Quick Look

- USD/CAD nears 1.3578 as investors await Fed’s rate decision

- Canadian CPI data fuels June rate cut expectations

- Fed likely to maintain rates; BoC poised for a June adjustment

The USD/CAD pair has been capturing investor attention, climbing to 1.3578 in Wednesday’s Asian session amidst anticipation surrounding upcoming central bank decisions. The pair’s ascent is underpinned by a stronger US Dollar and subdued Canadian inflation figures, setting the stage for a critical week in financial markets. Investors are particularly focused on the Federal Reserve’s interest rate decision, widely anticipated to result in a steady rate environment. Concurrently, weaker-than-expected Canadian CPI data has heightened expectations for a rate cut from the Bank of Canada (BoC) come June. This article delves into the intricacies of these developments, examining their implications for the USD/CAD trajectory and broader market dynamics.

The Fed’s Stance and Market Reactions

The Federal Reserve is set to keep interest rates within the 5.25% to 5.5% range, maintaining a two-decade high. This decision is part of efforts to combat persistent inflationary pressures. Despite this, market anticipations have leaned towards expected rate cuts. Notably, the CME FedWatch Tool shows a 63% chance of rate reductions starting in June. This expectation is based on three quarter-point adjustments within this year.

Amid these forecasts, recent US data has introduced a complex layer to the Fed’s decision-making process. For example, there has been a significant increase in New Home Sales and Building Permits. Investors are now eagerly waiting for the Fed’s policy announcement. Additionally, they look forward to the subsequent press conference for deeper insights into the central bank’s future direction.

Canadian Dollar Under Pressure

On the Canadian front, recent CPI data has been a focal point, revealing a softer inflationary environment than anticipated. This has consequently led to a shift in market sentiment, with a 75% probability now assigned to a BoC rate cut in June, a marked increase from prior estimates. The detailed inflation figures, indicating a year-over-year rise of 2.8% in February and a modest monthly increase, underscore the BoC’s challenges as it navigates economic headwinds. These developments exert downward pressure on the Canadian Dollar, influencing the USD/CAD pair’s dynamics and offering a glimpse into potential monetary policy adjustments.

Upcoming Events and Market Outlook

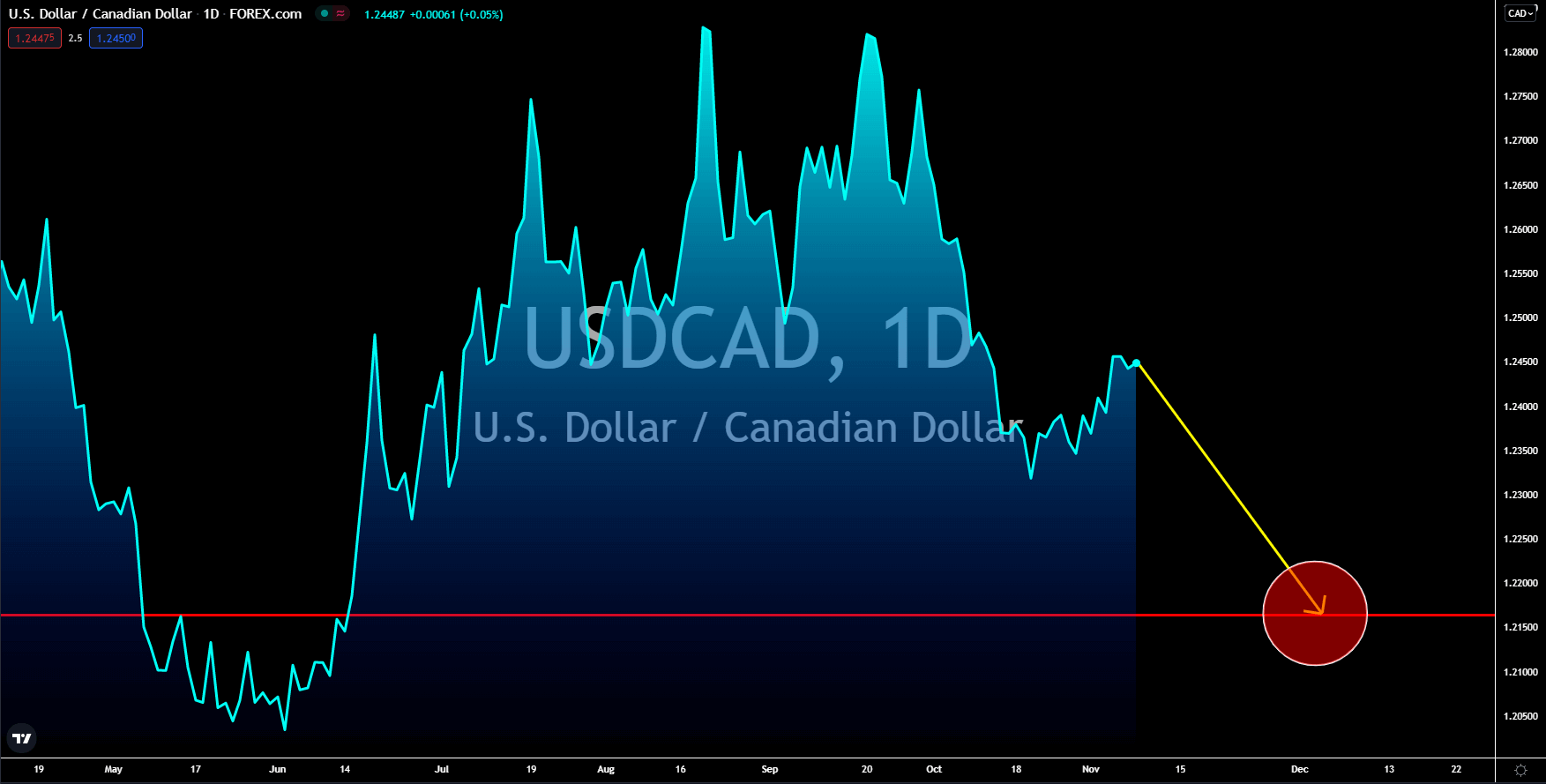

The week ahead promises significant market-moving events, with the Fed’s monetary policy decision and BoC’s subsequent releases standing out. Investors are bracing for potential volatility, as these developments could redefine market expectations and influence currency valuations. The USD/CAD pair’s movement, especially its approach to key resistance levels, will be closely watched. Technical indicators suggest a bullish near-term outlook for the pair, contingent on forthcoming economic data and central bank communications. As the market navigates through this period of uncertainty, the direction of the USD/CAD pair will be a key barometer of investor sentiment and economic expectations.