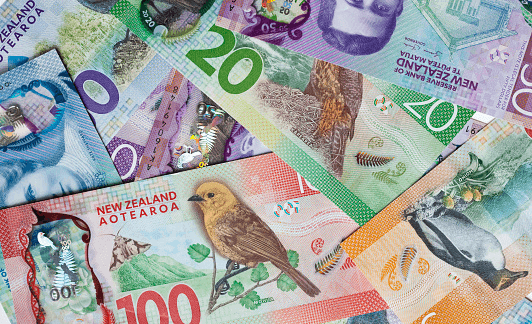

The New Zealand dollar has driven down to a low of 10 months. This was in anticipation of a recent meeting at the Reserve Bank of New Zealand. There was then a sudden spike after the meeting had taken place. The meeting had indicated that interest rates would remain at their current place of 5.5%. Overall, the USD to NZD rate has jumped up some, as traders feel positive about the NZ dollar’s performance.

The OCR was 525 bps above the low present during the pandemic and may even see another 25 bp jump by 2024. Before this meeting, they had raised the OCR numerous 12 times since late 2021. Before today’s meeting, analysts had not seen the likeliness of any more price jumps. Improving prospects in terms of interest rates has likely boosted the NZD exchange rate.

It is also possible that the rally may be due to traders jumping the gun. One official stated that the current and future OCR are contractionary in nature. It is too high for the OCR; they would expect a neutral forecast.

The indicators on the US dollar had not been as expected before the meeting due to a recent monetary policy statement. It indicated a hawkish mood on the dollar. In the US market, there were several issues.

Fed’s Effect on the American Market

Indices in the American market all fell, indicating a market-wide contraction. The Fed kept its harsh interest rate policy as it has been doing for many months now. This was against investor expectations. This, alongside unsustainable market growth for many months, led to a drop in US stocks. Furthermore, comments by a certain Fed official further tempered expectations. He had expressed uncertainty as to whether the Fed could get inflation below the 2% target with the current trajectory. Both of these developments have influenced USD-NZD interaction.

Another meeting for RBNZ will come in October. Judging by this latest development, the next meeting will likely have implications for the New Zealand dollar and the USD to NZD rate.