FORTRADE REVIEW

Home > Broker Reviews > Fortrade Review

GENERAL INFORMATION

Broker Name:

Fortrade

Broker Type:

Forex and CFD

Country

UK

Operating since year:

2013

Regulation:

FinCEN

Address:

144 Mayakovsky St., 220028 Minsk, Republic of Belarus

Broker status:

Regulated

CUSTOMER SERVICE

Phone:

+44 203 966 4505

Email:

Languages:

German, Spanish, French, Croatian, Italian, Dutch, Polish, Portuguese, Slovene, Swedish, Russian, Arabic, Albanian, and Macedonian

Availability:

Between 9 AM and 9 PM GMT Monday – Friday by phone, email or live chat

TRADING

Trading platforms:

MT4 and proprietary platform

Trading platform Time zone:

/

Demo account:

YES

Mobile trading:

YES

Web-based trading:

YES

Bonuses:

YES

Other trading instruments:

YES

ACCOUNT

Minimum deposit ($):

$100

Maximal leverage:

30:1

Spread:

YES

Scalping allowed:

YES

GENERAL INFORMATION: Fortrade

Fortrade is a UK-based brokerage company that offers its clients two trading platforms for trading on Contracts for Difference (CFDs) and Forex. Fortrade traders have a choice between the proprietary Fortrader platform and the most commonly used MetaTrader 4 (MT4) platform. Fortrade’s advantages include its user-friendly technology, scalable platform, and regulation by one of the top worldwide regulatory bodies – FCA – Financial Conduct Authority, making it especially attractive for traders in the UK.

This review will cover all of the essential details about the company and help you form an opinion about its products and services.

FUNDS, TRADING, AND SECURITY

They are being regulated by the Financial Conduct Authority (FCA), UK (FRN: 609970). The broker puts all trader funds into a segregated bank account and uses tier-1 banks for this.

The broker requires a minimum deposit of £100, but Fortrade usually suggests clients deposit at least £500. Traders can deposit and withdraw their funds with Fortrade using one of several different methods:

- Credit card Instant, no fees

- Neteller Instant, no fees

- Skrill Instant, no fees

- Bitcoin Instant, no fees

- Wire Transfer Minimum transfer of $250, fee up to $40, can take up to 7 days to be credited to an account

TRADING ACCOUNTS

Fortrade likes to keep things simple and offers its clients only three types of accounts:

- Standard trading accounts

- Islamic accounts

- Demo accounts

Standard Trading Accounts

The broker requires a minimum initial deposit of £100, depending on the base currency of the client’s account. However, the broker usually recommends that traders make an initial minimum deposit of at least £500.

Islamic Accounts

Fortrade also offers an option to open an Islamic account. These accounts are swap-free, with no rollover interest on overnight positions in accordance with Islamic law. Islamic accounts require an initial deposit of $2,000.

Demo Accounts

Unlike some brokers, you don’t need a standard trading account to open a demo account. Demo accounts have all the same features as a standard account offers, including real-time charts and quotes for over a hundred financial assets. There is no time limit to the demo account. Fortrade deposits an initial notional sum of 100,000 demo credits into a future trader’s trading account, allowing a client to learn and practice online trading in a real trading environment.

Account Requirements

To sign up for Fortrade clients need to provide the following information in a process that lasts only a couple of minutes:

- Name

- Email address

- Physical address

- Mobile phone number

- Country of origin

- The base currency (US dollars, Euros, or British pound sterling)

- Date of birth

A client will also be asked a few questions about his financial status and employment situation and to inform the company about his trading goals.

TRADING CONDITIONS

Like most of the brokerage houses do, ForTrade takes a fee from each spread (the difference between the buy and sell price of an instrument).

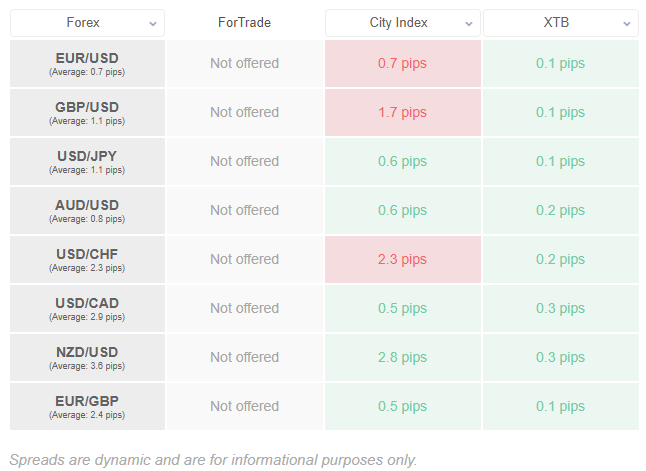

The commissions and spreads, as seen below, are based on the minimum spreads listed on the broker’s website. The color bars show how competitive ForTrade’s spreads are being compared to other popular brokers featured on BrokerNotes.

As it is visible, the company`s minimum spread for trading on EUR/USD is pips – which is low compared to the average EUR/USD spread of 0.70 pips. Below is a breakdown of how much it would cost a client to trade one lot of EUR/USD with ForTrade compared to similar brokers.

