Rampant inflation over many global economies has pushed central banks to tighten monetary policies that had been dramatically loosened to support consumers and businesses weather the financial hit from the epidemic.

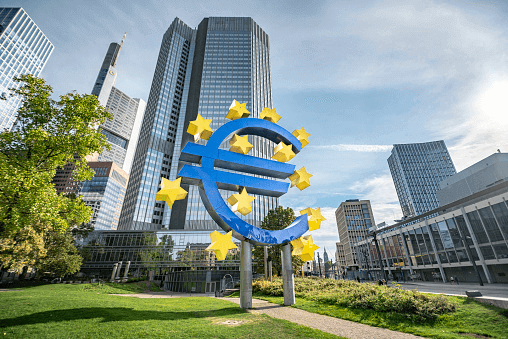

The ECB had fought the tide. But on Thursday, notwithstanding holding rates in negative territory, President Christine Lagarde admitted mounting inflation risks. She opened the door to possible rate hikes later this year.

This week, the euro has earned three cents versus the dollar to be just shy of $1.15, its best weekly gain after March 2020. It was last up 0.2% on the day at $1.14565.

The dollar index weakness showed the euro’s strength.

The dollar index is on track for about a 2% weekly slide, its poorest performance since the epidemic hit. It was last at 95.327.

Employment Data Expected

U.S. employment data should come later on Friday. It could give investors hints on how quickly the Federal Reserve will tighten policy. This year, the markets are now factoring in as numerous as five U.S. rate hikes.

Sterling also has been among the big currency movers this week, behind the Bank of England increased rates to 0.5% on Thursday, marking the first back-to-back increases by the central bank after 2004.

The pound is on track for a higher than 1% weekly gain versus the dollar, although it lost some ground on Friday and traded just fearful of $1.36.

Haven currency, the Japanese yen, was broadly intact on the day, at 115.020 yen per dollar.

On Friday, Australia’s central bank snappily revised its inflation outlook but kept policy super flexible as it sought a lasting recovery in wages and living standards.

The Australian dollar plunged on the day and was last down 0.4% versus the U.S. dollar at $0.71105.

Read also: CryptoIFX Review (2022) | Is it a good Forex broker?