Artificial Intelligence (AI) is rapidly becoming a driving force in transforming the financial sector, revolutionizing how institutions operate, analyze data, and engage with customers. The integration of AI technologies holds immense potential for efficiency, risk management, and personalized financial services.

One prominent application of AI in finance is data analysis and decision-making. Advanced algorithms and machine learning models enable financial institutions to process vast amounts of data quickly and accurately. This capability is particularly beneficial in risk assessment, fraud detection, and investment analysis. AI systems can identify patterns, anomalies, and trends in large datasets that might be challenging for human analysts to discern.

Customer experience is another key area where AI is making a substantial impact. Virtual assistants and chatbots powered by natural language processing enable financial institutions to provide personalized and real-time support to customers. These AI-driven interfaces can handle routine inquiries, assist in transactions, and offer financial advice based on individual preferences and behaviours.

Algorithmic trading, often referred to as robo-advisors, is gaining popularity in investment management. AI algorithms analyze market trends, assess risk factors, and execute trades at speeds impossible for human traders. This enhances the efficiency of investment strategies and reduces the emotional and psychological biases that can influence human decision-making in financial markets.

AI’s predictive capabilities significantly contribute to credit scoring and loan approvals. Machine learning models can assess an individual’s creditworthiness by analyzing broader variables, going beyond traditional credit scores. This approach allows financial institutions to make more informed lending decisions, expanding access to credit for individuals whom conventional methods may have overlooked.

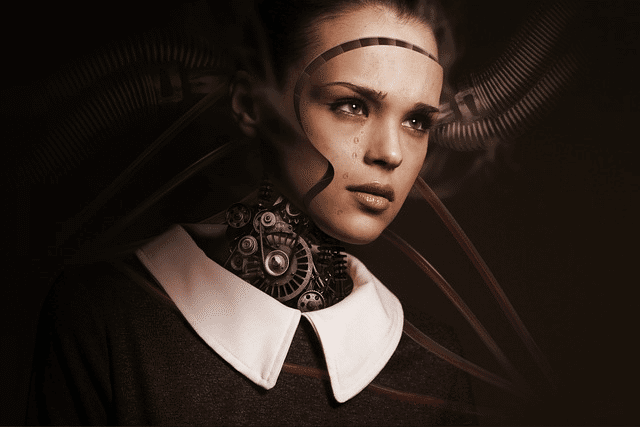

Development of AI Technologies

While integrating AI brings numerous benefits, it also raises ethical considerations and concerns about data privacy and security. Striking a balance between innovation and responsible AI use is crucial for fostering trust and ensuring the ethical deployment of these technologies in the financial sector.

In conclusion, the increasing penetration of artificial intelligence in the financial sector signifies a transformative era for the industry. From data analysis to customer service and investment management, AI is reshaping traditional financial practices. It fosters innovation and improves overall efficiency in delivering financial services. As technology advances, the financial landscape will likely witness further evolution with AI at its forefront.