Quick Look:

- USD/CAD hovers around 1.3580, awaiting US labour data and the Fed’s rate decision.

- US Nonfarm Payrolls and JOLTS Job Openings spotlight key economic indicators.

- March Manufacturing PMI at 50.3, signalling growth and resilience in the sector.

- Market sentiment is cautious with risk-off vibes and DXY at a four-month high.

- Technical analysis shows an ascending triangle, suggesting upcoming volatility.

Ah, the world of currency exchange – where numbers dance, economies tango, and traders keep the rhythm. Today, we’re swinging to the beat of the USD/CAD pair, currently prancing around 1.3580. It’s a fascinating time, as the air is buzzing with anticipation for the US labour data, and investors are playing a guessing game about the Federal Reserve’s next move. Will they cut rates in June, or won’t they? It’s like watching a thriller but with more charts and less popcorn.

Economic Indicators on the Dance Floor

Stepping onto the dance floor, we find the US Nonfarm Payrolls (NFP) Report for March taking centre stage. It’s a key performance that could dictate the market’s next move. Then, the JOLTS Job Openings for February are expected to decline slightly to 8.74 million from 8.863 million. It’s like expecting a ballet performance and realizing it’s more modern dance – unexpected but still intriguing.

Manufacturing Sector: Doing the Twist

In a delightful twist, the March Manufacturing PMI has pirouetted to 50.3, indicating growth for the first time in 16 months. It’s like watching a dancer triumphantly return to the stage after a long absence. The manufacturing sector’s performance signifies resilience and perhaps a hint of prosperity. It’s a performance worth a standing ovation.

Market Sentiment: A Mysterious Tango

The mood in the market is akin to a dimly lit ballroom, with a risk-off sentiment prevailing and the US Dollar Index (DXY) hitting a four-month high. It’s as if the music has slowed, and traders are cautiously navigating the dance floor, unsure of their partner’s next move. Amidst this, the Canadian labour market data whispers of an expected addition of 25K jobs in March, adding a note of optimism to the melody.

Technical Analysis: The Choreography of Numbers

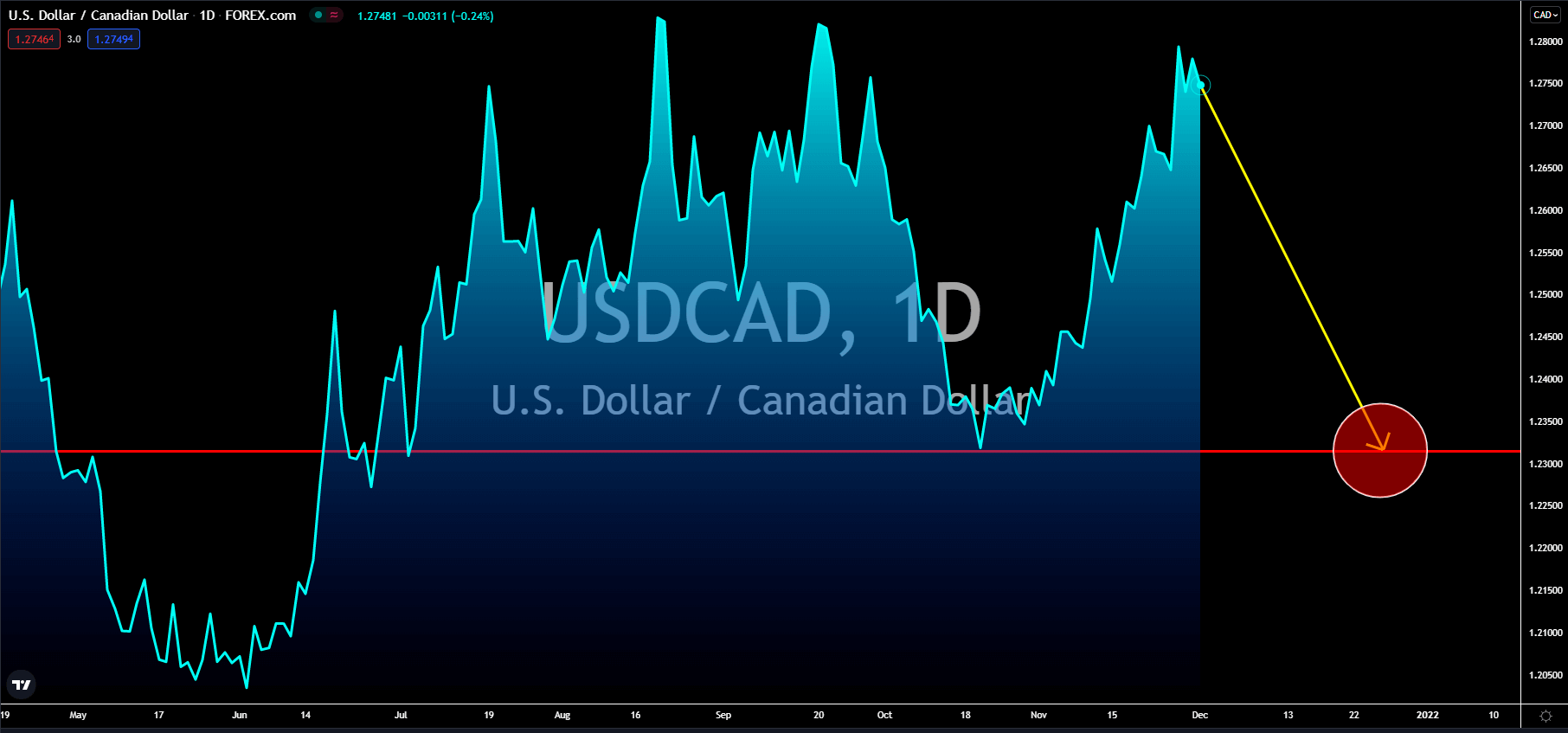

For those who prefer their dances choreographed with precision, the technical analysis of the USD/CAD pair reveals an ascending triangle pattern. This suggests potential volatility with key levels at 1.3620 for a breakout and 1.3441 for a breakdown. The 20-day EMA and 14-period RSI are like indecisive judges, showing no clear favour towards bulls or bears. It’s a dance-off that keeps every spectator on the edge of their seat.

The Future Outlook: An Encore Performance

The stage is set for volatility, driven by the US and Canadian labour reports, oil price trends, and broader market dynamics. It’s as if the curtain is rising for an encore performance, with all eyes fixed on the stage, waiting to see which direction the dancers will leap. Will the bullish crude oil prices give the Canadian dollar the lift it needs? Or will the US dollar continue to hold the spotlight?

Ultimately, the USD/CAD pair’s performance is a riveting spectacle, full of twists, turns, and breathtaking moves. As we watch this economic ballet unfold, one thing is clear: the world of currency exchange is never short of drama and excitement. So grab your programs, ladies and gentlemen; the show is just starting!