I recommend this broker. Signals will never fail you. I am impressed with forex signals, assets and services.

Did you find this review helpful? Yes No

Good trading results

Always deliver good trading services and good results. Will keep the services and definitely recommend.

Did you find this review helpful? Yes No

Good trading brokers

A trustworthy broker to use for forex trading. They also have exceptional execution and pricing is fair enough.

Did you find this review helpful? Yes No

Efficient and professional

They are efficient and skilled in forex. Been using their services for quite some time and so far I am satisfied.

Did you find this review helpful? Yes No

Good customer service

I am pleased with customer service. They always attend to my trading needs promptly. I am getting profit and I get my withdrawals on time.

Did you find this review helpful? Yes No

Great trading experience

I had a great trading experience with this broker. I was able to withdraw profit monthly. I never had any problem with any of their transactions.

Did you find this review helpful? Yes No

Excellent broker service

Excellent broker service especially in terms of signals and withdrawals. Withdrawals are always fast and signals are always profitable.

Did you find this review helpful? Yes No

Interesting

Interesting forex brokers. They are well-versed about the forex industry.

Did you find this review helpful? Yes No

Good trading company

Good trading company! Have traded with them for a while now and I am fully satisfied with the services and profit.

Did you find this review helpful? Yes No

Smooth transactions

Smooth transactions including withdrawals. Easy to deal with support. They have fair trading terms and good services.

Did you find this review helpful? Yes No

Worth keeping

Excellent spreads offered, minimal slippage and good trading profit. I will surely keep them as my forex broker.

Did you find this review helpful? Yes No

Warm and accomodating

These are the group of competitive teams from brokers, technical support to their customer service. They are nice, warm and accommodating. And the skills they have in forex are exemplary.

Did you find this review helpful? Yes No

Good services

One of the best brokers available for online trading. Signals are reliable and profitable. Good services, overall.

Did you find this review helpful? Yes No

Affordable trading

I can trade at a lower cost. They have affordable initial deposit and trading assets. Signals are also reliable.

Did you find this review helpful? Yes No

Good profit

I’ve got no regret choosing this broker over a few options. They can consistently help me gain good profit.

Did you find this review helpful? Yes No

Good trading opprtunites

There are so many opportunities to make money. They have guided me toward profitable trading.

Did you find this review helpful? Yes No

Easy withdrawals

This has been my broker for over a year now. What I love about their services is the profitable signals. I was able to gain really good profit that I can easily withdraw without any hassle.

Did you find this review helpful? Yes No

Good profit

This broker had helped me gain good profit. I will surely recommend.

Did you find this review helpful? Yes No

Excellent brokers

Excellent is not enough to describe their services. I am impressed with their support, their broker signals as well as their platform.

Did you find this review helpful? Yes No

Good broker

Always maintain a good connection with me. Trading results are favorable and I am happy with customer service.

Did you find this review helpful? Yes No

Good trading company

I get not only good trading advise but also excellent customer service and tools.

Did you find this review helpful? Yes No

Great choice for forex broker

A great choice for forex brokers. They have super fast and easy withdrawals and are excellent in providing profitable signals.

Did you find this review helpful? Yes No

Good profit

I am lucky to have them as my forex brokers. I have been gaining a really good profit.

Did you find this review helpful? Yes No

The best trading partner

One of the best trading partners I have dealt with. The moment I send them a message about any trading needs, they respond and call me right away. They also think out of the box and always come up with profitable trading advise.

Did you find this review helpful? Yes No

Great platform

State-of-the-art platform with comprehensive trading charts. Their trading platform is easy to use and their features are so useful.

Did you find this review helpful? Yes No

Happy with this broker

No problem with withdrawals, tools or even services. I am happy since day 1.

Did you find this review helpful? Yes No

Excellent trading broker

Excellent trading broker. They never fail to inform me of the latest market trends. Great signals and services.

Did you find this review helpful? Yes No

Signals and services are both wonderful.

I am impressed by Opticapital’s services, especially their speedy response. Signals and services are both wonderful.

Did you find this review helpful? Yes No

Plenty of tradable instruments, including cryptocurrencies.

Plenty of tradable instruments, including cryptocurrencies. I am earning well from all of their offers. Recommended broker

Did you find this review helpful? Yes No

I am happy to deal with Opticapital

Friendly customer service and very professional brokers. I am happy to deal with Opticapital, results are always efficient.

Did you find this review helpful? Yes No