Quick Look

- GBP/USD Futures Signal Potential Sentiment Extreme

- Mixed Signals in US Dollar Index Post-Fed Speculations

- Gold and Commodities Witness Varied Speculator Movements

- Nasdaq 100 Futures and GBP/USD: A Week of Divergence and Bearish Turns

The latest Commitment of Traders (COT) report, as of March 12, 2024, alongside an in-depth GBP/USD analysis, offers a fascinating glimpse into the current market dynamics. These insights shed light on speculative positions across various currencies and commodities and highlight the nuanced shifts that could influence future market directions. In particular, the GBP/USD futures have hit a sentiment extreme, suggesting an intriguing horizon for traders. Similarly, divergences in the Nasdaq 100 futures and shifts in commodity futures like gold, crude oil, copper, and platinum provide a complex tapestry of speculative sentiment. This article delves into these aspects, offering a detailed exploration of the implications of these positions and analyzing the potential outcomes in light of recent economic events and indicators.

GBP/USD Futures: An Extreme Sentiment on the Horizon

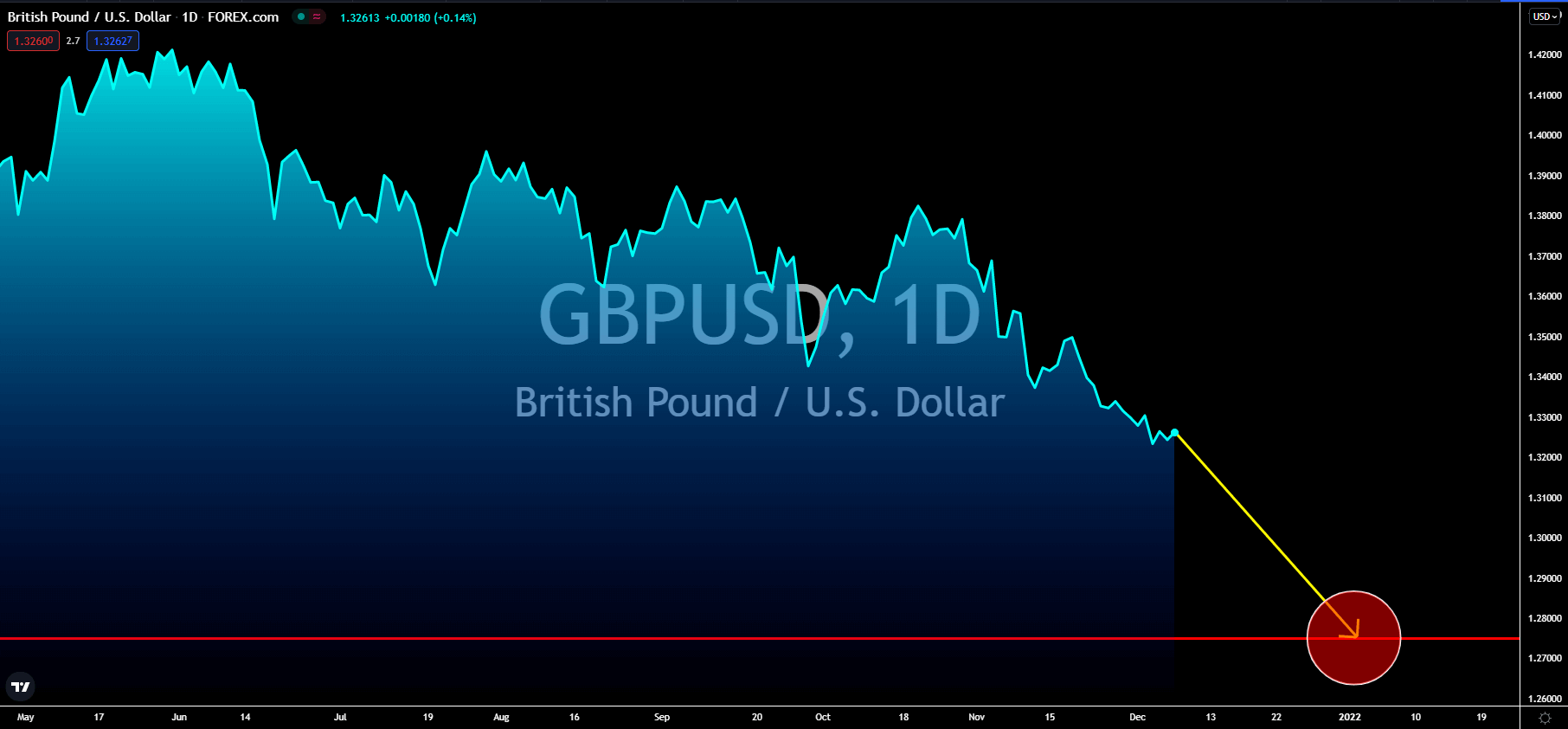

The COT report reveals a remarkable 100% rank in the 3-year, 1-year, and 3-month percentiles for GBP/USD futures, indicating a potential sentiment extreme. This is coupled with a notable divergence in speculator positions and an analysis that suggests a bearish outlook, further compounded by economic indicators such as slowing wages and rising unemployment in the UK.

Divergences and Directions in Commodities and Indices

Large speculators and managed funds show a cautious approach to commodities like WTI crude oil, with a decrease in long bets and an increase in short positions, questioning the recent break above $80. In contrast, a flip to net-long exposure in copper and platinum futures ahead of significant production announcements offers a bullish signal. The Nasdaq 100 futures and the US dollar index present mixed sentiments, with divergences and scaled-back bets, indicating uncertainty ahead of pivotal economic meetings and data releases.

GBP/USD Analysis: Navigating Bearish Turns and Support Levels

The GBP/USD pair’s recent price movements reveal a bearish trend, challenging previous bullish forecasts. Despite strong support levels, the currency pair has yet to sustain bullish momentum, facing downward pressure from a strengthening US Dollar. The analysis emphasizes the importance of key support levels as pivotal points for potential trades, highlighting the nuanced dynamics of currency markets amid economic fluctuations.