TRADING PLATFORMS

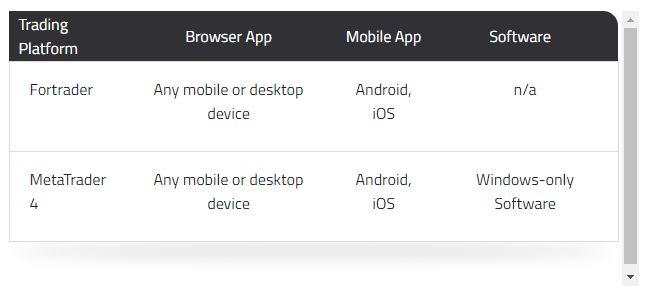

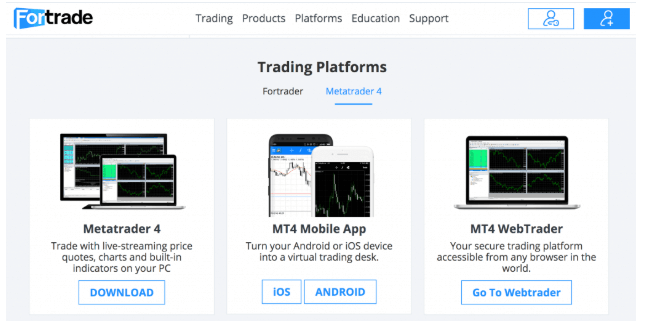

Fortrade offers two types of trading platforms, with three ways to access them:

- Web Platform

- Mobile application

- Software

Since the software trading platform is pretty basic and straightforward, most of the advanced and experienced traders decide on MetaTrader 4 as it is already a tested and proven platform in the world of trading.

The other significant feature related to the brokerage company is trending as a free trading option. This mobile application is easily installed and downloaded from the Apple App Store or Google Play Store. Because of those features, a client has a comfortable trading experience and does not have to handle the inconvenience of carrying a laptop or need a desktop computer almost regularly. You can do the same with the mobile phone. This software is accessible from the iPad and other tablets as well.

In the online trading world, quick and efficient market access is everything, which brings the client an ability to trade 24-hours a day wherever he is, along with advanced tools that enhance trading and analyzing capabilities. To meet these demands, the company`s team of developers designed a line of fully-scalable trading platforms that enabled us to monitor global financial markets and derivatives and capitalize on price movements at the time and place most convenient.

The proprietary platforms available in three versions Fortrader Web, Fortrader Desktop, and Fortrader Mobile that gives an ability to access trading throughout any convenient way, either on the go, by a browser, or by installed version. Every process on the platform performs via the powerful execution model through interbank quotes.

CUSTOMER SUPPORT

This review is there to help you find every information you need and have a hassle-free experience, and even after reading this article, you have any questions or concerns. You do not have to worry at all. The broker has a proven excellent customer support service that is available on this platform. Whenever you feel any trouble, you can submit a form regarding your questions, comments, and concerns to the specific staff. All of these inquires can be done via phone, email, or messaging and even by live chat. Doesn`t that sound amazing? Fortrade support is very fast with their responses and replies in a very professional manner.

CONCLUSION

There are a lot of features that count as a big plus in this software. It offers a client a seamless experience that makes him undoubtedly go for it. There are a whole lot of ways and features which make this broker user-friendly for anyone who makes an account on this platform. It has embedded as the best possible choice for traders who are looking for a fully automated trading platform. Also, clients are offered a wide variety of assets, such as stocks, indices, currencies, and commodities that can be traded.

Hence, we are fully supporting the usual choice that all the new users stick to the minimum amount that is possible for putting on their trading accounts. This tends to keep the traders safe from all the potential losses that one can face if any trade goes wrong.

This broker review explains how this intuitive trading platform designed to make online trading simple, fast, efficient, and user-friendly. Whether you’re a complete newbie or an experienced trader, you can find the right fit with this broker. The minimum deposit amount for a start, along with thoughtfully developed educational material and real-time market information, is a helpful tool for beginners in the trading world. At the same time, the more advanced traders will find a lot of solutions for personal trading goals and needs.

Fortrade’s passion built towards innovation and service has enabled them to grow and expand into new markets and offer products with the growing demand for retail and institutional clients. And what is essential, Fortrade provides a safe, secure, licensed, and regulated trading environment as per their reputable regulator’s FCA.

Besides, Fortrade established a fair trading environment that does not hide any concerns, and there are no hidden fees, no commissions, and no conflicts of interest.

Thank you for taking your time and reading our review of the Fortrade broker.

However, in case you need more information on the broker, feel free to do further research. We hope this review was helpful, and we wish you suitable luck trading!

COMMENTS

Recommended for You

Cryptocurrency Market Update: March 3

Recommended for You

Recommended for You

Recommended for You

Recommended for You

Recommended for You

Fortrade Review

-

Support

(4.5)

-

Platform

(2)

-

Spread

(2.5)

-

Trading Instrument

(2)

3 Comments

Not horrible, but too many drawbacks to be seriously considered

Did you find this review helpful? Yes No

The small leverage rate really hurts what could’ve otherwise been a decent broker.

Did you find this review helpful? Yes No

Not that impressive

The broker does sound good, but it’s nothing special. There are others that are much better.

Did you find this review helpful? Yes No