Quick look

- USD/CAD extends gains after strong US Producer Price Index (PPI) data; core PPI at 2.0% YoY.

- WTI crude oil price increase could support the Canadian Dollar (CAD).

- Recent economic data influences expectations around the Federal Reserve’s interest rate decisions.

- The US Dollar Index (DXY) sees an uptick, influenced by higher US Treasury yields.

- Analysts predict a weaker Canadian Dollar, potentially leading to aggressive rate cuts by the Bank of Canada.

The USD/CAD pair has seen notable movement, influenced by recent economic data from the United States. Noteworthy is the core Producer Price Index (PPI), which maintained a 2.0% increase YoY in February, slightly above expectations. This, coupled with a monthly rise of 0.3%, underscores the ongoing inflationary pressures in the US, reducing the likelihood of the Federal Reserve (Fed) cutting interest rates soon. As a result, the pair traded higher, marking a continuation of gains for the second consecutive session.

DXY at 103.40, Yields Climb Sharply

The US Dollar has found support from increasing Treasury yields, which have risen over the past four sessions. This uptrend has bolstered the US Dollar Index (DXY), pushing it into the green zone around 103.40. The yields on 2-year and 10-year US Treasury bonds have adjusted to 4.68% and 4.28%, respectively, reflecting a market sentiment that leans towards prolonged higher interest rates due to persistent inflation.

US Retail Sales Up 0.6%, Misses 0.8% Forecast

The US retail sales for February showed a 0.6% increase, falling short of the expected 0.8%, yet marking an improvement from the previous decline. This mixed bag of economic indicators, including the preliminary US Michigan Consumer Sentiment Index for March, will likely keep traders on their toes, closely monitoring the potential impact on market dynamics.

WTI Oil Prices Soar, CAD Eyes Support

The Canadian Dollar might gain support from increasing West Texas Intermediate (WTI) oil prices. These prices have been on the rise, driven by strong demand in the US. Additionally, the global consumption outlook for 2024 is positive. As the largest oil exporter to the US, Canada could benefit from this trend. Consequently, the uptrend in crude oil prices could curb the USD/CAD pair’s upward movement despite broader market trends.

NBC Eyes Rate Cuts, CAD Could Weaken

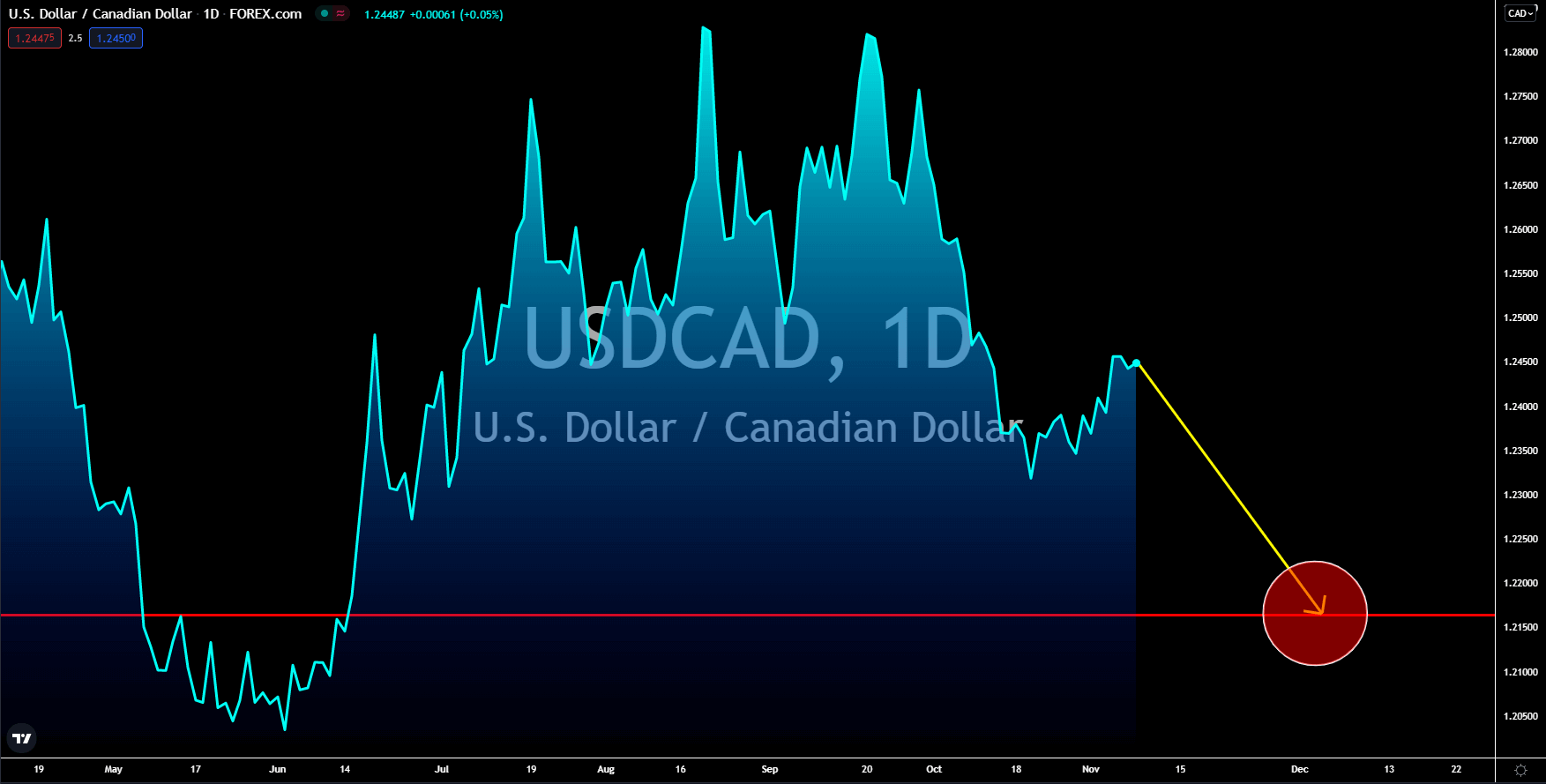

Recent Canadian economic data, including a modest rebound in Manufacturing Sales, points to a mixed economic outlook. The National Bank of Canada (NBC) forecasts a weaker Canadian Dollar, citing underwhelming economic performance and restrictive interest rates. With inflation within the target range, NBC advocates for rate cuts, anticipating more aggressive adjustments in Canada compared to the US. This monetary policy stance could influence the USD/CAD trajectory, potentially pushing the pair above 1.40 in the second half of 2024.